By Scott Welch, CIMA ®, Chief Funding Officer – Mannequin Portfolios, WisdomTree

By Scott Welch, CIMA ®, Chief Funding Officer – Mannequin Portfolios, WisdomTree

You recognize the day destroys the evening

Night time divides the day

Tried to run

Tried to cover

Break on by way of to the opposite aspect

Break on by way of to the opposite aspect

Break on by way of to the opposite aspect, yeah…

(From “Break on By (to the Different Facet)” by The Doorways, 1967)

I used to be on yet one more convention name the opposite day, and the “icebreaker” query was, “What have you ever realized about your self this yr?” I’m not probably the most introspective of individuals, so the query knocked me again for a second.

However after giving it some thought, my response was, “It was a yr of affirmation. After seeing myself on daily basis on videoconference calls, I confirmed that I’ve the right face for radio. However, extra importantly, I confirmed that I’m an optimist. If the spectrum is measured from Grinch to Pangloss, I positively am on the Panglossian aspect of the dimensions.” It’s onerous to think about making it by way of 2020 with a pessimistic perspective.

What does being optimistic imply from an funding perspective? It means we’re cautiously optimistic concerning the basic financial and market environments—we expect 2021 will likely be a “risk-on” yr, particularly within the second half, as the complete impacts of each COVID-19 vaccinations and financial stimulus within the U.S. begin working their methods by way of the system.

From an asset allocation perspective, right here is how we see issues:

1. The COVID-19 pandemic will hopefully quickly be within the rearview mirror—a nightmare none of us will ever neglect, however not the one factor we take into consideration—let’s name that for the second half of the yr, perhaps (being optimists) even Q2.

2. We imagine our grandchildren will curse our names concerning the nationwide debt and deficit—we’re borrowing from them to keep up our present existence, and neither political occasion appears inclined to sluggish it down a lot. When making an attempt to elucidate this to nonfinancial people, I ask them, “What if I gave you a brand new bank card with no spending restrict and no requirement to pay something again apart from curiosity. How massive would you reside?” The reply, after all, is LARGE. The piper finally should be paid, however not at present, and the grasshoppers[1] who run Congress will finally go a further fiscal stimulus package deal, which ought to present a catalyst for optimistic financial progress.

3.We nonetheless desire shares to bonds. Charges will probably grind increased from their present low ranges, and the yield curve might proceed to steepen. Credit score spreads basically have retraced again to their pre-pandemic ranges, and we simply don’t see big upside return potential. Moreover, credit score high quality will likely be important as we transfer by way of the yr. Bonds (as measured by the Bloomberg Barclays Mixture Bond Index) did their job in mitigating draw back threat when the pandemic first hit, however have lagged fairness markets (as measured by the S&P 500 Index and the MSCI ACWI (all world) Index) within the second half of the yr:

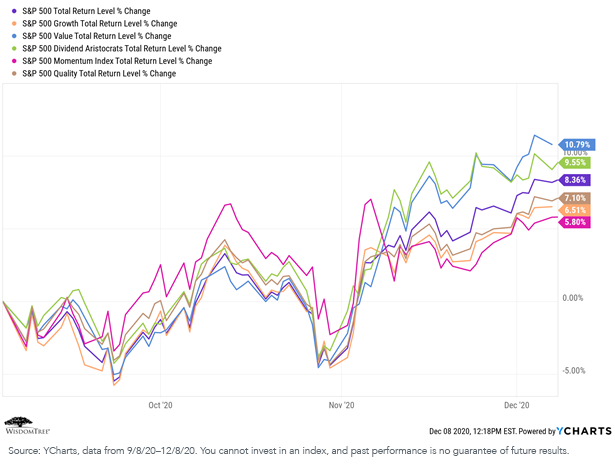

4. It’s too early to inform if “the good issue rotations” again towards worth and dimension will proceed, however there are indicators suggesting they may[2]. This second chart reveals the three-month outcomes for various threat components (progress, worth, dividends, momentum and high quality, all versus the broad market S&P 500 Index):

For definitions of phrases within the chart, please go to our glossary.

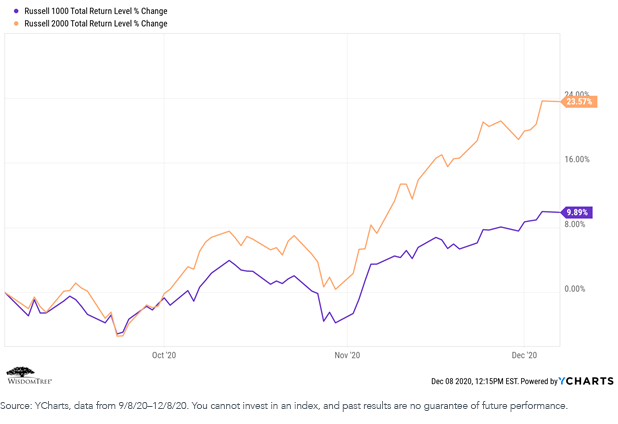

5. This third chart compares three-month returns for large-cap versus small-cap shares (the Russell 1000 Index versus the Russell 2000 Index):

6. Whereas dimension and worth could also be having fun with their day within the solar, this isn’t to counsel that progress not has a spot in a well-diversified portfolio, as illustrated by evaluating the three-month efficiency of the broad market S&P 500 Index to (a) the Nasdaq 100 Index (as a proxy for mega-cap tech shares) and (b) the S&P 500 Development Index:

