Most of the financial indicator

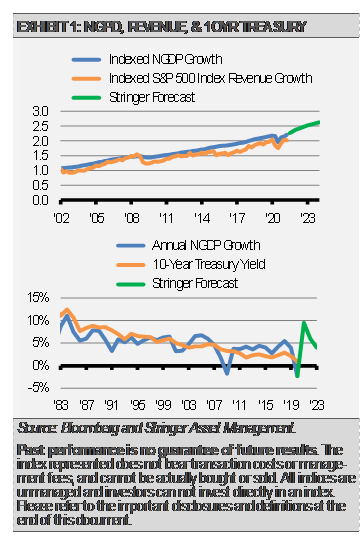

Most of the financial indicators that we observe, equivalent to financial circumstances and enterprise surveys, level to stable financial progress within the coming months and persevering with into 2022. Although nonetheless sturdy, we count on the tempo of financial progress to sluggish and have trimmed our 2021 GDP expectation to six.5%. Extra impactful for our work, nominal GDP (NGDP) ought to rise to its pre-COVID pattern path within the coming six to 9 months. NGDP, which is GDP plus inflation, has essential implications for each company income progress and long-term rates of interest. The optimistic relationships between NGDP and these different two components is among the causes we name for continued, although muted and risky, inventory market good points and better long-term rates of interest.

[wce_code id=192]

Our financial progress expectation could be even larger if not for provide chain bottlenecks in every thing from microchips to labor. We will see the consequences of those provide chain bottlenecks within the newest Buying Supervisor Index (PMI) knowledge that present the tempo of progress slipping. Nonetheless, the slower tempo of financial progress we might even see going ahead may be very sturdy relative to the final enterprise cycle.

Feedback from survey respondents recommend provide constraints are holding again potential progress in addition to fueling larger costs. Whereas we could also be nearing the height in year-over-year inflationary numbers, core inflation might stay extra persistent than market members and coverage makers count on.

We predict improved jobs creation numbers will proceed after the acceleration in June’s jobs report. The most recent Convention Board Employment Developments Index factors to sturdy jobs progress within the months forward. Greater wages mixed with enhanced unemployment advantages being phased out, continued vaccine distribution, colleges reopening within the fall, and the continuation of broader financial progress ought to propel sooner jobs good points.

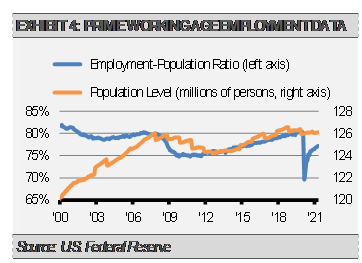

Moreover, we expect that the labor market is tighter than the headline unemployment charge implies. Each the variety of companies saying jobs are arduous to fill and the variety of people saying that jobs are simple to seek out replicate tight labor market circumstances. Moreover, the headline unemployment charge could also be distorted by each authorities intervention in addition to the quantity of people that merely retired. We desire to trace knowledge on prime age employees, that are these from 25-54 years outdated, because it consists of these at their peak spending and incomes years and is much less subjected to distortions at each the youthful and extra mature ends of the spectrum.

Our work means that we nonetheless have some solution to go earlier than we get again to full employment for the prime age employee cohort, however substantial progress has been made. On the finish of June, the prime age employment inhabitants ratio stood at 77.2%, down from the pre-COVID 80.5%. The prime age inhabitants is roughly 126 million, which suggests roughly four million new jobs are required to get the ratio again to 80.5%. That is far lower than the 7 million fewer employed that we see within the press, and we expect is extra reflective of the particular labor market circumstances. We count on because the economic system continues to get again to extra regular operation and jobs progress reaccelerates, we might see prime age employees at recovered employment figures by the top of 2021 or early 2022.

INVESTMENT IMPLICATIONS

A whole lot of this excellent news is already mirrored in market costs in our opinion. We predict that broad inventory market valuations are stretched, and markets could also be overly complacent. Stretched fairness market valuations by almost any metric in addition to tight fastened earnings credit score spreads recommend markets are pricing in a close to excellent financial consequence with steady progress and low inflation. We discover this unlikely given provide chain points and constructing inflationary pressures.

Regardless of our expectations for sturdy financial progress in the course of the second half of this yr, our expectations for fairness market good points are extra muted. In consequence, we have now elevated our diversification throughout fairness sectors and elevated defensive holdings along with the cyclical worth positions which have labored so properly this yr.

We do suppose that the inventory market’s upward pattern will proceed over time, however that stretched valuations mixed with complacency makes the inventory market susceptible to shocks within the near-term. We sit up for redeploying these defensive belongings in a extra opportunistic style quickly.

We’re watching our indicators intently and can regulate rapidly if we sense issues or different alternatives forward. That flexibility is among the advantages of getting a tactical allocation the place we are able to handle danger in actual time.

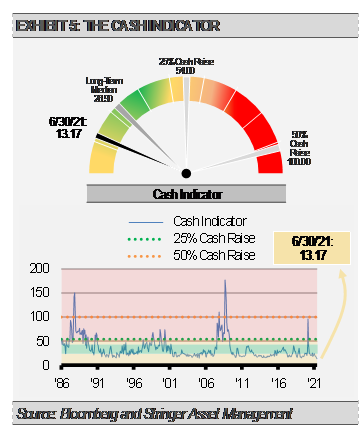

THE CASH INDICATOR

Our Money Indicator (CI) has held at traditionally low ranges. Although financial fundamentals stay sturdy, CI ranges this low recommend that markets could also be overly complacent and due for a shock. Some of these shocks, or market corrections, are typically quick lived. Given the optimistic financial again drop, we see market shocks as a shopping for alternative.

DISCLOSURES

Any forecasts, figures, opinions or funding strategies and techniques defined are Stringer Asset Administration, LLC’s as of the date of publication. They’re thought of to be correct on the time of writing, however no guarantee of accuracy is given and no legal responsibility in respect to error or omission is accepted. They’re topic to alter with out reference or notification. The views contained herein are to not be taken as recommendation or a advice to purchase or promote any funding and the fabric shouldn’t be relied upon as containing ample data to help an funding resolution. It ought to be famous that the worth of investments and the earnings from them might fluctuate in accordance with market circumstances and taxation agreements and buyers might not get again the complete quantity invested.

Previous efficiency and yield might not be a dependable information to future efficiency. Present efficiency could also be larger or decrease than the efficiency quoted.

The securities recognized and described might not symbolize the entire securities bought, offered or really helpful for shopper accounts. The reader shouldn’t assume that an funding within the securities recognized was or will likely be worthwhile.

Knowledge is offered by varied sources and ready by Stringer Asset Administration, LLC and has not been verified or audited by an impartial accountant.

Index Definitions:

S&P 500 Index – This Index is a capitalization-weighted index of 500 shares. The Index is designed to measure efficiency of a broad home economic system by way of modifications within the mixture market worth of 500 shares representing all main industries.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.