by Dan Weiskopf, ETF Professor

Dan Weiskopf, ETF Professor

As the worldwide economic system appears to be like to rebound, the rule about value and site has by no means been extra true in actual property than at this time. Belongings Beneath Administration (AUM) for this ETF funding class are $69.09 billion, or about 1.2% of the $5.686 trillion in mixture ETF AUM. Arguably, this implies the class is comparatively small within the ETF mixture of belongings. But, strolling house in New York Metropolis Saturday night time, I used to be made conscious of how foundational the asset class is to so many industries. For instance, the current heat climate in NYC appeared to deliver crowds to eating places once more. I anticipate a lot of NYC retail actual property will must be reorganized, however who is aware of – possibly in a few years, the emptiness charge will discover a baseline to rebound from. Let’s face it – Manhattan retail actual property was on a decline for years already. As a New Yorker, I’m additionally reminded of how necessary innovation is as a driver of revitalization. I spotlight this as a result of I discover it wonderful that within the ETF market, there are solely three lively ETFs providing actual property entry. Maybe not coincidentally, on February 26th, SS&C Alps, in tandem with the Blue Tractor mannequin and with GSI Capital Advisors because the sub-advisor, lately launched a brand new lively ETF underneath the image REIT. The symbols for the opposite two lively funds are Invesco Lively US Actual Property ETF (PSR – $95.eight million AUM) and Constancy Actual Property Funding ETF (FPRO – $5.2 million in AUM). Lively ETFs providing actual property entry, together with REIT, have solely about $113 million in AUM. Heather Bell, of ETF.com, goes deep into the construction of the brand new REIT ETF within the following hyperlink.

[wce_code id=192]

Wanting on the U.S. and why Lively

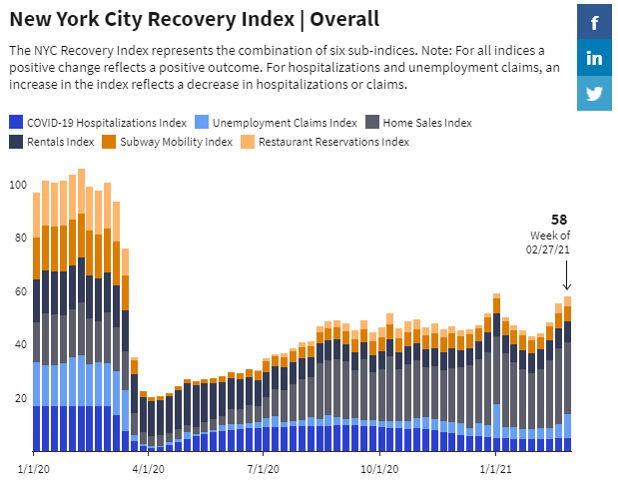

Considering by the longer term, we consider that lively ought to be anticipated to outperform passive on this class, regardless of the dominance in passive belongings, particularly given the disruption from deliberate modifications in taxes, demographics and employment. As traders who take pleasure in benchmarking traits, we’re monitoring the traits within the New York Metropolis space intently and word the beneath New York Metropolis Restoration Index as a metrics to measure progress. As a key metric, we additionally spotlight that because the variety of Covid-19 vaccines enhance to now 2 million a day, the velocity of financial restoration will speed up, pushed by subway riders and restaurant reservation elements measured by the New York Metropolis Restoration Index.

We additionally spotlight that the Empire State constructing is owned by a public REIT (ESRT), and can also be a metric to observe the progress of New York’s restoration. In fact, wanting past the grace and imagery of the Empire State constructing, we additionally spotlight a $59 billion income shortfall for New York by the subsequent two years. So far, we see the chance for traders to embrace lively over passive on this class of monumental significance. Actual property will not be cell, however fund flows finally ought to gravitate in the direction of the place demographics and financial disruption is finest addressed, by a strategy of focused analytics that tackle particular circumstances. We additionally hope that these portfolio managers providing lively methods will really present excessive lively share portfolios. Alpha over low-cost entry can solely be achieved by differentiation.

