By Dan Weiskopf, ETF Professor, Toroso Investments Within t

By Dan Weiskopf, ETF Professor, Toroso Investments

Within the ETF Assume Tank, we don’t keep away from awkward conversations. Generally essential selections are made when persons are uncomfortable. In that regard, this week we determined to tackle the dialogue of US / China tensions. Our purpose is to not get political or level the finger, however somewhat to spotlight the chance and hope that individuals is not going to fall prey to the media headline hype. US traders must concentrate on the chance as a result of isolationism and protectionism is not going to finally result in world progress, and subsequently aren’t practical choices. Furthermore, the momentum for China’s envisioned financial progress over the following 10 years is just too highly effective a pressure to disregard. It is for that reason we have now invited hedge fund supervisor Kyle Bass, as our visitor on this week’s 6:00 pm Get Assume Tanked Blissful Hour (Hyperlink to hitch). Be aware, Mr. Bass may be very vocal and open about his controversial views as regards to China, and these views don’t replicate these of the Toroso Portfolio Managers or the agency. See Kyle Bass on Twitter for particulars.

US Traders can goal China allocations by way of about 50 completely different ETFs with nearly $19 billion in AUM, and these selections slender additional to 42 ETFs while you eradicate leverage and inverse. Decisions exist for China A-Shares, Broad China shares, the China Bond market, varied trade/sectors in China, even options that place traders’ alignment with ESG, and corporations in search of to have a optimistic impact on the surroundings which are based mostly in China. Mockingly, the disparity of funding efficiency between an ETF that focuses on Surroundings (the KraneShares MSCI China Surroundings ETF (KRGN) versus a conventional Chinese language power firm (the World X MSCI China Power ETF (CHIE), exhibits that YTD efficiency is optimistic 55% and down 25%, respectively. (A whole record could be offered upon request, however clear management exists when it comes to innovation; entry of platform selections could be discovered at KraneShares, DWS and World X.)

[wce_code id=192]

TikTok: The Polls Spotlight a Want for Change

Polls present an elevated degree of hysteria on each side of the globe. The most recent PEW Analysis ballot, from July, discovered 73% of American respondents have unfavorable attitudes in direction of China. Equally, polls present Chinese language individuals additionally digging in additional in assist of their political system and life-style. The very fact is that each international locations are at an essential crossroads, and polls are suggesting an elevated polarization of views on this mid-COVID-19 world which can’t be useful for world financial progress. China is the quickest rising financial system, and the US is the most important financial system. If politicians take us down the route of isolationism, everybody loses globally. Whereas there could also be good cause for mistrust between each constituencies, the very fact is that there’s a mutual want for cooperation. This is the reason the battle over TikTok and the ban of WeChat may turn out to be an instance of both essential compromise or authorized precedent. It is for that reason that circumstances should be mentioned brazenly.

Development in China

Will China (and individually, India) turn out to be bigger economies than the US? It is a query that makes many individuals within the U.S. uncomfortable, and the imagery makes some individuals even really feel powerless. To be clear, linear projected progress ought to be seen for illustration functions solely, and the standard of life for many Individuals ought to be emphasised over particular projections. Know-how and E-Commerce, in fact, is on the core of anticipated progress, and clearly the lever on each political sides. As well as, questions and dangers round a $52 Trillion actual property bubble have additionally popped up, which may influence world progress and China’s potential to carry 20% of its US Treasuries holdings. In line with ZeroHedge, possession of US Treasuries peaked in 2013 and bottomed in 2016. Precisely what this implies is unknown, however let’s not be so hasty with reference to views in direction of our collectors. Life is a balancing act of self-interest!