7. International diversification nonetheless is smart, particularly when you imagine that (a) non-U.S. progress and earnings will outpace the U.S. and (b) the U.S. greenback will proceed to slip. First, here’s a three-month comparability of the S&P 500 Index to (a) the MSCI EAFE (developed worldwide) Index and (b) the MSCI Rising Markets (EM) Index:

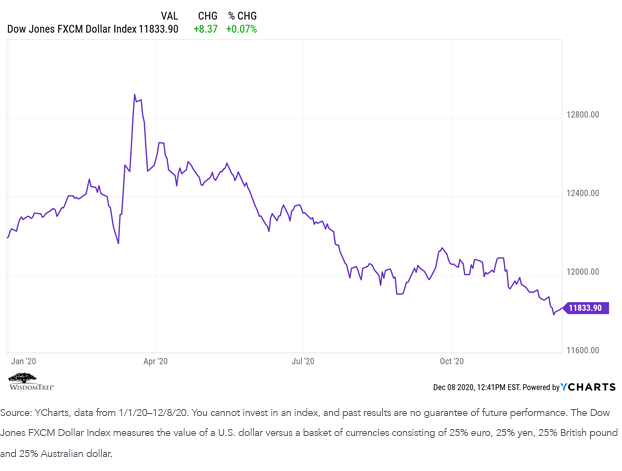

8. Subsequent is a YTD chart illustrating the motion of the U.S. greenback versus a diversified basket of currencies:

Conclusion

Whereas we usually are optimistic concerning the prospects for 2021, we stay conscious that unexpected occasions can (and doubtless will) happen. As we headed into early 2020, who foresaw a world pandemic?

U.S.-China and U.S.-Iran relations stay rocky. Right here at house we now have upcoming Senate races in Georgia, the outcomes of which can have vital results on the tax, regulatory, judicial and legislative environments as we head by way of 2021.

In abstract, there are lots of points that might alter our outlook and portfolio positioning. However primarily based on what we all know now, our asset allocation pointers are as follows:

- Shares over bonds

- We stay globally diversified. Relative to the MSCI ACWI Index, we stay barely over-weight within the U.S. and EM and under-weight in EAFE (developed worldwide)

- Additionally relative to the MSCI ACWI Index, our fairness portfolios preserve strategic tilts to small cap, worth, yield and high quality

- Relative to the Bloomberg Barclays Mixture Bond Index, our bond portfolios stay under-weight in length and over-weight in credit score. We additionally preserve a heavy give attention to credit score high quality

- We proceed to imagine that present earnings/yield is finest delivered from our fairness allocations as a substitute of from taking extreme threat in our bond portfolios

- Our portfolios stay extremely diversified at each the asset class and threat issue ranges

2021 could be the yr we “break on by way of to the opposite aspect,” however we imagine in constructing all-weather portfolios that may deal with no matter comes our means.

We want you all a really completely happy vacation season and a protected, affluent and wholesome 2021!

Initially revealed by WisdomTree, 12/18/20

1 This can be a reference to the Aesop fable concerning the ant and the grasshopper, the place the grasshopper pays no consideration to the long run and easily lives for at present, then finally ends up on the surface of the anthill wanting in when winter lastly arrives.

2 Together with, for instance, indicators that we’re getting into a cyclical financial restoration when, traditionally, dimension and worth components have carried out nicely. Additionally within the combine are merely the dramatic valuation variations between large-cap progress and the dimensions and worth components. Sooner or later it was cheap to count on not less than considerably of a “imply reversion” of those valuations.

U.S. buyers solely: Click on right here to acquire a WisdomTree ETF prospectus which accommodates funding targets, dangers, prices, bills, and different data; learn and contemplate rigorously earlier than investing.

There are dangers concerned with investing, together with attainable lack of principal. International investing includes forex, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller corporations might expertise better value volatility. Investments in rising markets, forex, mounted earnings and various investments embody further dangers. Please see prospectus for dialogue of dangers.

Previous efficiency just isn’t indicative of future outcomes. This materials accommodates the opinions of the creator, that are topic to vary, and will to not be thought-about or interpreted as a suggestion to take part in any specific buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There isn’t a assure that any methods mentioned will work beneath all market circumstances. This materials represents an evaluation of the market setting at a particular time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation concerning any safety particularly. The consumer of this data assumes your complete threat of any use fabricated from the knowledge supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Companies, LLC, or its associates present tax or authorized recommendation. Traders looking for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly acknowledged in any other case the opinions, interpretations or findings expressed herein don’t essentially characterize the views of WisdomTree or any of its associates.

The MSCI data might solely be used in your inside use, will not be reproduced or re-disseminated in any kind and will not be used as a foundation for or element of any monetary devices or merchandise or indexes. Not one of the MSCI data is meant to represent funding recommendation or a suggestion to make (or chorus from making) any form of funding resolution and will not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI data is supplied on an “as is” foundation and the consumer of this data assumes your complete threat of any use fabricated from this data. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI data (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this data, in no occasion shall any MSCI Get together have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss income) or some other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Companies, LLC.

WisdomTree Funds are distributed by Foreside Fund Companies, LLC, within the U.S. solely.

You can’t make investments immediately in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.