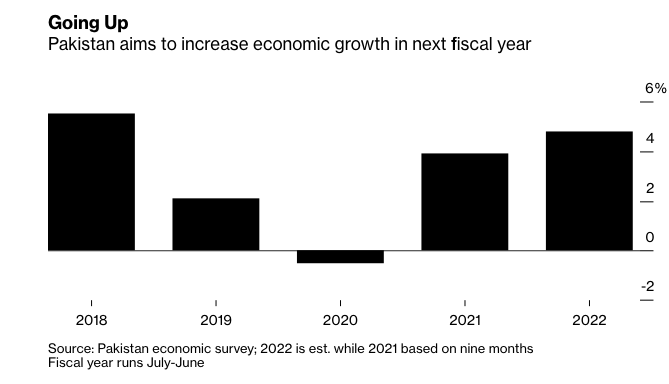

The pandemic has crippled many economies, however because the world continues to heal in 2021, the nation of Pakistan is eyeing sturdy progress over the approaching years, which is nice information for the World X MSCI Pakistan ETF (PAK).

“Pakistan plans to spend its method out of the pandemic-induced hunch, with a brand new funds that seeks to place extra money within the fingers of individuals and enhance financial exercise,” a Bloomberg article famous.

“The federal authorities proposes to boost salaries of presidency staff by 10% within the 12 months starting July 1, Finance Minister Shaukat Tarin mentioned in his funds speech in Islamabad on Friday,” the article added additional. “Taxes on some fairness in addition to banking transactions will probably be pared or abolished, he mentioned.”

PAK seeks to supply funding outcomes that correspond usually to the value and yield efficiency, earlier than charges and bills, of the MSCI All Pakistan Choose 25/50 Index. The underlying index is designed to signify the efficiency of the broad Pakistan fairness universe.

The fund’s sector breakdown features a main concentrate on supplies, which includes about 35% of the fund’s internet property. Subsequent up are the financials and vitality sectors, which make up 26% and 22%, respectively.

Total, PAK offers traders with:

- Environment friendly Entry: Environment friendly entry to a broad basket of Pakistani securities.

- Focused Publicity: The fund targets publicity to a single nation.

- Frontier Market Publicity: Frontier markets are among the many highest progress potential economies on the earth.

Aiming to Meet Budgetary Objectives

Budgetary objectives would be the main purpose of Pakistan’s authorities. In response to the Bloomberg article, Tarin hopes to “slim the funds hole to six.3% of gross home product from 7.1% of GDP this 12 months, lower than 1 to 1.5 proportion factors the minister estimated final month.”

With the intention to try this, Tarin “goals to attain that by ramping up income assortment by 25% to 7.9 trillion rupees ($51 billion) within the subsequent fiscal 12 months.”

“Of that, 5.eight trillion rupees can be mopped up from taxes, in contrast with 4.7 trillion rupees this 12 months,” the article added.

“The funds is a chance for Tarin to strengthen Pakistan’s fragile financial system, which is at the moment underneath a $6 billion bailout program from the Worldwide Financial Fund,” the Bloomberg article continued. “A drop in coronavirus instances is permitting the nation to reopen slowly, paving the best way for demand to kick in.”

For extra information and data, go to the Thematic Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.