Confluence Funding Administrati

Confluence Funding Administration provides varied asset allocation merchandise that are managed utilizing “prime down,” or macro, evaluation. We publish asset allocation ideas on a weekly foundation on this report, updating the report each Friday, together with an accompanying podcast and chart guide.

In our report from June 25, we mentioned the information from the Monetary Accounts of the U.S., in any other case identified by its authentic identify, the Stream of Funds Report. There’s a part of the report that comes out a pair weeks after the preliminary launch often known as the Distributional Monetary Accounts of the U.S. This second dataset gives a steadiness sheet by wealth percentile. In different phrases, it gives the breakdown of property, liabilities, and web price by the highest 1% of households, the subsequent 9%, the center 40%, and the underside 50%. For essentially the most half, we mixture the highest 1% and the subsequent 9% in our evaluation.

Within the earlier report, we famous that family saving has risen dramatically as a result of authorities switch funds. This report offers us a sign of who’s holding the money.

[wce_code id=192]

Over the previous yr, money holdings of the highest 10% are up $161,000. Holdings of the center 40% are up $14,962, whereas that of the underside 10% are up $2,051. Though there have been giant authorities transfers, focused to the underside 90%, many of the further liquidity is within the fingers of upper earnings households.

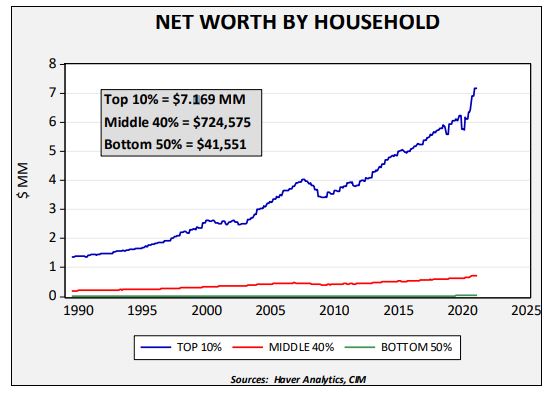

Internet price rose throughout all family classes.

Over the previous yr, the highest 10% noticed their web price rise by $1.four million. The center 40% elevated by $101,090, and the underside 50% rose by $10,786.

Lastly, when it comes to liabilities relative to money, the underside 50% are steadily deleveraging.

This chart exhibits a macro type of the money ratio. Presently, the underside 50% liabilities exceed money by 8.8x. The ratio for the center 40% is 1.3x and it’s 0.4x for the highest 10%. The important thing level of this chart is that the underside 50% have been deleveraging for the reason that Nice Monetary Disaster.

These three charts are sending an analogous message, which is that the distribution of money and property doesn’t help sustained inflation. We would wish to see extra liquidity and property held within the center and backside earnings brackets, however many of the liquidity is held by the highest 10% of households. They’re much less doubtless to make use of it to purchase items and companies and extra more likely to make investments. With regard to the third chart, it’s all the time troublesome to know when a family reaches a degree the place it’s snug with its debt ranges and needs to borrow once more. Present ranges are in keeping with values from 1995 to 2000. Nevertheless, we observe that within the early 1990s, a ratio of 6x was regular. If this group of households decides to additional scale back its debt, the probabilities of this liquidity feeding a reflation could be additional decreased.

Previous efficiency is not any assure of future outcomes. Data supplied on this report is for instructional and illustrative functions solely and shouldn’t be construed as individualized funding recommendation or a advice. The funding or technique mentioned might not be appropriate for all traders. Buyers should make their very own selections based mostly on their particular funding targets and monetary circumstances. Opinions expressed are present as of the date proven and are topic to vary.

This report was ready by Confluence Funding Administration LLC and displays the present opinion of the authors. It’s based mostly upon sources and information believed to be correct and dependable. Opinions and forward-looking statements expressed are topic to vary. This isn’t a solicitation or a proposal to purchase or promote any safety.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.