Confluence Funding Administration affords numerous asset allocation merchandise that are managed utilizing “high down,” or macro, evaluation. We publish asset allocation ideas on a weekly foundation on this report, updating the report each Friday, together with an accompanying podcast.

August 27, 2021

Because the Federal Reserve was granted independence in 1951 there have been 11 recessions. Though every recession and restoration are considerably distinctive, analysts have a tendency to match them for clues about future financial exercise and coverage actions. When it comes to financial coverage, Chair Powell has staked out a dovish path, suggesting that the primary fee hike could not happen till 2023. Nevertheless, latest feedback from Fed officers recommend the chair’s place is changing into more and more remoted.

[wce_code id=192]

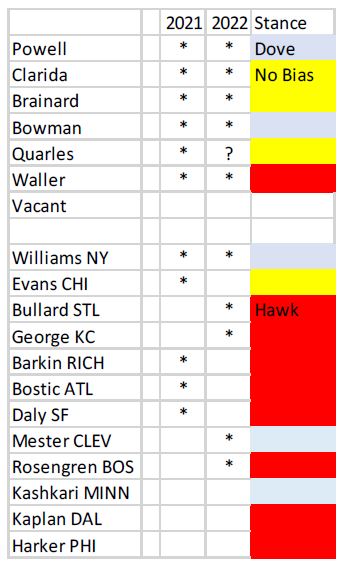

On this desk, voters are designated by stars. At the moment, there are 5 dedicated doves on the FOMC. We anticipate the no-bias camp to vote for stimulus discount subsequent yr on the earliest. The hawks, alternatively, are dedicated to shifting this yr. Though we may see an increase in dissents later this yr, we suspect that coverage will stay regular till 2022.

Subsequent yr may very well be attention-grabbing, to say the least. Powell’s time period as chair ends in February and Quarles’s time period as vice chair for regulation ends in October 2021. His full time period as governor extends to 2032; though it’s customary for a governor to step down as soon as a vice chair place ends, Quarles has indicated he’ll keep round for some time. If the no-bias group shifts to tightening, Powell could should tighten or face shedding a vote.

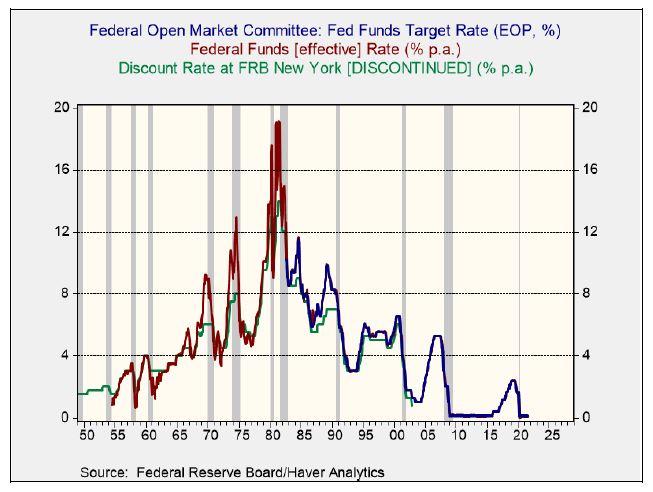

Financial coverage in recoveries and expansions has assorted over time. Previous to 1982, it wasn’t all the time clear from the habits of fed funds alone whether or not coverage had modified. To estimate modifications, we are able to additionally use the New York FRB low cost fee as an indicator.

Trying on the recessions from 1955 (the primary after independence) onward, what’s putting is that the FOMC usually moved to boost charges relatively rapidly after the recession ended. Through the seven recessions, the typical variety of months from the tip of the recession to the primary fee hike is 13 months. Up to now three, the typical is 48 months. It has been 4 many years for the reason that FOMC raised charges rapidly right into a restoration. For 3 many years, traders have turn into accustomed to the sluggish withdrawal of stimulus.

