Confluence Funding

Confluence Funding Administration provides varied asset allocation merchandise that are managed utilizing “prime down,” or macro, evaluation. We publish asset allocation ideas on a weekly foundation on this report, updating the report each Friday, together with an accompanying podcast and chart guide.

The supply of ample funding capital is important for financial development in each wealthy, well-developed nations and poorer growing nations. Nevertheless, if the out there capital is poorly utilized and/or debt ranges get too excessive, the outcomes could be fairly unfavorable. In such a scenario, financial development can gradual as firms and people wrestle to make their debt funds. Financial shocks could cause firms, people, or governments to overlook their funds and go bankrupt, doubtlessly sparking a monetary disaster and damaging the nation’s monetary system. Excessive debt ranges in China have been particularly regarding for years, so it might be helpful to evaluate the newest information on that nation from the Financial institution for Worldwide Settlements.

[wce_code id=192]

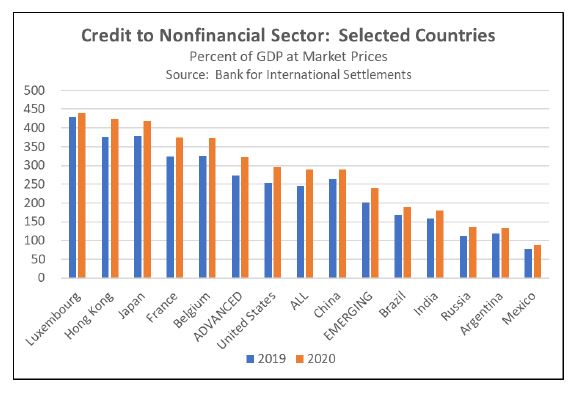

As proven within the following chart, the stronger, richer, superior nations can usually tolerate the next stage of debt (per BIS follow, we concentrate on complete credit score to the nonfinancial sector). For the typical superior nation within the BIS database, complete credit score to the nonfinancial sector stood at 321.3% of gross home product (GDP) on the finish of 2020. For the typical rising market, credit score to the nonfinancial sector stood at simply 240.1% of GDP. Be aware, nevertheless, that China stands out with its debt burden of 289.5%, which is considerably larger than the rising market common and much above the burdens for different massive growing nations like Brazil, India, and Mexico.

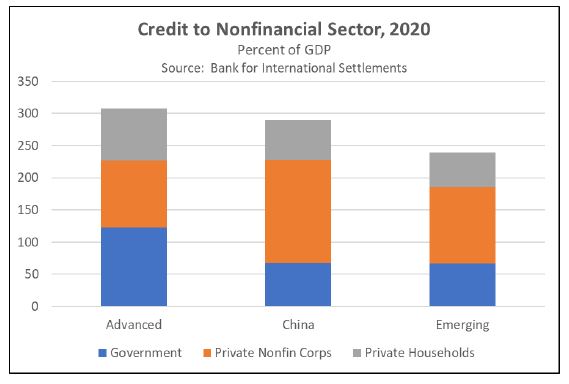

The BIS figures are damaged down into the quantity of credit score supplied to the nonfinancial company sector, the family sector, and the federal government sector. At this stage of element, we will see that China’s excessive total debt burden stems largely from its nonfinancial company sector. In China, nonfinancial company debt alone stands at 160.7% of GDP in contrast with 119.4% of GDP within the common rising market. Furthermore, China’s excessive company debt relative to the remainder of the rising markets has endured for years. Usually, China’s company debt burden by this measure is nearly half once more as excessive as for the typical rising market. China’s nonfinancial company debt burden is even larger in contrast with the 104.4% of GDP within the common superior nation. Certainly, nonfinancial company debt to GDP in China is even larger than in high-debt Japan, and it’s nearly as excessive as in Belgium.

This excessive reliance on company debt marks a brand new technique for China. Through the International Monetary Disaster of 2008-2009, Beijing relied totally on authorities fiscal spending and public borrowing to help the financial system, however that left many authorities entities burdened with debt for years afterward. In distinction, Beijing’s strategy to supporting the financial system through the 2020 coronavirus pandemic was to channel funds via the enterprise sector to maintain employees of their jobs and keep manufacturing to the extent potential. The ensuing increase to debt within the company sector was even greater than the rise in debt inside the authorities sector, as proven within the chart beneath.

Due to the increase in credit score to the company sector final 12 months, Chinese language firms could now be hobbled by their excessive debt ranges, particularly if rates of interest rise or the worsening U.S.-China geopolitical rivalry additional crimps Chinese language commerce flows. That is one purpose why we’ve got taken steps to restrict our publicity to China in our asset allocation methods. In our view, China’s mixture of excessive company debt ranges and elevated regulatory dangers associated to potential capital circulate restrictions ought to argue for below-benchmark weightings to the nation.

Previous efficiency isn’t any assure of future outcomes. Data supplied on this report is for instructional and illustrative functions solely and shouldn’t be construed as individualized funding recommendation or a suggestion. The funding or technique mentioned is probably not appropriate for all traders. Traders should make their very own choices based mostly on their particular funding goals and monetary circumstances. Opinions expressed are present as of the date proven and are topic to vary.

This report was ready by Confluence Funding Administration LLC and displays the present opinion of the authors. It’s based mostly upon sources and information believed to be correct and dependable. Opinions and forward-looking statements expressed are topic to vary. This isn’t a solicitation or a suggestion to purchase or promote any safety.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.