In the early going of second quarter earnings, banks have posted robust earnings, which ought to give the Direxion Day by day Monetary Bull 3X ETF (FAS) a lift.

“Earnings season is off to a monster begin, with corporations from PepsiCo to UnitedHealthcare reflecting the continuing financial reopening of their Q2 numbers,” a Cheddar Information article talked about. “Nevertheless it was the banks that blew the quilt off the ball, because of robust client spending and a busy dealmaking season on the Avenue.”

“JPMorgan Chase and Goldman Sachs had been among the many first to exceed revenue expectations for the quarter (JPM greater than doubled its revenue from the identical time a 12 months in the past.) Morgan Stanley beat expectations for all three of its funding banking, wealth administration, and funding administration divisions,” the article added. “Wells Fargo and Citigroup additionally beat — and but, the sector traded sideways or decrease for a lot of the week as traders questioned whether or not the momentum that took the massive banks by way of the worst of the pandemic can final in a post-COVID world.”

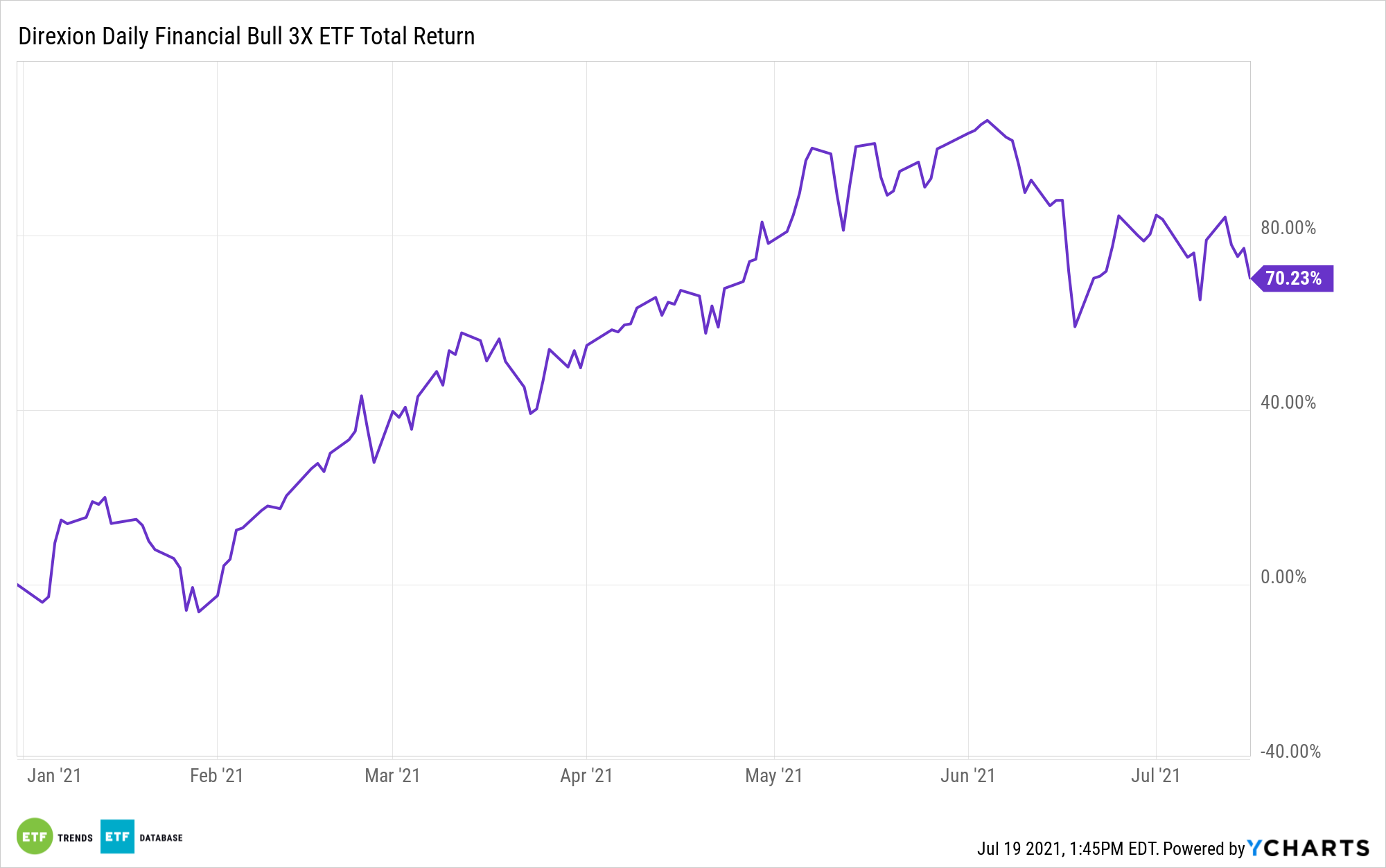

FAS seeks day by day funding outcomes, earlier than charges and bills, of 300% of the day by day efficiency of the Russell 1000® Monetary Companies Index. The fund invests at the very least 80% of its web belongings in monetary devices and securities of the index, ETFs that observe the index, and different monetary devices that present day by day leveraged publicity to the index or ETFs that observe the index.

