Yield-starved buyers do not need to tackle a number of positions in high-yield bonds, rising market

Yield-starved buyers do not need to tackle a number of positions in high-yield bonds, rising markets bonds, and different property with a view to get yield in at this time’s setting. They will have all of it and keep on the right track with their earnings necessities utilizing the World X TargetIncome Plus 2 ETF (TFLT).

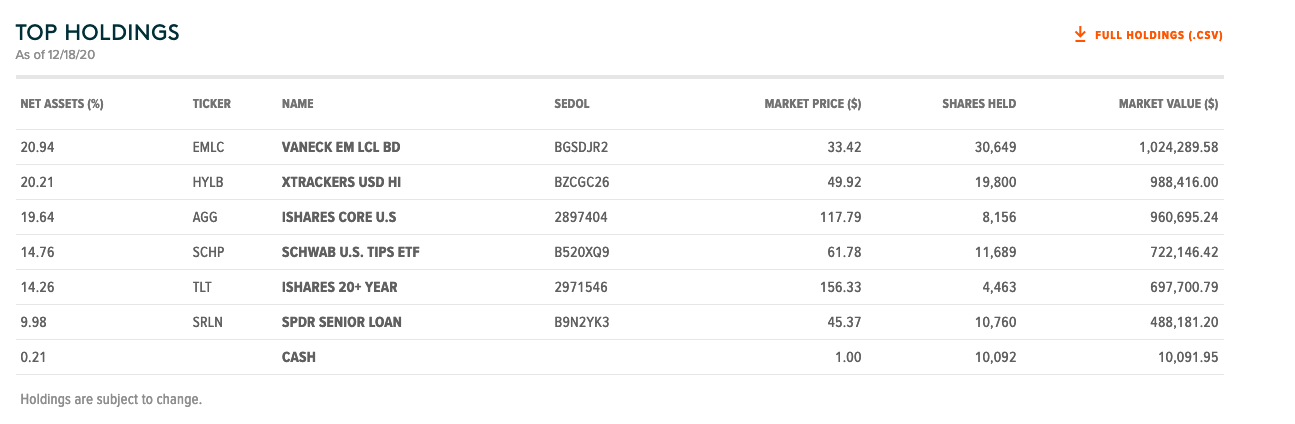

TFLT seeks funding outcomes that correspond to the value and yield efficiency, earlier than charges and bills, of the Wilshire TargetIncomeTM 10-12 months Treasury +2% Plus Index. The fund is a fund of funds and invests a minimum of 80% of its complete property within the securities of the underlying index.

The underlying index seeks to offer broad publicity to income-producing asset courses utilizing a portfolio of exchange-traded funds, with the aim of offering publicity that could be ample to assist an annualized yield of the U.S. 10-12 months Treasury yield plus two p.c for the fund, web of charges.

Taking a look at its high holdings, you may see a majority of the fund lies inside a mixture of ETFs specializing in excessive yield, rising markets bonds, and even Treasury Inflation Protected Securities (TIPs).

Low Charges Piloting a Flight From Protected Havens

Low charges are actually piloting a flight from protected haven authorities debt with low yields. Funds like TFLT will help fight the present low-rate market setting that might persist for a while if the Fed stays true to its pledge to maintain charges low.

“The ultra-low charges have despatched buyers chasing after high-yield dividend shares this yr,” a Zacks article defined. “That is very true because the 10-year Treasury yields have been at traditionally decrease ranges of beneath 1% for a lot of the yr and can stay underneath strain given the influx of low-cost cash into the economic system.”

“The Fed has pledged to maintain rates of interest close to zero and can proceed to purchase a minimum of $120 billion of bonds every month till “substantial additional progress” has been made towards reaching most employment and wholesome inflation,” the article added. “Moreover, the coronavirus outbreak wreaked havoc on the economic system, driving the enchantment for dividend-paying shares. Although the pandemic is seemingly nearing its finish with the arrival of the vaccine, the surging variety of new circumstances continues to be weighing on buyers’ sentiment. Considerations over the supply of protected vaccines to all People quickly added to the woes.”

For extra information and knowledge, go to the Thematic Investing Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.