By Asset Allocation Committee | PDF

By Asset Allocation Committee | PDF

When discussing the fiscal deficit in a gathering with then-President Invoice Clinton and his Council of Financial Advisors, Chief Strategist James Carville was quoted as saying, “I used to assume that if there was reincarnation, I needed to come back again because the president or the pope or as a .400 baseball hitter. However now I want to come again because the bond market. You may intimidate everyone.” As Carville recommended, rising 10-year T-note yields are at present shaking investor confidence in world shares, significantly within the Know-how sector. The first concern for traders is that the subsequent stimulus package deal may spark inflation over the subsequent couple of years. On this report, we focus on why a few of these fears could also be misplaced.

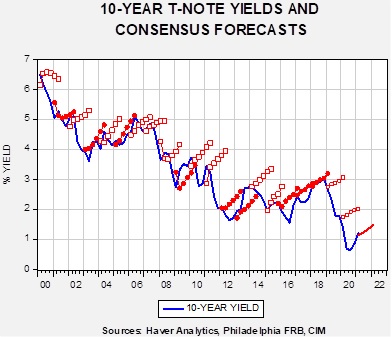

The 10-year T-note yield has tripled from 0.51% final August to slightly over 1.54% at the moment. The surge in yields may be partly attributed to fears of accelerated inflation because of the federal authorities’s rising deficit. The brand new COVID-19 aid plan has drawn the ire of bondholders as a result of they believe it was larger than crucial. The prospect of upper borrowing prices hurts equities as a result of it lowers valuations. In different phrases, larger yields are inclined to depress P/E multiples.

[wce_code id=192]

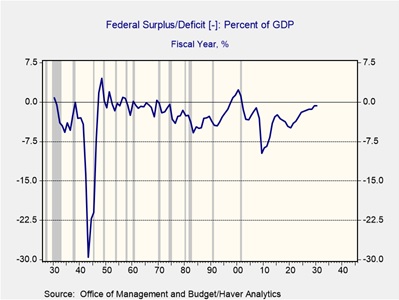

Normally, the connection between fiscal deficits and inflation will not be all that sturdy. During the last 20 years, the U.S. price range deficit relative to GDP has been the biggest throughout any interval of peacetime. All through this era, nonetheless, inflation has by no means reached the degrees seen within the 1970s and 1980s. Actually, core CPI for the final 20 years has grown across the Fed’s 2% goal. The 2 main drivers of the Shopper Value Index (CPI) have come from healthcare and shelter. Composing almost 40% of the index, costs in these two sectors have persistently outpaced the general index.

Inflation has been comparatively muted over latest years as a result of the situations that allowed it to thrive within the 70s and 80s not exist at the moment. Deregulation, globalization, and decrease taxes have made it simpler to chop prices, whereas making it troublesome for companies to boost costs. Deregulation and globalization have made it simpler for companies to outsource labor and take away pricey rules, whereas decrease taxes incentivized companies to undertake cost-saving applied sciences. Moreover, elevated competitors meant that solely corporations with differentiated or specialised items had any actual pricing energy. Consequently, the costs for items comparable to attire and autos have been roughly unchanged during the last 20 years.

As a substitute of seeing inflation in items and providers, we suspect that deficit spending will seemingly discover its means into monetary property. Authorities spending is paid for by way of the personal sector (which incorporates companies and households) and international financial savings. A lot of these financial savings to this point have come from households as larger ranges of unemployment have deterred spending. These financial savings have been used to pay down debt and put money into equities (cue the Reddit military). Overseas financial savings will seemingly additionally choose up within the coming months as customers start to spend extra. This ought to be supportive of monetary property as an increase in imports is usually funded by a rise of flows into the capital account.

Practically each president since Nixon has ruled with a watch on the bond market. That’s as a result of bondholders overestimate the impression that new presidents will usually have on the economic system. The chart above exhibits the 10-year T-note yield together with the first-quarter forecast for the subsequent six quarters from the Philadelphia FRB’s survey {of professional} economists. When the forecast is usually appropriate, we mark it with dots; when in error, we use open containers. In 12 of the previous 20 years, the expectation has been for rising charges and has been incorrect. Thus, traders ought to be conscious that expectations lean towards larger charges however are fallacious greater than half the time. One other mind-set concerning the latest rise in charges is that more often than not, the consensus is that long-duration rates of interest will rise. That being stated, we suspect the rise in present charges most likely gained’t exceed 2% on the 10-year T-note and fairness markets will be capable of handle this stage of improve.

View PDF

These experiences had been ready by Confluence Funding Administration LLC and mirror the present opinion of the authors. Opinions expressed are present as of the date proven and are based mostly upon sources and knowledge believed to be correct and dependable. Opinions and forward-looking statements expressed are topic to alter. This isn’t a solicitation or a proposal to purchase or promote any safety. Previous efficiency is not any assure of future outcomes. Info offered on this report is for academic and illustrative functions solely and shouldn’t be construed as individualized funding recommendation or a advice. Investments or methods mentioned might not be appropriate for all traders. Traders should make their very own selections based mostly on their particular funding targets and monetary circumstances.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.