Following the earlier night's U.S. presidential debate, eq

Following the earlier night’s U.S. presidential debate, equities responded to the upside in Wednesday’s buying and selling session with a 300-point bounce within the Dow Jones Industrial Common. Nonetheless, the bond markets have been sending a nervous sign to the capital markets that there is nonetheless a variety of uncertainty forward of the election.

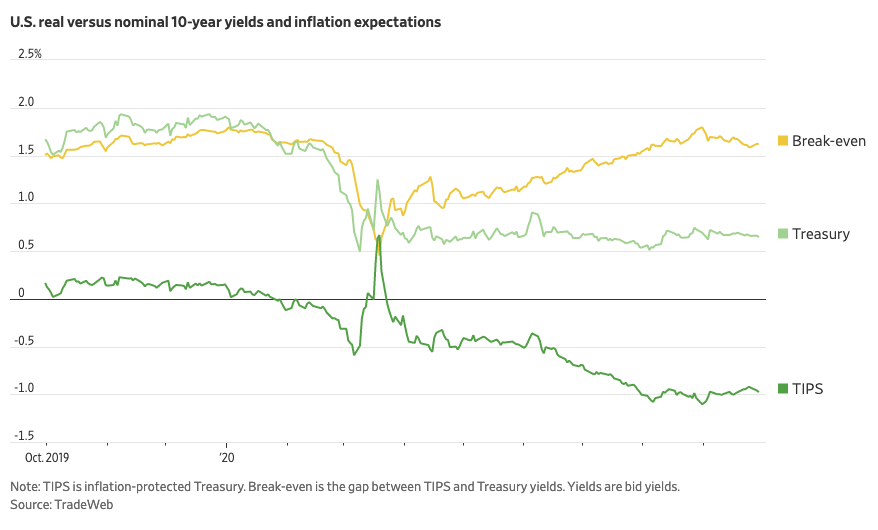

“Buyers in Treasury markets confirmed indicators of nervousness Tuesday forward of the primary debate between the candidates on this yr’s U.S. presidential election,” a Wall Avenue Journal article added. “Yields fell on each 10-year U.S. authorities bonds and Treasury inflation-protected securities, referred to as TIPS. The distinction between the 2 yields, known as the break-even charge, shrank, indicating a fall in inflation expectations in markets.”

“That charge has been essentially the most dependable predictor of equity-market strikes this yr, in accordance with analysts and buyers. When the speed falls, shares are likely to additionally fall,” the article added.

Within the meantime, ETF buyers can nonetheless get a dose of bond publicity, particularly in the event that they wish to play the lengthy finish of the yield curve in relation to company bonds can have a look at ETF such because the FlexShares Credit score‐Scored US Lengthy Company Bond Index Fund (CBOE: LKOR). LKOR follows the Northern Belief Credit score-Scored US Lengthy Company Bond Index, which addresses potential company bond liquidity challenges by optimizing a rigorously chosen subset of all credit score issuers from which illiquid, orphaned and small lot names have been eliminated.

Moreover, buyers can even go for an actively-managed choice just like the Principal Funding Grade Company Lively ETF (IG). IG seeks to offer present earnings and, as a secondary goal, capital appreciation.

The fund invests a minimum of 80% of its internet belongings, plus any borrowings for funding functions, in funding grade company bonds and different mounted earnings securities on the time of buy. “Funding grade” securities are rated BBB- or larger by S&P World Scores (“S&P World”) or Baa3 or larger by Moody’s Buyers Service, Inc. or, if unrated, of comparable high quality within the opinion of these deciding on such investments.

Key options of the IG fund:

- Lively administration: Combines bottom-up unbiased credit score analysis with top-down technique, in search of alpha via credit score choice, business rotation, and curve positioning

- A straight ahead course of: Funding grade publicity, freed from derivatives, unrated points, and huge period bets

- A strategic perspective: Ahead trying, iterative course of seeks credit exhibiting stable-to-improving credit standing trajectory which can profit from unfold compression and earnings premiums

For extra market tendencies, go to ETF Traits.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.