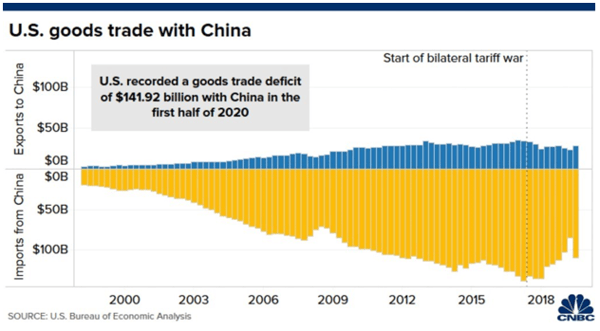

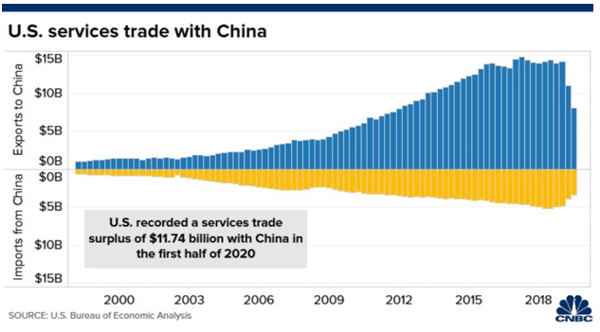

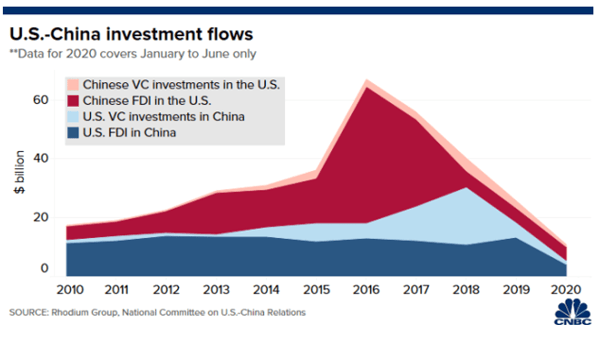

Past the interdependence within the possession of US Treasuries the under charts spotlight an alignment in the US Commerce deficit, US Surplus commerce in providers and the impacts from Funding flows from china within the US.

Conclusion

Developments in China GDP progress and its financial management, as carried out by way of coverage and know-how, should be on the core of each American and Chinese language individuals. Can or not it’s that an increasing world pie is nice for everybody and can raise all boats? We look ahead to a wholesome debate on Thursday. Be aware that ETF Assume Tank calls are by no means recorded, so insights are shared solely with these on the calls.

Initially printed by Toroso Investments, 9/30/20

Disclosure

The knowledge offered right here is for monetary professionals solely and shouldn’t be thought of an individualized suggestion or personalised funding recommendation. The funding methods talked about right here might not be appropriate for everybody. Every investor must evaluation an funding technique for his or her personal specific scenario earlier than making any funding choice.

All expressions of opinion are topic to vary with out discover in response to shifting market situations. Information contained herein from third get together suppliers is obtained from what are thought of dependable sources. Nonetheless, its accuracy, completeness or reliability can’t be assured.

Examples offered are for illustrative functions solely and never meant to be reflective of outcomes you possibly can count on to attain.

All investments contain danger, together with attainable lack of principal.

The worth of investments and the revenue from them can go down in addition to up and traders might not get again the quantities initially invested, and could be affected by adjustments in rates of interest, in alternate charges, common market situations, political, social and financial developments and different variable components. Funding includes dangers together with however not restricted to, attainable delays in funds and lack of revenue or capital. Neither Toroso nor any of its associates ensures any price of return or the return of capital invested. This commentary materials is on the market for informational functions solely and nothing herein constitutes a proposal to promote or a solicitation of a proposal to purchase any safety and nothing herein ought to be construed as such. All funding methods and investments contain danger of loss, together with the attainable lack of all quantities invested, and nothing herein ought to be construed as a assure of any particular consequence or revenue. Whereas we have now gathered the data offered herein from sources that we imagine to be dependable, we can’t assure the accuracy or completeness of the data offered and the data offered shouldn’t be relied upon as such. Any opinions expressed herein are our opinions and are present solely as of the date of distribution, and are topic to vary with out discover. We disclaim any obligation to offer revised opinions within the occasion of modified circumstances.

The knowledge on this materials is confidential and proprietary and might not be used aside from by the meant person. Neither Toroso or its associates or any of their officers or staff of Toroso accepts any legal responsibility in any way for any loss arising from any use of this materials or its contents. This materials might not be reproduced, distributed or printed with out prior written permission from Toroso. Distribution of this materials could also be restricted in sure jurisdictions. Any individuals coming into possession of this materials ought to search recommendation for particulars of and observe such restrictions (if any).

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.