Confluence Funding Administrati

Confluence Funding Administration affords varied asset allocation merchandise that are managed utilizing “prime down,” or macro, evaluation. We publish asset allocation ideas on a weekly foundation on this report, updating the report each Friday, together with an accompanying podcast and chart e book.

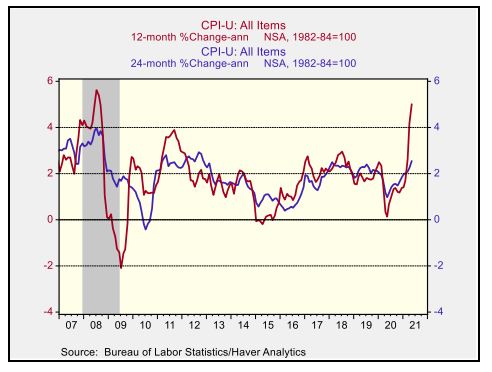

As the worldwide financial system begins to get well from the coronavirus, we’ve been warning that the obvious surge in worth inflation might not be all that it appears. Inflation is normally calculated as the share change over one yr. Since many client costs stagnated or fell initially of the pandemic a yr in the past and solely lately began to get well, “base results” alone make it seem like inflation is very excessive. In actual fact, the Could client worth index (CPI) was up 5.0% from one yr earlier, marking its largest annual acquire since mid-2008. To look via the bizarre pandemic distortions and see the place the traits actually are, we’ve begun to focus extra on the two-year fee of change. As proven within the chart beneath, a comparability of the CPI in Could 2021 versus the CPI in Could 2019 would suggest a mean annual rise of simply 2.5% during the last two years. That’s nonetheless elevated in contrast with the current previous, however it’s solely half as huge because the inflation fee calculated over one yr.

[wce_code id=192]

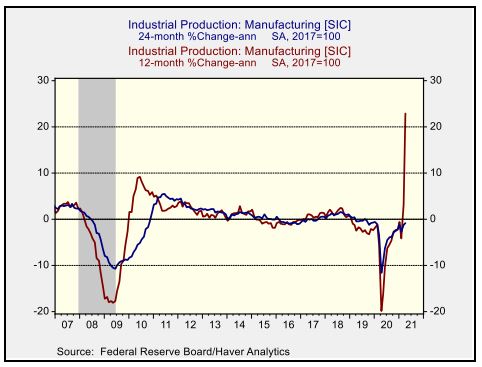

We’ve been arguing that these base results will drop out of the calculation and lead to extra average inflation readings later this yr, however the identical will be mentioned for a lot of different financial indicators, even when they aren’t sometimes calculated on a year-over-year foundation. For instance, the Federal Reserve’s index of producing manufacturing for April (newest obtainable information) was up an astounding 22.8% from April 2020. Nonetheless, that largely displays base results associated to final spring’s sharp drop in output adopted by a more moderen restoration in manufacturing. If we evaluate output in April 2021 to the output in April 2019, the common annual improve during the last two years involves -0.9%. In different phrases, manufacturing unit manufacturing lately is definitely a bit lower than it was earlier than the pandemic.

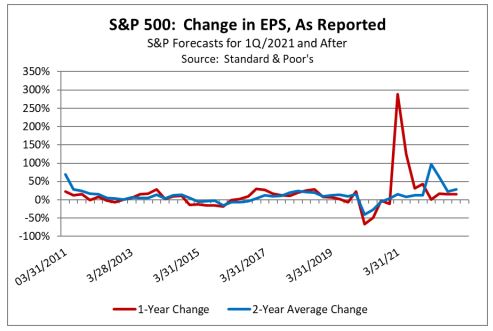

The idea of base results could also be particularly necessary for inventory traders as they have a look at company earnings. Within the first quarter of 2021, earnings per share (EPS) on the S&P 500 index will likely be up roughly 288.1% year-over-year, however that’s solely due to the sharp drop in earnings on the outset of the pandemic adopted by a restoration in current quarters. As proven within the chart beneath, the anticipated EPS of $46.10 would solely symbolize a mean annual acquire of about 14.7% during the last two years. That’s higher than the common annual EPS progress of about 8.4% during the last couple of a long time, however it’s nonetheless weaker than the common acquire of 16.2% over probably the most

current 5 years. In sum, traders must be aware of the massive distortions that the pandemic has prompted in every kind of financial and monetary information. Trying on the two-year common adjustments might assist traders gauge the true state of affairs extra precisely. Whereas we nonetheless suppose equities can carry out effectively within the close to time period, the positive factors could also be a lot much less dramatic than is likely to be implied by simply the year-over-year earnings progress.

Previous efficiency isn’t any assure of future outcomes. Data supplied on this report is for instructional and illustrative functions solely and shouldn’t be construed as individualized funding recommendation or a suggestion. The funding or technique mentioned might not be appropriate for all traders. Traders should make their very own choices based mostly on their particular funding goals and monetary circumstances. Opinions expressed are present as of the date proven and are topic to alter.

This report was ready by Confluence Funding Administration LLC and displays the present opinion of the authors. It’s based mostly upon sources and information believed to be correct and dependable. Opinions and forward-looking statements expressed are topic to alter. This isn’t a solicitation or a suggestion to purchase or promote any safety.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.