Key TakeawaysIn 13 of the final 15 calendar years, the typical large-cap lively mut

Key Takeaways

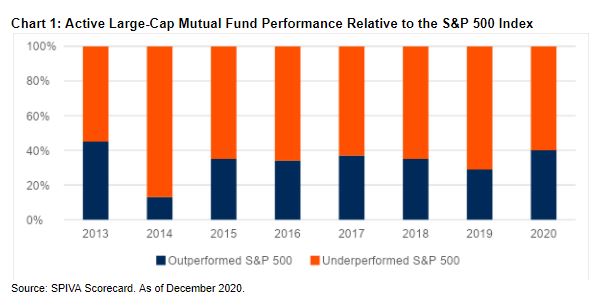

In 13 of the final 15 calendar years, the typical large-cap lively mutual fund lagged the extensively adopted S&P 500 Index. In 2020, simply 40% of huge caps stored tempo with the benchmark behind Vanguard S&P 500 ETF (VOO) and Vanguard 500 Index Fund (VFIAX), in response to the most recent SPIVA Scorecard.

In 13 of the final 15 calendar years, the typical large-cap lively mutual fund lagged the extensively adopted S&P 500 Index. In 2020, simply 40% of huge caps stored tempo with the benchmark behind Vanguard S&P 500 ETF (VOO) and Vanguard 500 Index Fund (VFIAX), in response to the most recent SPIVA Scorecard.

- Excessive charges eat into actively managed fund returns, with large-cap mutual funds generally charging a 100-basis-point expense ratio. The common large-cap mutual fund lagged the S&P 500 by 170 foundation factors in 2020.

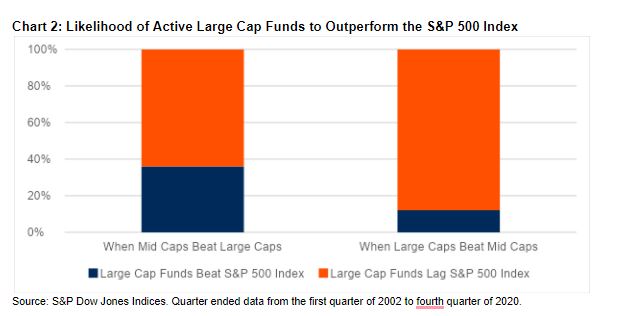

- 3 times as many lively large-cap funds outperformed the S&P 500 Index throughout quarters when the S&P MidCap 400 Index carried out comparatively properly in comparison with when it lagged, a sign that lively managers’ efforts to distinguish a fund typically concerned a smaller-cap bias.

Basic Context

Solely 4 in 10 large-cap funds outperformed the S&P 500 in 2020. Whereas final 12 months was the very best 12 months for lively large-cap funds since 2013 on a relative foundation, solely 40% of lively large-cap funds tracked within the SPIVA Scorecard beat the distinguished large-cap index. This was a modest enchancment from 2019 when simply 29% of large-cap mutual funds outperformed in addition to the years between 2015 and 2018 when a mid-30s proportion did in order seen in Chart 1. However the persistent underperformance during the last 15 years has contributed to the expansion of S&P 500 Index-based ETFs, which held over $750 billion in belongings on the finish of 2020.

Excessive charges eat into returns however inventory choice issues too. In 2020, on an equal weighted foundation, the typical large-cap mutual fund rose 16.7%, lagging the 18.4% return for the S&P 500. Whereas lively mutual funds generally cost 1.0% or extra in charges, the S&P 500 Index’s relative return is aided by the absence of charges. But, buyers can select between three fairness ETFs – iShares Core S&P 500 ETF (IVV), SPDR Portfolio S&P 500 ETF (SPLG), and VOO – and pay an expense ratio of simply 0.03% or a mutual fund model, similar to VFIAX for only a foundation level extra.

Nonetheless, charges are solely a part of what impacts a mutual fund and why CFRA’s fund score methodology consists of an evaluation of danger and reward on the portfolio degree along with reviewing a fund’s efficiency file and key prices. Energetic managers make discretionary choices on what shares to personal and the way a lot they characterize within the portfolio, which in the end drives efficiency.

Actively managed fairness funds additionally don’t neatly slot in a method field. Whereas advisors and buyers wish to construct asset allocation methods to find a fund for the large-, mid-, and small-cap types, when working with discretionary managers in addition they want to simply accept that few lively funds are twins. CFRA’s mutual fund score methodology additionally differs from different analysis suppliers as we search to establish what funds from a broad universe, similar to Home Fairness, have the best chance of outperforming within the subsequent 12 months no matter what fashion it falls underneath.

The inventory choice choices fund administration makes clarify why a fund will carry out in another way than friends or an index-based ETF. It is a key takeaway for us from a current S&P Dow Jones report titled “Fashion Bias and Energetic Efficiency”. The co-authors Anu Ganti and Craig Lazzara dug into SPIVA Scorecard information between 2002 and 2020 to attempt to perceive what (if something) distinguishes the intervals when most lively managers outperformed S&P benchmarks from more often than not once they failed.

When large-cap managers outperformed the S&P 500, the S&P MidCap 400 Index was extra prone to have shined brighter. Ganti and Lazzara discovered 42 quarters when the S&P 400 beat the S&P 500. In 15 of these situations (36% of the time), most large-cap managers outperformed the S&P 500. In the meantime, when the large-cap index beat the mid-cap one, the chance a majority of large-cap mutual fund managers outperformed the S&P 500 fell to 12% (Four of 34). In each instances, an index-based funding, similar to VOO, would have been most rewarding. But, in response to Ganti and Lazzara, the information is in line with the view large-cap managers as a gaggle have a bias towards smaller corporations.

Having a larger-cap bias relative to the S&P 500 Index is tough. On the finish of 2020, the weighted common market capitalization of the S&P 500 was a whopping $437 billion. Nonetheless, to have a mega-cap bias relative to the S&P 500, which probably would have helped efficiency, a supervisor would wish to chubby Apple (AAPL), Microsoft (MSFT), Amazon.com (AMZN), and 5 different constituents within the benchmark with increased market caps than the weighted common. In the meantime, merely overweighting extra reasonably sized corporations within the S&P 500 Index, which probably harm in 2020, would trigger the fund to look and carry out fairly in another way.

For instance, CFRA five-star rated Constancy Fairness Earnings Fund (FEQIX) rose simply 6.8% in 2020, lagging the S&P 500 Index, however outperforming the S&P 500 Worth Index’s 1.4%. FEQIX lately held top-10 holdings in Danaher (DHR) and NextEra Power (NEE), that are towards the decrease finish of S&P 500’s market-cap spectrum. The fund’s low 0.60% expense ratio coupled with its decrease danger profile contribute to our favorable fund score for 2021.

Conclusion

Perennially there are articles projecting why every year will likely be totally different enabling actively managed mutual funds to shine. However as soon as once more in 2020, most lively large-cap funds did not beat the S&P 500 Index, harm by charges and safety choice. CFRA offers forward-looking star rankings on each mutual funds and ETFs, to arm our shoppers with the instruments to kind via the universe in hopes of discovering merchandise to personal for the long run. There’ll all the time be lively funds outperforming. But, we predict simply selecting final 12 months’s winners anticipating a repeat efficiency, or final 12 months’s laggards hoping for a reversion to the imply, is a mistake.

Todd Rosenbluth is Director of ETF & Mutual Fund Analysis at CFRA.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.