By Chris Konstantinos, CFA, Director of Investments, Chief Funding Strategist

SUMMARY

- We imagine the current Chinese language ‘offshore’ inventory sell-off is unlikely to be the catalyst for the top of the US inventory rally, in our opinion.

- China seems to be prioritizing social stability and political goals over shareholder safety and company earnings, in our view.

- We see this episode as emblematic of the ‘New Chilly Battle’ between the US and China.

- In Might, we trimmed weightings to Chinese language shares in our balanced portfolios and like US and European shares.

Chinese language shares beneath hearth…however points largely remoted to China

In an in any other case comparatively uneventful summer season for world shares, it has been a wild couple of weeks for ‘offshore’ Chinese language shares – firms domiciled in mainland China however traded on overseas exchanges. Since July 24, Chinese language shares listed on US exchanges worn out $400 billion in market worth. On condition that China is the one largest nation weighting in broad rising markets (EM) indexes, this selloff has turn into a spotlight for world buyers nervous about this downturn triggering broad contagion in world shares.

What Triggered the Selloff…and What It Means for World Shares?

[wce_code id=192]

The catalyst for the selloff has been elevated Chinese language regulatory scrutiny in sure fast-growing sectors, equivalent to for-profit training, web, and property administration. We don’t anticipate this regulatory stress– and the related uncertainty it brings – to clear up quickly, and thus we anticipate it to stay a drag on Chinese language shares within the near-term. Nonetheless, we additionally imagine that the problems presently plaguing Chinese language shares are typically China-specific, and don’t anticipate China to be the catalyst for a major broader sell-off within the US inventory market. To this finish, we might notice that over the previous week or so, the S&P 500 made one other new all-time excessive at the same time as Chinese language indices have been plummeting (see chart, above).

RiverFront’s balanced asset allocation portfolios trimmed their weighting in Chinese language and broad EM shares from an chubby positioning to barely underweight again in Might, sustaining no direct publicity in any respect to China in our two shortest-horizon fashions. We proceed to favor US shares over worldwide equities, with a variety desire inside worldwide for European versus Asian shares, together with China.

Previous efficiency isn’t any assure of future outcomes. Proven for illustrative functions. Not indicative of RiverFront portfolio efficiency. Index definitions can be found within the disclosures.

Why China Is Scrutinizing Extremely Worthwhile Firms?

On July 24, Chinese language authorities launched new rules for ‘for-profit’ training firms. The brand new rules embody forcing tutoring and training providers firms to transform to non-profit standing and disallowing overseas curriculums or overseas academics from educating remotely in China. This comes on the heels of an ongoing debate amongst Chinese language residents surrounding tutoring. Many view costly tutoring as an unfair benefit that helps rich college students rating nicely on the ‘gaokao’, the Chinese language entrance examination essential for college admittance. These rules additionally permit the state to maintain a tighter lid on what overseas ideologies are taught to college students.

Chinese language authorities have additionally been concentrating on highly effective expertise firms which might be seen as monopolies, nationwide safety dangers, or threats to the social equity and stability goals of the Chinese language Communist Celebration (CCP). This usually impacts these firms’ enterprise fashions and talent to drift shares on overseas exchanges. Final month, Chinese language ride-sharing firm Didi had its cell app banned over information safety points, simply after the agency’s $four billion US preliminary public providing (IPO) on the NYSE. Shortly thereafter, Beijing introduced a deliberate overview of abroad listings of all Chinese language web firms with greater than one million customers. Final November, lending large Ant Monetary was compelled to droop their US IPO and alter their enterprise mannequin. Different huge web firms equivalent to Alibaba and TenCent –firms with a big following amongst Western buyers – have felt the wrath of presidency scrutiny just lately, because the state grew to become more and more involved with management.

The Chinese language state’s current crackdown has additionally prolonged to highly effective businesspeople; Solar Dawu, a Chinese language billionaire agricultural mogul, was sentenced this week to 18 years in jail. Some China watchers imagine the fees in opposition to him have been largely motivated by Solar’s friendships and ties with political dissidents.

Communist China Prioritizing Social and Political Goals Over Shareholder Returns

Does this imply that the Chinese language authorities is at ‘struggle with its personal personal sector’, as some have urged? Not precisely…we as a substitute view current occasions as a vivid reminder that the overarching goals of communist China have by no means sat comfortably subsequent to the pursuit of company revenue. It’s clear to us that President Xi and the CCP will proceed to prioritize social order over ‘capitalist’ issues equivalent to return-on-equity or inventory costs. Some of these strikes are designed partly to keep away from mass rebellion in a nation of 1.three billion folks. China can be more and more involved about sustaining state management over homegrown shopper and lending information and entry.

We imagine that the upshot of that is that high-growth Chinese language shares in sectors that contact or accumulate information on the Chinese language shopper – training, housing, meals supply, lending, and web commerce amongst them- are prone to stay on low cost. It isn’t misplaced on us that ‘offshore’ Chinese language public shares have to date fared a lot worse within the sell-off than local-listed China shares (see chart, first web page), which suggests to us that the ache being felt in Chinese language inventory markets is disproportionately borne by worldwide (Western) shareholders in China.

