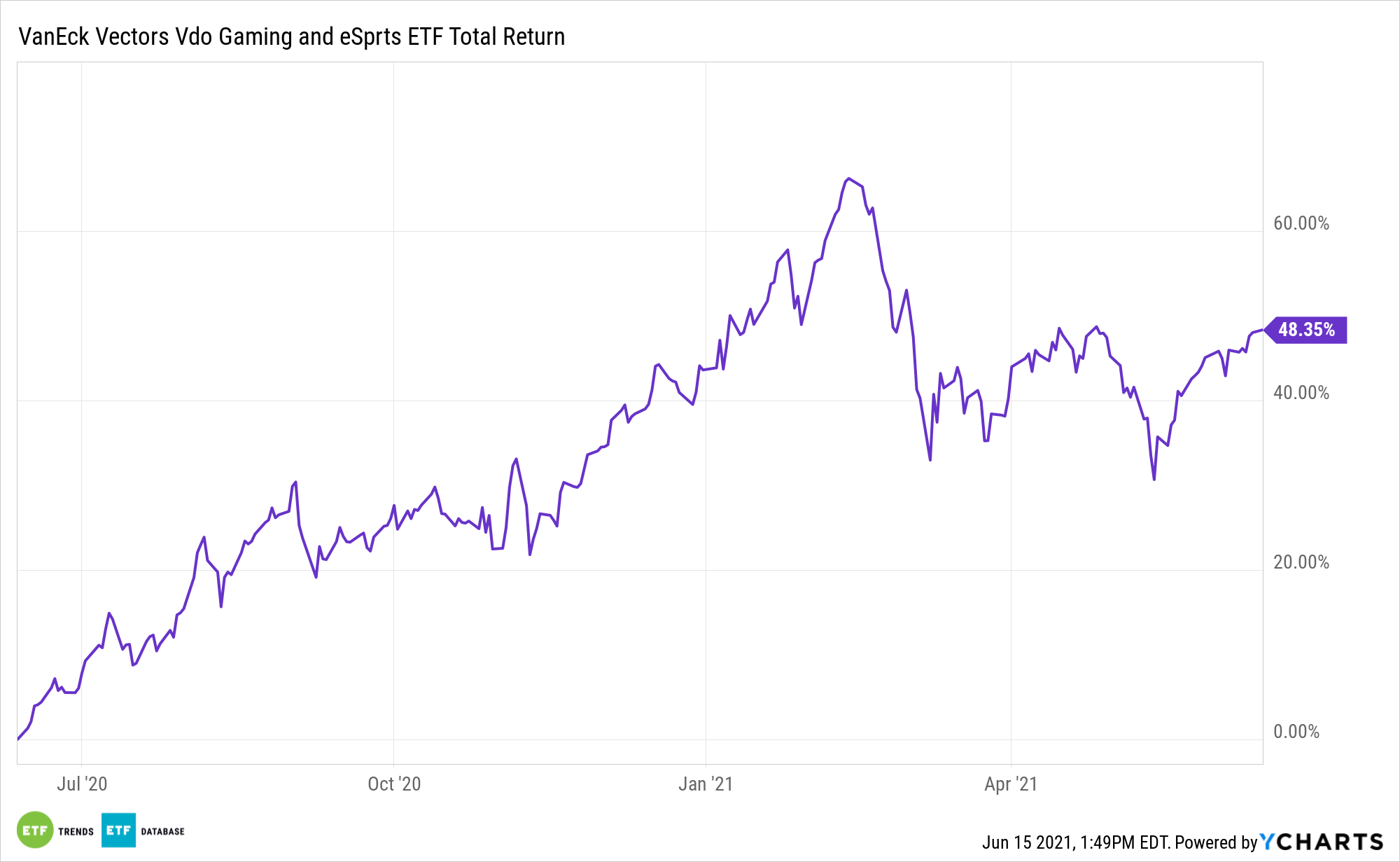

The VanEck Vectors Video Gaming and eSports ETF (NASDAQ: ESPO) is larger by simply 3.30% year-to-date, however traders ought to look at the online game change traded fund’s potential on a deeper degree.

That analysis could reveal that ESPO’s 11.34% decline from its 52-week peak is a chance to purchase on the dip. Among the fund’s 2021 lethargy is attributable to progress shares being out of favor relative to worth. Practically the entire 25 holdings within the $819.four million ESPO are categorized as progress names.

Then there’s the a lot mentioned international semiconductor scarcity, which is related to ESPO traders as a result of chips are very important to the manufacturing of online game consoles. ESPO allocates nearly 17% of its weight to NVIDIA (NASDAQ: NVDA) and Superior Micro Gadgets (NASDAQ: AMD), the dominant makers of graphic processing models (GPU) for consoles.

Fortuitously, it seems as if the darkest days of the chip provide chain woes are right here now, which means the state of affairs may ease within the again half of 2021.

“Our analysts consider we’re most likely within the worst interval of that proper now,” mentioned chief Asia economist Andrew Tilton in a latest CNBC interview. “That may regularly ease over the again half of the 12 months.”

Participant Habits Altering? Do not Wager on It

One more reason ESPO and rival funds are trailing the broader market this 12 months is the priority that because the world shakes off the consequences of the coronavirus pandemic, avid gamers have a tendency to place down their controllers and embrace different types of leisure.

In any case, it was shelter-in-place directives and the elevated transfer towards in-home leisure that propelled ESPO to an almost 84% acquire final 12 months. Take-Two Interactive (TTWO) Chief Govt Officer Strauss Zelnick lately made feedback indicating there might be some moderation in gamer habits in a post-pandemic world, however that the runway for gaming software program progress is now forward of the place it was earlier than the pandemic. Take-Two is ESPO’s ninth-largest part.

Along with Take-Two, ESPO is house to a number of the different big-name online game publishers, together with Activision Blizzard (ATVI), Digital Arts (EA), and Konami. For traders contemplating ESPO, the fund’s software program publicity is related as a result of this 12 months will carry new releases of fashionable franchises and new video games.

“This 12 months can even function some main releases of high-profile video games for the latest Xbox and PlayStation consoles, together with the primary Battlefield sequel from EA in three years,” reviews Dan Gallagher for the Wall Road Journal.

For extra information and knowledge, go to the Past Fundamental Beta Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.