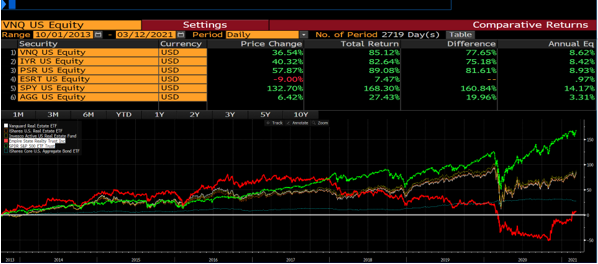

We’re shocked to see how share issuance for Vanguard Actual Property ETF (VNQ) has rebounded at 388 million shares, which is close to its peak of 409.43 million on February 27, 2020, and its value is inside 10% of its all time excessive. Are traders not recognizing the rule that location issues? Maybe extra folks ought to check out these unloved lively funds. Since November 2008, when the Invesco Lively US Actual Property ETF (PSR) was launched, it barely outpaced the Vanguard Actual Property ETF (VNQ). However arguably, this era was far more forgiving than the longer term outlook is ready as much as be. Rates of interest went one course since 2008, taxes have been affordable, and peaks and valleys have been forgiving for affected person collectors. Forecasting the longer term is difficult, however it will appear that such assumptions cannot be fairly anticipated sooner or later. There are about 47 methods to spend money on actual property utilizing US ETFs, worldwide and international ETFs. On this report we solely targeted on US ETFs.

Abstract

The Vanguard Actual Property ETF (VNQ) makes up about 53% of the AUM, and the passive wrapper total makes up nearly 100% of the class. Given the variety of shifting elements on this asset class and the primary rule in actual property investing being “location, location, location,” we predict lively methods will generate alpha over passive funds within the coming 5 – 10-year cycle for this class. We simply hope New York will likely be one of many successful actual property areas.

Disclosure

The data offered right here is for monetary professionals solely and shouldn’t be thought-about an individualized advice or customized funding recommendation. The funding methods talked about right here might not be appropriate for everybody. Every investor must evaluate an funding technique for his or her personal specific scenario earlier than making any funding choice.

All expressions of opinion are topic to alter with out discover in response to shifting market circumstances. Information contained herein from third celebration suppliers is obtained from what are thought-about dependable sources. Nonetheless, its accuracy, completeness or reliability can’t be assured.

Examples offered are for illustrative functions solely and never meant to be reflective of outcomes you may anticipate to attain.

All investments contain danger, together with doable lack of principal.

The worth of investments and the earnings from them can go down in addition to up and traders might not get again the quantities initially invested, and will be affected by modifications in rates of interest, in trade charges, normal market circumstances, political, social and financial developments and different variable elements. Funding includes dangers together with however not restricted to, doable delays in funds and lack of earnings or capital. Neither Toroso nor any of its associates ensures any charge of return or the return of capital invested. This commentary materials is out there for informational functions solely and nothing herein constitutes a suggestion to promote or a solicitation of a suggestion to purchase any safety and nothing herein ought to be construed as such. All funding methods and investments contain danger of loss, together with the doable lack of all quantities invested, and nothing herein ought to be construed as a assure of any particular consequence or revenue. Whereas we’ve gathered the knowledge offered herein from sources that we consider to be dependable, we can not assure the accuracy or completeness of the knowledge offered and the knowledge offered shouldn’t be relied upon as such. Any opinions expressed herein are our opinions and are present solely as of the date of distribution, and are topic to alter with out discover. We disclaim any obligation to supply revised opinions within the occasion of modified circumstances.

The data on this materials is confidential and proprietary and might not be used apart from by the meant person. Neither Toroso or its associates or any of their officers or staff of Toroso accepts any legal responsibility in any respect for any loss arising from any use of this materials or its contents. This materials might not be reproduced, distributed or revealed with out prior written permission from Toroso. Distribution of this materials could also be restricted in sure jurisdictions. Any individuals coming into possession of this materials ought to search recommendation for particulars of and observe such restrictions (if any).

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.