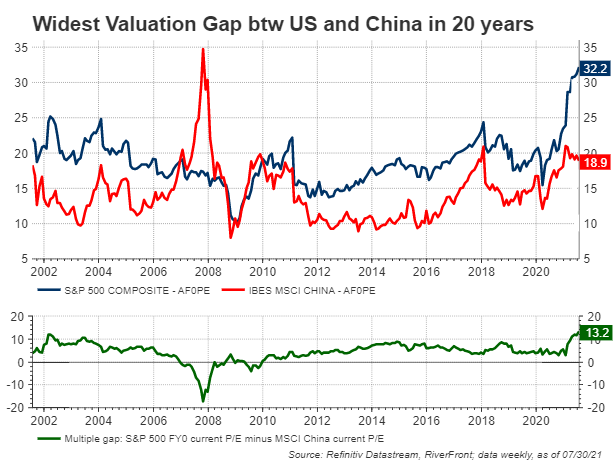

These shareholders going ahead could must proceed to assign a constant ‘uncertainty’ low cost to Chinese language shares in these areas, no matter structural progress and profitability prospects. For comparability’s sake, the valuation of the MSCI China inventory index – a Chinese language index widely-followed within the West, which is roughly a 3rd expertise shares and has behaved equally within the selloff to pure offshore Chinese language indices. MSCI China is presently buying and selling on the most cost-effective valuation low cost – over 13x a number of factors – relative to the US bellwether S&P 500 index in 20 years, as judged by trailing yr price-to-earnings ratios (see backside chart, proper). Nonetheless, we predict it’s too early to attempt to ‘bottom-fish’ in these China names, as this uncertainty is unlikely to abate anytime quickly.

Previous efficiency isn’t any assure of future outcomes. Proven for illustrative functions. Not indicative of RiverFront portfolio efficiency. Index definitions can be found within the disclosures.

Grievances Between the US and China Deepening

Along with the occasions of the final couple of weeks, there’s a rising laundry listing of grievances between the world’s first and second-largest economies. That is epitomized by the commerce struggle of the previous couple of years, the US’s outspoken stance on human rights abuses in Hong Kong and Xinyang, the US probe into the origins of COVID-19, and President Xi’s aggressive rhetoric in the direction of the West throughout the CCP’s 100-year anniversary celebration of the celebration’s founding in July.

For the US’s half, the Biden administration appears to be doubling down on former President Donald Trump’s adversarial stance in opposition to Chinese language tech firms thought to help and abet IP theft and cyber espionage. Whereas in workplace, President Trump launched a ‘blacklist’ that prevented US buyers for proudly owning stakes in roughly 30 Chinese language firms attributable to nationwide safety issues. In June, President Joe Biden added nearly 30 extra names to the listing, together with telecom gear large Huawei and different giant Chinese language telecom firms.

As well as, Securities and Trade Fee (SEC) Chairman Gary Gensler on Friday mentioned he has requested SEC employees to hunt particular disclosures from Chinese language corporations earlier than signing off on pre-IPO filings, based on the weekend version of the Wall Avenue Journal. In an excessive state of affairs, it’s doable that inside stress in each the US and China may ultimately result in Chinese language firms delisting en masse on US exchanges, although for his or her half Chinese language securities regulators tried to downplay these dangers of their tackle to buyers on Wednesday.

Conclusion: The New ‘Chilly Battle’ Enters the Subsequent Part – We Favor US and European Shares to Chinese language Ones

All of this seems to us as a continuation of the ‘New Chilly Battle’ between China and enormous Western economies just like the US. We first made point out of this new Chilly Battle in our June 2020 Weekly View entitled China, COVID-19, and the New ‘Chilly Battle’. We imagine this can proceed to place a ceiling on US-listed China shares for the foreseeable future, as Beijing pivots away from a concentrate on revenue maximization in the direction of social initiatives.

Given China’s volatility and growing authorities intervention of their capital markets, we predict Chinese language fairness publicity ought to be restricted for some conservative Maintain and Distribute investor profiles. For long-term Accumulate buyers, we proceed to favor an lively technique, presently preferring US shares over worldwide equities. Inside worldwide allocations, we’ve a variety desire for European over Asian shares. Inside broad rising markets, buyers are compelled to weigh the positives of enticing long-term worth and leverage to world reflation with these structural dangers, although we might notice the economies of different Asian international locations equivalent to Korea, India, and Taiwan proceed to fare comparatively nicely.

Essential Disclosure Data

The feedback above refer typically to monetary markets and never RiverFront portfolios or any associated efficiency. Opinions expressed are present as of the date proven and are topic to vary. Previous efficiency isn’t indicative of future outcomes and diversification doesn’t guarantee a revenue or shield in opposition to loss. All investments carry some stage of threat, together with lack of principal. An funding can’t be made instantly in an index.

