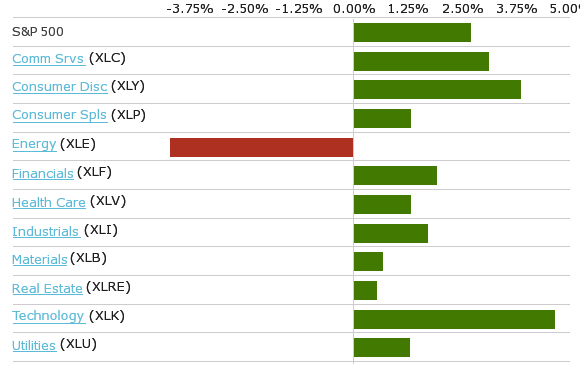

The S&P 500 index rose 2.7% this week to new document highs because the know-how, client discretionary, and communication companies sectors led a broad climb.

The market benchmark ended the week at 4,128.80, up from its closing degree of 4,019.87 final Thursday, the final buying and selling day final week as a result of market being closed final Friday for the Good Friday vacation. Friday’s closing degree marked the S&P 500’s highest shut ever. It additionally set a recent intraday document Friday at 4,129.48.

The features got here as Federal Open Market Committee minutes launched this week from the policy-setting committee’s March 16-17 assembly confirmed settlement amongst members that it “would doubtless be a while till substantial additional progress towards the Committee’s maximum-employment and price-stability objectives can be realized,” including that asset purchases “would proceed at the least on the present tempo till then.”

Investor sentiment additionally improved as JPMorgan (JPM) Chief Govt Jamie Dimon mentioned in a letter to shareholders he sees an financial “Goldilocks second” forward and expects an financial growth by way of 2023 due to extra financial savings, new stimulus financial savings, deficit spending, and profitable COVID-19 vaccines, amongst different elements.

Progress continued to be made this week in vaccine distributions, though newly reported COVID-19 instances within the US additionally rose amid spreading variants. Practically 20% of the entire US inhabitants has been absolutely vaccinated to date, whereas nearly 34% have had at the least one dose.

The weekly advance in US shares was broad, with all however one sector posting weekly features. The know-how sector recorded the biggest proportion improve, up 4.7%, following by a 4.2% climb in client discretionary and a 3.2% rise in communication companies. The lone declining sector was power, down 4%.

The know-how sector’s gainers included Mastercard (MA), up 4.6% on the week, because the US-based fee know-how firm mentioned worldwide on-line retail gross sales elevated by $900 billion in 2020. The corporate additionally reported US retail gross sales excluding automotive and gasoline elevated 26% 12 months over 12 months in March whereas on-line gross sales jumped 57%. Mastercard plans to launch Q1 outcomes on April 29.

Amongst client discretionary shares, Norwegian Cruise Line (NCLH) shares climbed 10%. The cruise operator mentioned it plans to renew cruises from the US in July and has requested the US Facilities for Illness Management & Prevention to raise the conditional sail order. The corporate plans to renew cruises outdoors the US with cruises in Greece in late July.

In communication companies, Twitter (TWTR) shares jumped 12%. A Bloomberg Information report mentioned Twitter has held deal talks with audio-based social community Clubhouse in current months. Nonetheless, the discussions are now not ongoing, in response to unnamed folks conversant in the matter.

On the draw back, the power sector’s drop got here as crude oil futures slid. The decliners included Occidental Petroleum (OXY), whose shares fell 10% on the week amid a regulatory submitting displaying activist investor Carl Icahn bought 7 million shares of the corporate for $25.60 every, totaling about $180 million.

Subsequent week marks the Q1 earnings reporting season’s unofficial kickoff, with huge banks JPMorgan Chase, Wells Fargo (WFC), and Goldman Sachs (GS) anticipated to launch outcomes Wednesday. Financial institution of America (BAC), Alcoa (AA), and PepsiCo (PEP) are among the many firms anticipated to report Thursday, adopted by Morgan Stanley (MS) on Friday.

As for financial knowledge, subsequent week’s calendar options the March client value index on Tuesday, March retail gross sales on Thursday, and March constructing permits and housing begins, in addition to April client sentiment on Friday.

For extra info, go to www.sectorspdr.com.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.