Confluence Funding Administrati

Confluence Funding Administration presents numerous asset allocation merchandise that are managed utilizing “high down,” or macro, evaluation. We publish asset allocation ideas on a weekly foundation on this report, updating the report each Friday, together with an accompanying podcast and chart e-book.

Could 14, 2021

Because the Nice Monetary Disaster of 2007-2008 (GFC), any speedy rise in dwelling costs has tended to spark fears of one other bubble bursting. U.S. dwelling costs have not too long ago been up greater than 10% from one 12 months earlier, marking their strongest positive aspects for the reason that restoration interval proper after the GFC. Nevertheless, these positive aspects have been overshadowed by the even greater will increase in Canada. Residence costs north of the border rose 13% within the 12 months ended December 2020, they usually had been up a good stronger 20.1% within the 12 months ended March 2021 (see chart). Does that imply the Canadian housing market is in a bubble? What’s the danger that Canadian dwelling costs will crash again to earth, dragging down the monetary system and Canadian shares?

[wce_code id=192]

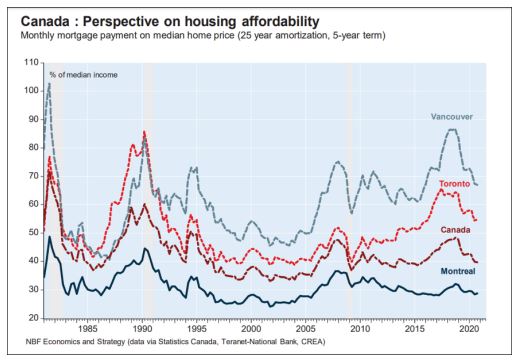

One reassuring signal is that Canadian houses are nonetheless reasonably priced regardless of the latest worth surge. Primarily based on right now’s median dwelling worth, mortgage rates of interest, and typical Canadian mortgage phrases, a homebuyer’s month-to-month mortgage cost would equal solely about 40% of the nation’s median earnings. As proven within the following chart, that’s just like the extent seen throughout many of the final decade. It’s additionally a lot decrease than within the 1980s and 1990s. Naturally, housing prices could be a lot greater in main metropolitan areas. Nevertheless, even in these locales, affordability has improved over the previous few years. That’s as a result of the latest worth hikes have been largely offset by falling rates of interest and rising incomes. Between 2017 and 2019, worth positive aspects had been additionally held in test by tightened rules, like a brand new tax on foreigners shopping for property in Vancouver and Toronto and “stress check” guidelines requiring mortgage candidates nationwide to indicate they might afford their mortgage even when rates of interest had been 2% greater than once they utilized. Present affordability ranges recommend Canadian dwelling sellers can nonetheless discover loads of patrons.

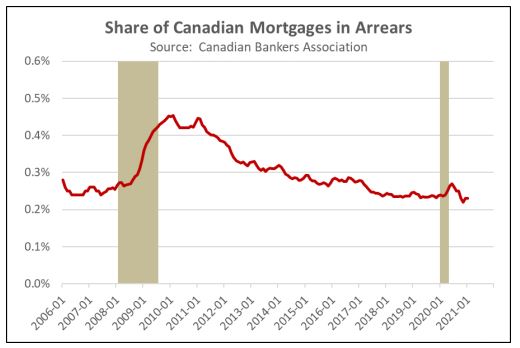

Lastly, it’s essential to keep in mind that Canadian financial institution rules and mortgage phrases are rather more conservative than within the U.S. The standard Canadian mortgage cost is calculated based mostly on an amortization interval of 25 years, and the mortgage matures in 5 years, with steep penalties for early refinancing. Lengthy-term householders in Canada count on to roll over their mortgage on a strict five-year schedule. Even when householders promote their property to purchase one other, the excellent stability on the unique mortgage is often utilized to the brand new home. This technique helps shield Canadian banks from falling rates of interest. As well as, the brand new stress checks assist

be certain that debtors are good credit score dangers, whereas authorities guidelines discourage banks from promoting or securitizing their mortgage loans. The Canadian system subsequently tends to maintain lenders and householders “married” for prolonged durations, which seems to enhance underwriting requirements. As proof of that, the chart under exhibits that there was no discernable rise in Canada’s mortgage delinquencies. Canadian mortgage delinquencies stay only a fraction of U.S. delinquencies, regardless of the latest leap in dwelling costs and elevated mortgage debt.

In sum, it seems that the Canadian housing market is responding to the identical sorts of pandemic-driven traits dealing with the U.S. market. Elevated need for private area, falling mortgage charges, and ample financial savings have boosted housing demand, at the same time as job fears or well being issues have restricted new listings. The growth in Canadian dwelling costs merely doesn’t appear to mirror free mortgage requirements or irresponsible lending, so we aren’t presently involved a couple of housing bubble bursting or inflicting widespread monetary issues north of the border.

Previous efficiency isn’t any assure of future outcomes. Info offered on this report is for instructional and illustrative functions solely and shouldn’t be construed as individualized funding recommendation or a suggestion. The funding or technique mentioned will not be appropriate for all traders. Traders should make their very own choices based mostly on their particular funding goals and monetary circumstances. Opinions expressed are present as of the date proven and are topic to alter.

This report was ready by Confluence Funding Administration LLC and displays the present opinion of the authors. It’s based mostly upon sources and knowledge believed to be correct and dependable. Opinions and forward-looking statements expressed are topic to alter. This isn’t a solicitation or a suggestion to purchase or promote any safety.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.