Solar vitality is an important part within the push towards renewable vitality—a win-win for the World X Renewable Vitality Producers ETF (RNRG).

Solar energy was as soon as an possibility that was completely accessible for the well-to-do. These days, photo voltaic prices are dropping, making the know-how extra accessible for extra people.

Moreover, the federal authorities’s inexperienced agenda is pushing for extra solar energy within the coming years. The solar energy sector has already skilled exponential progress over the past 10 years.

“Solar energy within the U.S. has grown 4,000% p.c over the past decade, but it surely nonetheless solely accounts for 3% of electrical energy era,” a CNBC report famous. “The Biden Administration needs to vary that, and on Tuesday (August 17) stated that photo voltaic might present 40% of the nation’s electrical energy by 2035 — if the federal government enacts supportive insurance policies.”

RNRG seeks to trace, earlier than charges and bills, the worth and yield efficiency of the Indxx YieldCo & Renewable Vitality Revenue Index. The fund invests at the very least 80% of its whole property within the securities of the underlying index and in ADRs and GDRs primarily based on the securities within the underlying index.

The underlying index is designed to supply publicity to publicly traded firms that produce vitality from renewable sources, together with wind, photo voltaic, hydroelectric, geothermal, and biofuels (together with publicly traded firms which might be shaped to personal working property that produce outlined money flows). RNRG’s expense ratio is available in at 0.65%.

RNRG provides buyers:

- Excessive Progress Potential: RNRG permits buyers to entry excessive progress potential by way of firms at the vanguard of a structural shift in international vitality manufacturing.

- Renewables Publicity: The ETF is a focused, thematic play on renewable vitality producers.

- A Aware Strategy: RNRG incorporates the environmental, social, & Governance (ESG) proxy voting pointers from Glass Lewis.

Photo voltaic Prices Should Proceed to Fall

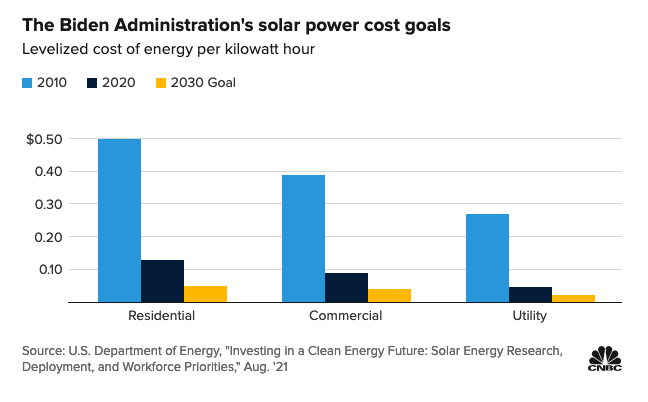

The federal government’s solar energy objectives are definitely formidable. As a way to meet these objectives, photo voltaic prices should proceed to lower.

In response to the CNBC report, “the Division of Vitality stated that photo voltaic’s progress price might want to triple — and even quadruple — by 2030. Meaning prices must preserve dropping.”

“The whole price of a photo voltaic system depends upon variables together with dimension, whether or not it’s bought outright or leased and energy costs within the particular location,” the report added. “Photo voltaic’s levelized price of vitality, which permits it to be in comparison with different types of energy era, has fallen greater than 70% over the past decade. However prices might want to proceed to say no to fulfill these progress objectives.”

For extra information and knowledge, go to the Thematic Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com