With charges having been so low for therefore lengt

With charges having been so low for therefore lengthy, savers have been damage by the dearth of accessible protected earnings out there. Typical knowledge says that these savers will both be pushed into risker property or compelled to take the traditionally low rates of interest provided by low-risk debt. A extra novel resolution can also be doable, nonetheless. No matter one’s portfolio make-up, using choice overlays is a method to offer constant earnings with a low likelihood of loss.

One instance is an iron condor technique. This technique writes out of the cash places and calls to provide earnings, after which buys deeper out of the cash places and calls to guard towards losses. By shopping for and promoting the choices on an index, the earnings generated from the technique is tax advantaged (60% long-term, 40% short-term) regardless that the choices could also be short-dated. Additionally, one needn’t personal the index to make use of the technique. Any portfolio can act as margin, and the utmost potential loss is outlined on the outset of the commerce.

[wce_code id=192]

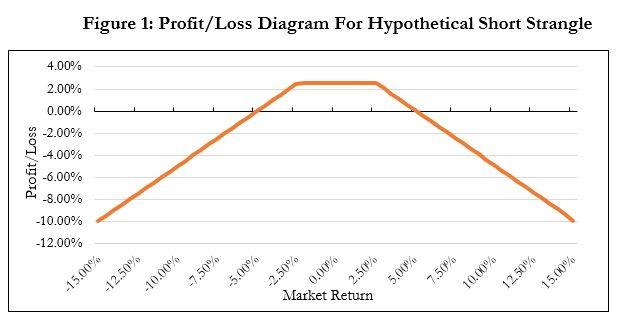

In an iron condor technique, one first writes out-of-the-money (OTM) put and name choices to generate earnings. A name choice, which provides the proprietor the correct (however not the duty) to purchase the underlying asset at an agreed upon worth and date, is efficacious when the strike worth of the choice is under the market worth of the underlying asset at expiration. In distinction, a put choice, which provides the proprietor the correct to promote at an agreed upon worth and date, has intrinsic worth when the strike worth of the put is above the market worth of the asset at expiration. Determine 1 under reveals the revenue and loss diagram for a hypothetical commerce consisting of the sale of 1 OTM put and one OTM name (known as a brief strangle).

The decision choice had a strike worth 2.5% OTM and was bought for 0.92%. The put choice additionally had a strike worth 2.5% OTM and was bought for 1.63%. Each choices had the identical expiration date. The technique made probably the most cash if the market was ±2.5% by expiration, however made cash at any time when the market was ±5%.

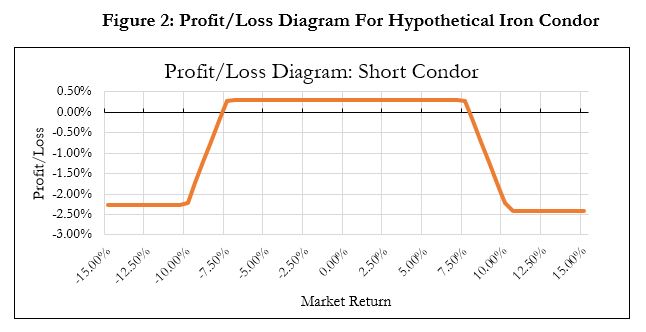

A downside to this technique is the presence of limitless draw back threat on both finish of the strike costs. To fight this, a condor technique can even purchase deeper OTM choices, which creates an outlined draw back on the outset of the commerce. That is illustrated in Determine 2 under. The additive sum of the put and name unfold is the utmost worth of the commerce, whereas the proportion distinction in strike worth between the purchased and bought legs is the utmost loss.

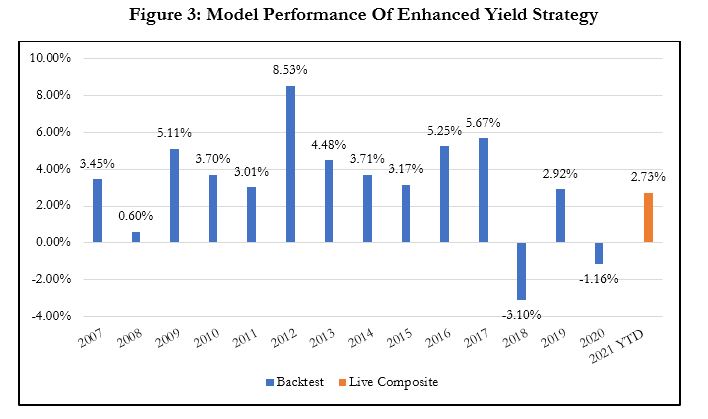

Julex Capital provides their model of the iron condor, the Enhanced Yield Technique, which has low correlation with conventional property and is negatively correlated with fastened earnings. The technique is very liquid with no lock, provides a well-defined weekly threat funds, and might be carried out with no change to the shopper’s underlying asset allocation.

For extra data, please contact Liam Flaherty ([email protected]).

Disclosure: This text is for the aim of knowledge alternate solely. It’s not a solicitation or supply to purchase or promote any safety. You will need to do your individual due diligence and seek the advice of knowledgeable funding advisor earlier than making any funding selections. All data posted is believed to return from dependable sources. We don’t warrant the accuracy or completeness of knowledge made accessible and due to this fact is not going to be accountable for any losses incurred. Previous efficiency will not be indicative of future returns.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.