Looking on the present trajectory for iShares, the iShares iBonds suite has now crossed $10 billion

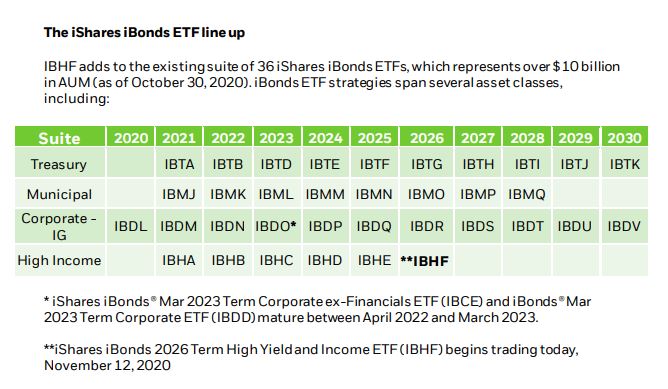

Looking on the present trajectory for iShares, the iShares iBonds suite has now crossed $10 billion in AUM and is projected to develop to $20 billion within the subsequent 5 years. On Thursday, BlackRock introduced the launch of the iShares iBonds 2026 Time period Excessive Yield and Earnings ETF (IBHF).

The fund, obtainable on NYSE Arca, seeks to trace the funding outcomes of an index composed of U.S. dollar-denominated, excessive yield, and different income-generating company bonds maturing between January 1, 2026 and December 15, 2026.

Karen Schenone, Head of iShares Mounted Earnings Technique for USWA inside BlackRock’s International Mounted Earnings Group, says, “Having now served traders for over a decade, iBonds ETFs have superior the modernization of bond portfolios.”

Schenone continues, “Like all improvements, iBonds ETFs streamlined what was beforehand a cumbersome course of by making it handy to construct scalable bond ladders, choose exact factors on the yield curve, and match anticipated money flows to focus on time-specific targets. As investor demand for iBondsETFs continues, we count on the AUM of the suite to double, reaching $20 billion over the following 5 years.”

iBonds ETFs are designed to mature, like a bond. The funds have a specified maturity date, and just like particular person bonds, traders are uncovered to much less rate of interest threat over time, as iBonds ETFs strategy maturity.

They’re additionally traded like inventory. Traders can commerce these ETFs all through the day on the change as an alternative of the over-the-counter (OTC) bond market. This helps, because the ETFs will be diversified like a fund as properly. iBonds present exposures to a number of bonds in a single fund.

iBonds ETFs by the numbers

- 10 years of iBonds: iShares launched the primary iBonds ETFs – the primary time period maturity ETFs to market – in January 2010, providing traders a brand new tackle bond laddering – ETFs designed to mature at a selected date like a bond, commerce like a inventory, and provide the diversification of a fund.

- Over $10 billion in AUM: iBonds ETF AUM has seen regular progress because the suite’s inception in 2010, crossing $10 billion throughout all asset courses in October of this yr. Within the final three years, the AUM has greater than doubled in measurement from $4.5 billion on the finish of 2017 to $10.08billion on the finish of October 2020, a rise of over 124%.

- 56 iBonds ETFs launched because the suite’s inception: The launch of IBHF expands the iShares iBonds suite to 37 reside merchandise throughout 4 asset classes-U.S. treasury, municipal, funding grade, and high-income company sectors. 19 iBonds ETFs (10 funding grade and 9 municipal funds) have, by design, matured, offering traders a complete return expertise near holding a portfolio of particular person bonds.

- A median of 293 particular person bonds: Throughout the 4 asset courses, on common, every iBonds ETF consists of293 particular person bonds.3Bond ETFs maintain a whole bunch of particular person bonds and assist traders enhance diversification throughout bond issuers whereas doubtlessly lowering focus threat.

For extra market traits, go to ETF Developments.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.