By Natalia Gurushina, VanEck

Will China’s unexpectedly weak exercise gauges result in a extra aggressive coverage response?

Please be aware: Rising Markets Debt Day by day is not going to be printed on September 1st– September 6th. We look ahead to resuming our day by day updates on September 7th.

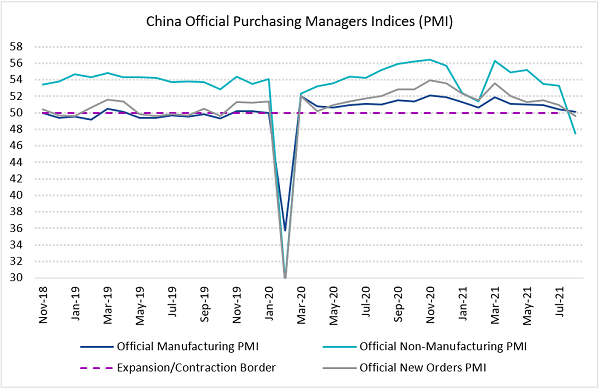

There are draw back surprises and there are shockers. China’s August providers PMI1was the latter. It dived deep into contraction zone (to 47.5 from 53.Three in July) towards the expectation of a light decline to 52.0. The manufacturing PMI additionally undershot consensus. It did handle to remain in enlargement territory – however solely barely (50.1 – see chart beneath). Different particulars seemed dangerous as properly. The brand new orders PMI moved to contraction zone (for the primary time since February 2020), the brand new export orders PMI slipped to 46.7 (the weakest since June 2020), the big corporations PMI moved perilously near the enlargement/contraction border (50.3), and the providers new orders PMI collapsed to 42.2.

So, what prompted the carnage, and what authorities are going to do about it? The primary a part of the query is absolutely about how tighter laws/tech clampdown stack up towards “different stuff”. Nicely, the Delta outbreak in a number of cities was actual, and the following motion restrictions hit providers. The identical applies to provide chain points and excessive freight costs, and their influence on exports and manufacturing. These elements are damaging, however they’re prone to show transitory. Within the meantime, we must always see extra help coming through fiscal and financial channels (doubtlessly together with one other reduce within the reserve necessities for banks). The regulatory overhaul, nonetheless, may very well be a unique and longer-lasting situation – the state media simply known as it a “profound revolution” – and this raises authentic questions on its influence on the labor market, revenue, and consumption, in addition to on the personal sector investments.

Progress “incidents” like this name for decrease native charges – in China. However they are prone to feed development considerations in the remainder of EM. Based on the IMF, rising markets are anticipated to glow slower than then U.S. in 2021 – for the primary time for the reason that 1990s – and the market may not take the concept of additional EM development downgrades frivolously. As a result of it’s not simply development – there’s a number of associated points, together with fiscal efficiency and coverage challenges for central banks that cope with rising inflation. Keep tuned!

Charts at a Look: Sharp Deterioration in China’s Exercise Gauges

Supply: Bloomberg LP

1We consider PMIs are a greater indicator of the well being of the Chinese language economic system than the gross home product (GDP) quantity, which is politicized and is a composite in any case. The manufacturing and non-manufacturing, or service, PMIs have been separated so as to perceive the completely different sectors of the economic system. Lately, we consider the manufacturing PMI is the quantity to look at for cyclicality.

Initially printed by VanEck on August 31, 2021.

PMI – Buying Managers’ Index: financial indicators derived from month-to-month surveys of personal sector corporations. A studying above 50 signifies enlargement, and a studying beneath 50 signifies contraction; ISM – Institute for Provide Administration PMI: ISM releases an index primarily based on greater than 400 buying and provide managers surveys; each within the manufacturing and non-manufacturing industries; CPI – Shopper Value Index: an index of the variation in costs paid by typical customers for retail items and different gadgets; PPI – Producer Value Index: a household of indexes that measures the typical change in promoting costs obtained by home producers of products and providers over time; PCE inflation – Private Consumption Expenditures Value Index: one measure of U.S. inflation, monitoring the change in costs of products and providers bought by customers all through the economic system; MSCI – Morgan Stanley Capital Worldwide: an American supplier of fairness, mounted revenue, hedge fund inventory market indexes, and fairness portfolio evaluation instruments; VIX – CBOE Volatility Index: an index created by the Chicago Board Choices Change (CBOE), which reveals the market’s expectation of 30-day volatility. It’s constructed utilizing the implied volatilities on S&P 500 index choices.; GBI-EM – JP Morgan’s Authorities Bond Index – Rising Markets: complete rising market debt benchmarks that monitor native foreign money bonds issued by Rising market governments; EMBI – JP Morgan’s Rising Market Bond Index: JP Morgan’s index of dollar-denominated sovereign bonds issued by a collection of rising market international locations; EMBIG – JP Morgan’s Rising Market Bond Index World: tracks complete returns for traded exterior debt devices in rising markets.

The data introduced doesn’t contain the rendering of personalised funding, monetary, authorized, or tax recommendation. This isn’t a suggestion to purchase or promote, or a solicitation of any supply to purchase or promote any of the securities talked about herein. Sure statements contained herein might represent projections, forecasts and different ahead wanting statements, which don’t mirror precise outcomes. Sure info could also be offered by third-party sources and, though believed to be dependable, it has not been independently verified and its accuracy or completeness can’t be assured. Any opinions, projections, forecasts, and forward-looking statements introduced herein are legitimate because the date of this communication and are topic to vary. The data herein represents the opinion of the creator(s), however not essentially these of VanEck.

Investing in worldwide markets carries dangers resembling foreign money fluctuation, regulatory dangers, financial and political instability. Rising markets contain heightened dangers associated to the identical elements in addition to elevated volatility, decrease buying and selling quantity, and fewer liquidity. Rising markets can have better custodial and operational dangers, and fewer developed authorized and accounting programs than developed markets.

All investing is topic to threat, together with the attainable lack of the cash you make investments. As with all funding technique, there isn’t any assure that funding goals will probably be met and traders might lose cash. Diversification doesn’t guarantee a revenue or shield towards a loss in a declining market. Previous efficiency isn’t any assure of future efficiency.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com