The worth of copper is on a tear proper now due to information that numerous pharmaceutical corpora

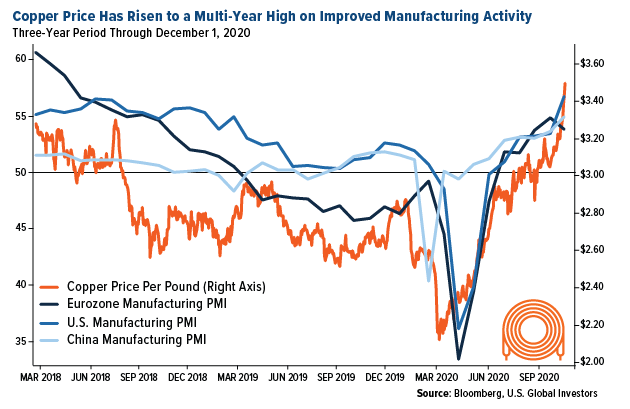

The worth of copper is on a tear proper now due to information that numerous pharmaceutical corporations have developed efficient vaccines in opposition to COVID-19, elevating hopes that the world economic system will open to full capability prior to anticipated. The commercial steel rose 12.24% in November, its greatest month in 4 years. Immediately it was buying and selling as excessive as $3.50 per pound ($7,616 per ton), its highest stage since 2013.

The copper rally is due largely to improved manufacturing exercise within the U.S., China and eurozone. For the month of November, the IHS U.S. Manufacturing PMI hit 56.7, up considerably from 53.four in October. The month-to-month improve was the sharpest since September 2014, in accordance with IHS Markit.

In the meantime, Chinese language factories signaled their strongest enchancment in over a decade. The Caixin China Normal Manufacturing PMI posted 54.9 in November as output and new orders surged to 10-year highs.

Taking a look at producers on a worldwide scale, you’d be forgiven for not realizing we had been in the midst of a pandemic and financial pullback. The JPMorgan World Manufacturing PMI climbed from 53.zero in October to 53.7, a 33-month excessive. Based on JPMorgan economists, this marks the quickest tempo since January 2018.

The Begin of One other China-Pushed Supercycle?

In mild of the constructive manufacturing uptrend, some economists and market specialists see the beginning of a brand new copper-price supercycle pushed largely by China. The Asian nation at present consumes about half of all copper produced worldwide, and this share might improve because the nation undergoes an enormous vitality shift to renewables resembling wind and photo voltaic.

This week, a senior govt at BHP, one of many world’s high copper producers, mentioned that copper output would wish to double over the following 30 years to satisfy surging demand for inexperienced renewable vitality.

“To maintain tempo with these mega developments, copper manufacturing should double over the following 30 years,” commented Tariq Salaria, VP for gross sales and advertising and marketing at BHP.

Reflecting on the copper bull run, which has lifted the steel’s worth some 72% because the March low, one cash supervisor believes this rally may very well be one for the historical past books. Says Luke Sadrian, chief funding officer at Commodities World Capital, copper is “wanting prefer it did in ’04 and ’05, and the world didn’t get the memo.”

As a result of large imports from China, copper costs elevated greater than 280% between the start of 2004 till they peaked in Could 2006.

Immediately’s China imports of the crimson steel are a lot higher than they had been then. In July of this yr, the nation purchased a report 762,211 tonnes of unwrought copper, which is near 4 instances higher than the typical month-to-month import quantities between 2004 and 2007.

In a observe to shoppers this week, Goldman Sachs analysts mentioned they imagine the present worth power “is just not an irrational aberration” however relatively “the primary leg of a structural bull market in copper.” By the primary half of 2022, the Wall Road financial institution says that it’s “extremely possible” copper might take a look at its earlier report excessive of almost $10,150 per ton, set in February 2011.

Copper Miners on Hearth

Because of this, shares of copper producers and explorers have soared. For the six months via December 3, the Solactive World Copper Miners Index was up greater than 66%, outpacing the returns for different steel miner teams. Efficiency for the interval was pushed by corporations resembling Capstone Mining (up 174.04%), which operates within the U.S. and Mexico; Arizona-based Freeport-McMoRan (140.68%); and Ivanhoe Mines (93.93%), which is at present creating three properties in Southern Africa.

Our favourite copper title continues to be Ivanhoe. As I reported in September, the Vancouver-based firm is set to start manufacturing at its tier-one Kamoa-Kakula Copper Venture within the Democratic Republic of the Congo (DRC), believed to be the world’s second-largest copper deposit.

“Kakula is on observe to start manufacturing in beneath one yr from now, which, contemplating we’ve been working in Africa for 27 years now, looks like tomorrow morning,” commented Robert Friedland, Ivanhoe’s billionaire founder and co-chairman.

Register Immediately for O’Share ETFs Dwell

A lot of you listened in to my final dialogue with Kevin O’Leary, “Mr. Great” himself, chairman of O’Shares ETFs.

A second dialogue has been scheduled and we’re now taking registrations. Among the many matters Kevin and I will probably be masking are potential insurance policies beneath President-elect Joe Biden, the post-COVID world and the implications in your portfolio.

Be a part of us on Thursday, December 10, at 11:00 AM Japanese. Register for FREE by clicking right here!

Initially printed by U.S. Funds, 12/3/20

All opinions expressed and information offered are topic to vary with out discover. A few of these opinions is probably not applicable to each investor. By clicking the hyperlink(s) above, you can be directed to a third-party web site(s). U.S. World Buyers doesn’t endorse all info provided by this/these web site(s) and isn’t liable for its/their content material.

The Solactive World Copper Miners Index consists of worldwide corporations lively in exploration, mining and/or refining of copper. The index features a minimal of 20 and a most of 40 members. The S&P Metals & Mining Choose Trade Index contains shares within the S&P Whole Market Index which can be categorised within the GICS metals & mining sub-industry. The S&P/TSX World Mining Index offers traders with a benchmark for world mining portfolios and a foundation for modern, index-linked funding autos.

Holdings could change each day. Holdings are reported as of the newest quarter-end. The next securities talked about within the article had been held by a number of accounts managed by U.S. World Buyers as of (09/30/2020): Ivanhoe Mines Ltd.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.