By Komson Silapachai, Sage VP of Analysis & Portfolio Technique

Fueled by stimulus and pent-up demand from the Covid-induced recession, the U.S. economic system staged one of many sharpest recoveries within the first half of 2021 to output ranges properly past the slowdown skilled final yr. Because of this, policymakers wish to transition from unprecedented financial stimulus to a coverage that displays the improved situation of the economic system. Given the truth that quantitative easing (QE) served as a ballast to monetary property throughout their latest ascent – the act of withdrawing liquidity via both the tapering of QE or elevating charges leaves market members at a crossroads.

The idea of the Fed tapering Treasury and company MBS purchases in the course of the present financial cycle was first formally acknowledged by Fed Chairman Jerome Powell following the June FOMC assembly.

[wce_code id=192]

Within the days after the announcement, rate of interest markets reacted by pulling ahead the coverage fee liftoff date to round September/October 2022, whereas the longer-term “terminal fee” wherein the Fed would cease mountaineering fell by three to 4 hikes (earlier hikes would necessitate much less hikes over the total cycle).

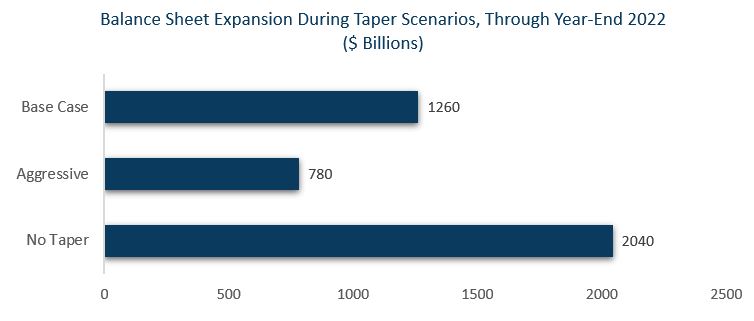

Our base case is for tapering to begin in January 2022 at a tempo of $10 billion per 30 days, with a fee liftoff in December 2022. The extra aggressive case has tapering start in November 2021 at a tempo of $15 billion per 30 days for eight months, with a fee liftoff beginning in July or August. The third and least possible case is not any tapering, which can function the dovish increased boundary for asset purchases over the subsequent yr.

In all three circumstances, the Fed stability sheet is anticipated to develop – by $1.26 trillion in our base case, $780 billion within the aggressive case, and $2.04 trillion within the no-taper situation. Even with a particularly aggressive Fed tapering situation, the Fed will purchase no less than $780 billion of bonds from the open market! To place that into perspective, the very best tempo of asset purchases pre-Covid was in the course of the 2012-2013 interval wherein the Fed bought $85 billion per 30 days of Treasuries and company MBS. Over that point interval, the stability sheet grew by $1.02 trillion.

The size of the present tempo of purchases underscores the urgency with which policymakers try to “thread the needle” within the tapering of bond purchases. It’s vital for buyers to take into account that the present taper tempo in our base case would lead to $200 billion extra in bond purchases than on the peak post-Nice Monetary Disaster tempo!

BOTTOM LINE FOR MARKETS

Regardless of the fears round tapering because the harbinger of volatility for credit score, equities, and different threat property, we consider that, as asset purchases are going to proceed at a historic tempo for a while, monetary circumstances ought to stay accommodative. That is more likely to proceed supporting credit score spreads and market segments linked to cyclical progress, corresponding to transportation, shopper discretionary, financials, and actual property.

Disclosures: That is for informational functions solely and isn’t meant as funding recommendation or a suggestion or solicitation with respect to the acquisition or sale of any safety, technique or funding product. Though the statements of truth, data, charts, evaluation and knowledge on this report have been obtained from, and are based mostly upon, sources Sage believes to be dependable, we don’t assure their accuracy, and the underlying data, knowledge, figures and publicly accessible data has not been verified or audited for accuracy or completeness by Sage. Moreover, we don’t signify that the data, knowledge, evaluation and charts are correct or full, and as such shouldn’t be relied upon as such. All outcomes included on this report represent Sage’s opinions as of the date of this report and are topic to alter with out discover as a result of varied components, corresponding to market circumstances. Buyers ought to make their very own choices on funding methods based mostly on their particular funding aims and monetary circumstances. All investments comprise threat and will lose worth. Previous efficiency just isn’t a assure of future outcomes.

Sage Advisory Companies, Ltd. Co. is a registered funding adviser that gives funding administration providers for a wide range of establishments and excessive web value people. For added data on Sage and its funding administration providers, please view our website online at www.sageadvisory.com, or confer with our Kind ADV, which is out there upon request by calling 512.327.5530.

Sources for chart “Steadiness Sheet Enlargement Throughout Taper Situations, By way of Yr-Finish 2022” are Sage and Bloomberg, as of 8/13/21.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com