Chartered Monetary Analyst is an expert designation given by the CFA Institute (previously AIMR) that measures the competence and integrity of economic analysts. Candidates are required to move three ranges of exams protecting areas equivalent to accounting, economics, ethics, cash administration and safety evaluation. 4 years of funding/monetary profession expertise are required earlier than one can turn into a CFA charterholder. Enrollees in this system should maintain a bachelor’s diploma.

Data or information proven or used on this materials was obtained from sources believed to be dependable, however accuracy isn’t assured.

This report doesn’t present recipients with info or recommendation that’s ample on which to base an funding determination. This report doesn’t keep in mind the precise funding targets, monetary state of affairs or want of any explicit consumer and will not be appropriate for all sorts of buyers. Recipients ought to think about the contents of this report as a single think about investing determination. Extra basic and different analyses can be required to make an funding determination about any particular person safety recognized on this report.

In a rising rate of interest atmosphere, the worth of fixed-income securities typically declines.

When referring to being “chubby” or “underweight” relative to a market or asset class, RiverFront is referring to our present portfolios’ weightings in comparison with the composite benchmarks for every portfolio. Asset class weighting dialogue refers to our Benefit portfolios. For extra info on our different portfolios, please go to www.riverfrontig.com or contact your Monetary Advisor.

Investing in overseas firms poses further dangers since political and financial occasions distinctive to a rustic or area could have an effect on these markets and their issuers. Along with such normal worldwide dangers, the portfolio might also be uncovered to forex fluctuation dangers and rising markets dangers as described additional under.

Modifications within the worth of foreign exchange in comparison with the U.S. greenback could have an effect on (positively or negatively) the worth of the portfolio’s investments. Such forex actions could happen individually from, and/or in response to, occasions that don’t in any other case have an effect on the worth of the safety within the issuer’s dwelling nation. Additionally, the worth of the portfolio could also be influenced by forex trade management rules. The currencies of rising market international locations could expertise important declines in opposition to the U.S. greenback, and devaluation could happen subsequent to investments in these currencies by the portfolio.

Overseas investments, particularly investments in rising markets, will be riskier and extra unstable than investments within the U.S. and are thought-about speculative and topic to heightened dangers along with the final dangers of investing in non-U.S. securities. Additionally, inflation and speedy fluctuations in inflation charges have had, and should proceed to have, destructive results on the economies and securities markets of sure rising market international locations.

Shares signify partial possession of an organization. If the company does nicely, its worth will increase, and buyers share within the appreciation. Nonetheless, if it goes bankrupt, or performs poorly, buyers can lose their whole preliminary funding (i.e., the inventory value can go to zero). Bonds signify a mortgage made by an investor to an organization or authorities. As such, the investor will get a assured rate of interest for a selected time period and expects to get their unique funding again on the finish of that point interval, together with the curiosity earned. Funding threat is reimbursement of the principal (quantity invested). Within the occasion of a chapter or different company disruption, bonds are senior to shares. Buyers ought to concentrate on these variations previous to investing.

Index Definitions:

MSCI China Index captures giant and mid cap illustration throughout China A shares, H shares, B shares, Crimson chips, P chips and overseas listings (e.g. ADRs).

The MSCI China A Index captures giant and mid-cap illustration throughout China securities listed on the Shanghai and Shenzhen exchanges. The index covers solely these securities which might be accessible by means of “Inventory Join”. The index is designed for worldwide buyers and is calculated utilizing China A Inventory Join listings primarily based on the offshore RMB trade price (CNH).

The Dow Jones China Offshore 50 Index measures the inventory efficiency of firms whose main operations are in mainland China however whose shares commerce on the exchanges of Hong Kong and the U.S.

Normal & Poor’s (S&P) 500 Index measures the efficiency of 500 giant cap shares, which collectively signify about 80% of the overall US equities market.

RiverFront Funding Group, LLC (“RiverFront”), is a registered funding adviser with the Securities and Trade Fee. Registration as an funding adviser doesn’t suggest any stage of ability or experience. Any dialogue of particular securities is offered for informational functions solely and shouldn’t be deemed as funding recommendation or a suggestion to purchase or promote any particular person safety talked about. RiverFront is affiliated with Robert W. Baird & Co. Integrated (“Baird”), member FINRA/SIPC, from its minority possession curiosity in RiverFront. RiverFront is owned primarily by its staff by means of RiverFront Funding Holding Group, LLC, the holding firm for RiverFront. Baird Monetary Company (BFC) is a minority proprietor of RiverFront Funding Holding Group, LLC and subsequently an oblique proprietor of RiverFront. BFC is the dad or mum firm of Robert W. Baird & Co. Integrated, a registered dealer/seller and funding adviser.

To overview different dangers and extra details about RiverFront, please go to the web site at www.riverfrontig.com and the Kind ADV, Half 2A. Copyright ©2021 RiverFront Funding Group. All Rights Reserved. ID 1745174

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.