The index is a subset of the Russell 1000® Index that measures the efficiency of the securities labeled within the monetary providers sector of the large-capitalization U.S. fairness market. FAS is up 70% halfway although 2021.

The Bearish Case

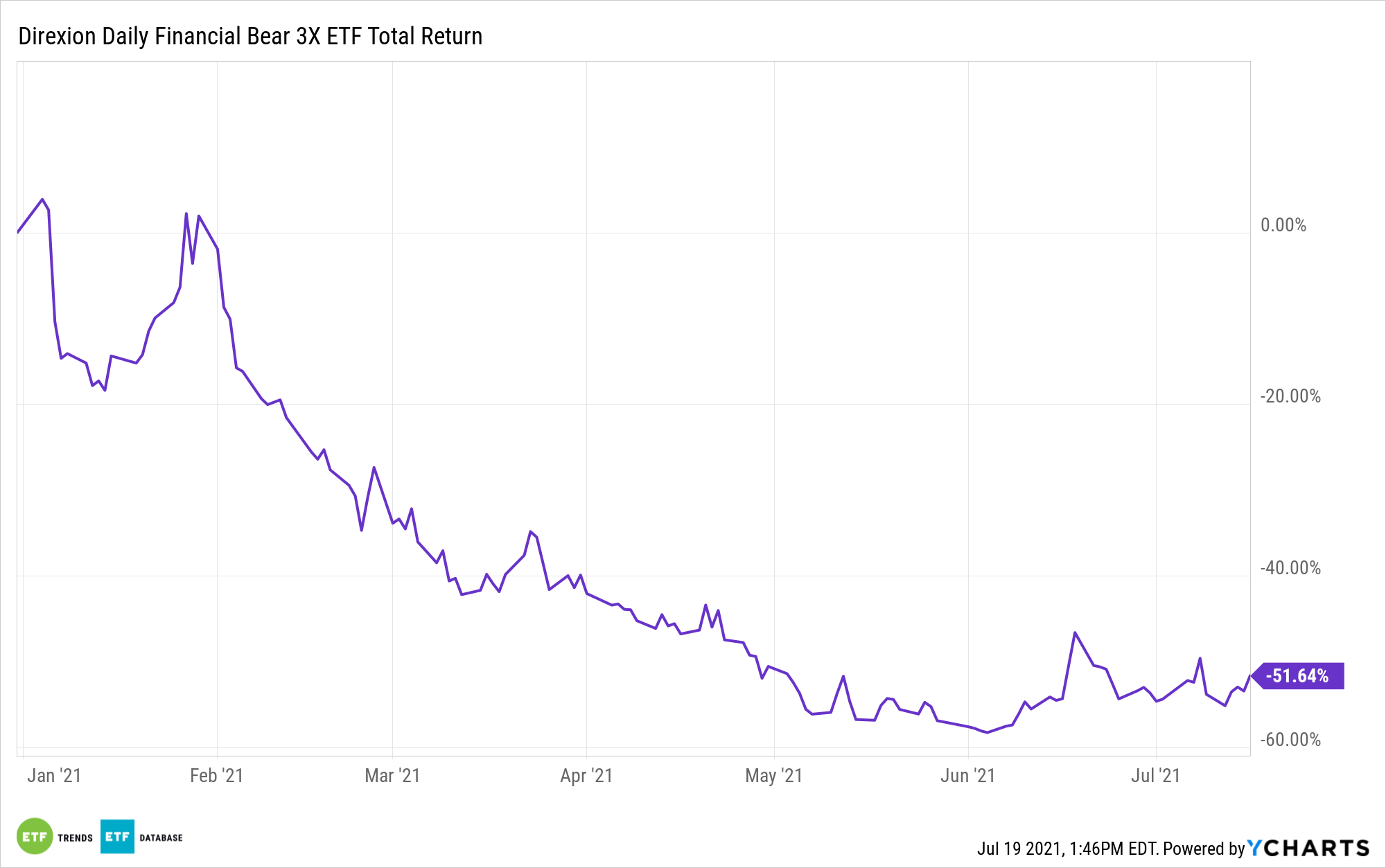

If the Federal Reserve retains on standing pat on rates of interest, this might maintain again extra income from banks that depend on mortgage merchandise. As such, there is a bearish case for the Direxion Day by day Monetary Bear 3X ETF (FAZ).

Taking the other facet of FAS, FAZ seeks day by day funding outcomes that equate to 300% of the inverse (or reverse) of the day by day efficiency of the Russell 1000® Monetary Companies Index. As talked about, the index is a subset of the Russell 1000® Index that measures the efficiency of the securities labeled within the monetary providers sector of the large-capitalization U.S. fairness market.

For extra information and knowledge, go to the Leveraged & Inverse Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.