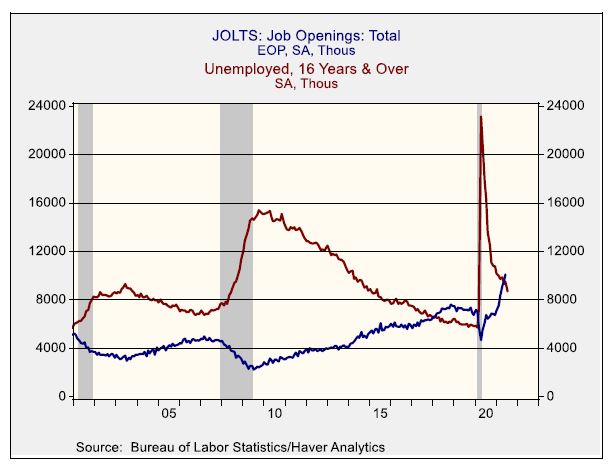

Nevertheless, this restoration seems to be a lot completely different than the previous three. Partly, the restoration has been stronger on account of huge fiscal and financial coverage assist. However one other issue is that the recession, though brief in period, was unusually deep. Though typically deep recessions have “L”-shaped recoveries, this one didn’t. One strategy to see that is by evaluating job openings to the variety of unemployed employees.

Through the entirety of the restoration from the 2001 recession, the variety of unemployed exceeded job openings. Within the earlier restoration, it took till March 2018, nearly 9 years after the recession ended, for openings to exceed the variety of unemployed. Within the present restoration, we crossed that line in Might, 13 months after the final recession ended.

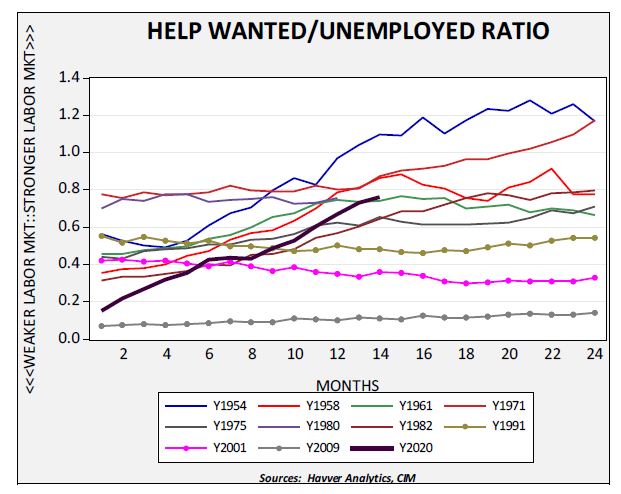

Sadly, the JOLTS report, which measures job openings, began in 2000, so it doesn’t present a long-term historical past. The Convention Board had a sequence the place it measured assist needed advertisements relative to the variety of unemployed. It was discontinued in 2010. Though that quantity is a ratio primarily based on an index, we created a mannequin from the JOLTS report that approximates the assistance needed/unemployed ratio to the current.

Evaluating the habits of the assistance needed/unemployed ratio from the tip of each recession since Fed independence, the present restoration is performing extra just like the pre-1990 cycles. We’ve got denoted the previous three with dots on their traces and it’s notable that the labor market didn’t enhance over the 2 years after the tip of the recessions. To this point, the FOMC management is performing as if this restoration is much like the previous three cycles; if it’s not, coverage will possible have to tighten a lot quicker than the market expects.

Previous efficiency is not any assure of future outcomes. Info offered on this report is for academic and illustrative functions solely and shouldn’t be construed as individualized funding recommendation or a advice. The funding or technique mentioned will not be appropriate for all traders. Traders should make their very own choices primarily based on their particular funding goals and monetary circumstances. Opinions expressed are present as of the date proven and are topic to vary.

This report was ready by Confluence Funding Administration LLC and displays the present opinion of the authors. It’s primarily based upon sources and information believed to be correct and dependable. Opinions and forward-looking statements expressed are topic to vary. This isn’t a solicitation or a proposal to purchase or promote any safety.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com