Written by: Matthew J. Krajna,

Written by: Matthew J. Krajna, CFA

The state of the housing market nationwide may be finest described as nothing wanting strong. Demand stays intense, and provide stays, effectively, in brief provide. In accordance with the Nationwide Affiliation of Homebuilders (NAHB), homebuilder sentiment hit 83 in Might, remaining elevated at above-average ranges. Every of the previous 9 months has proven readings above 80, after hitting a file excessive of 90 again in November. Site visitors additionally stays strong, with the Site visitors sub-index hitting 73, additionally remaining elevated, with eight of the previous 9 months posting readings above 70. Readings above 50 sign builders view situations as favorable. Common month-to-month stock stands at 2.Four months’ value of provide in accordance with the Nationwide Affiliation of Realtors, not far off of the file low of 1.9 months hit in December, down from 4.2 months in March 2020. These dynamics have led to larger costs, with current house gross sales rising +19.1% 12 months over 12 months in April, with a median promoting value of $341,600. Houses are promoting at a break-neck tempo, with the everyday house bought final month spending barely 17 days available on the market.

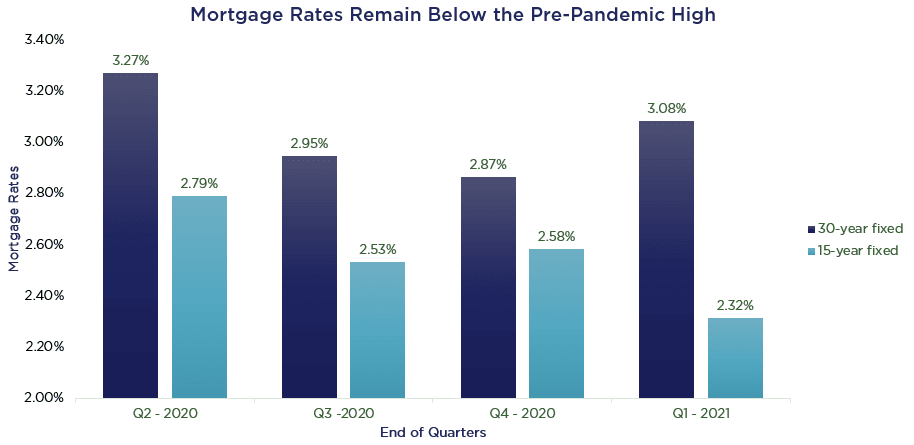

Stimulus checks and pent-up financial savings proceed to bode effectively for all the housing-related provide chain as householders proceed to reinvest of their properties, each with added financial savings and stimulus, in addition to for prospects of upper house values. Optimistic dynamics stem from extra than simply provide and demand imbalances. Low-interest charges ought to proceed to persist for a while, even when they creep up barely. In accordance with Freddie Mac, the newest 30-year fixed-rate mortgage price of three.0% remained under the pre-pandemic excessive of three.72% on January 2, 2020. Even when charges had been to rise 0.75%, they’d be simply getting again to their pre-COVID highs.

[wce_code id=192]

Supply: Nerdwallet, https://www.nerdwallet.com/weblog/mortgages/current-interest-rates/; Information proven from 06/2020 to 03/2021

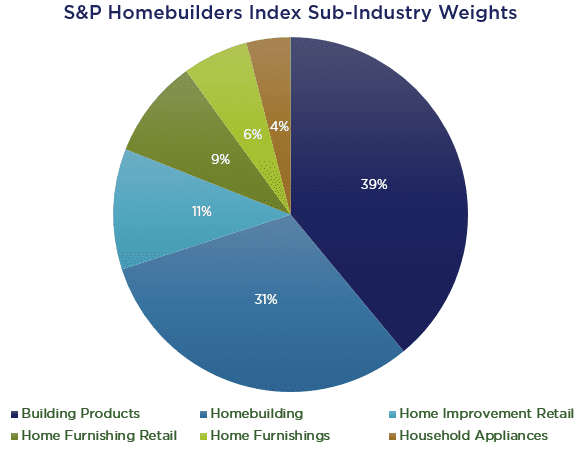

A broad measure of housing, the S&P Homebuilders Choose Business Index has been a powerful performer 12 months so far, handily outpacing the S&P 500. As of Might 19. 2021, the S&P Homebuilders Choose Business Index ETF had returned +26.22% versus +10.25% for the S&P 500 ETF. Energy within the Homebuilder Index has been broad-based, coming from all sub-industry teams.

Supply: SSGA, Nottingham Advisors, Might 19, 2021

With quarterly earnings season nearing an in depth, we’ve successfully heard from all the provide chain throughout the Homebuilding ecosystem. Demand stays strong for inputs (i.e. house furnishings, home equipment, supplies, and so on.) and outputs (i.e. new properties). Inflationary pressures are usually being handed alongside to customers, by means of larger costs and smaller sq. footage of recent properties. Many corporations predict margin growth this 12 months attributable to sturdy demand, lesser COVID associated prices, and working leverage. As such, we’ve seen a big quantity of index constituents enhance their income and earnings per share (EPS) steering for 2021, which continues to bode effectively for all the homebuilding associated class. Couple this with comparatively engaging valuations and robust secular tailwinds, and homebuilding stays a good tactical publicity in consumer portfolios, to not point out a possible inflation hedge shifting ahead.

Supply: Nottingham Advisors, Bloomberg, SSGA. S&P 500 ETF (ticker: SPY) and Homebuilders Choose Business ETF (ticker: XHB).

This info is included for informational functions solely and doesn’t replicate previous suggestions by Nottingham or precise buying and selling in any particular person purchasers’ accounts. Nottingham makes no illustration as as to whether funding in any safety or technique talked about herein was worthwhile or would have been worthwhile for any individual prior to now.

This weblog doesn’t represent present suggestions by Nottingham for any particular person consumer or potential consumer to purchase or promote any safety or have interaction in a selected funding technique and Nottingham makes no illustration as as to whether funding in any safety or technique talked about herein will show worthwhile sooner or later.

All such info is offered solely for comfort functions solely and all customers thereof must be guided accordingly. Nothing on this piece must be interpreted as customized funding recommendation.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.