By Shaun Wurzbach, Managing Director, International Head of Monetary Advisor Channel, S&P Dow J

By Shaun Wurzbach, Managing Director, International Head of Monetary Advisor Channel, S&P Dow Jones Indices

I outline core ESG indexing as using indices designed to use environmental, social, and governance (ESG) screening and ESG scores to acknowledged and generally iconic indices just like the S&P 500®, S&P/ASX 200, or S&P/TSX Composite. These headline indices develop into actionable elements of asset allocation when a fund or individually managed accounts (SMA) supplier tracks the index. Our SPIVA® and Persistence Scorecards show again and again that these well-designed indices are match for that objective. Now we now have designed and launched core ESG variations of those indices to leverage SAM’s1 strong ESG knowledge to measure the ESG engagement of corporations within the benchmark index. Wanting on the value and availability of the ETFs that presently exist within the U.S., U.Okay./Europe, Canada, and Australia on this core ESG class, it’s honest to say that the partnership of index suppliers, ETF knowledge suppliers, asset managers, and market makers has democratized entry to ESG for strategic allocation. Nevertheless it’s okay with me in case you favor to think about that use of ESG as thematic relatively than strategic.

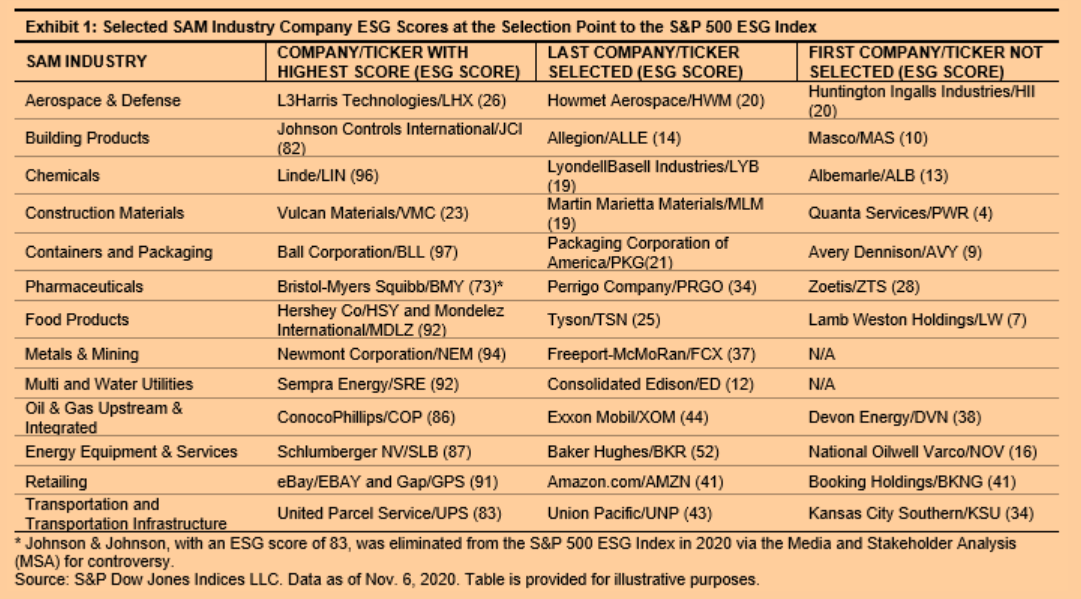

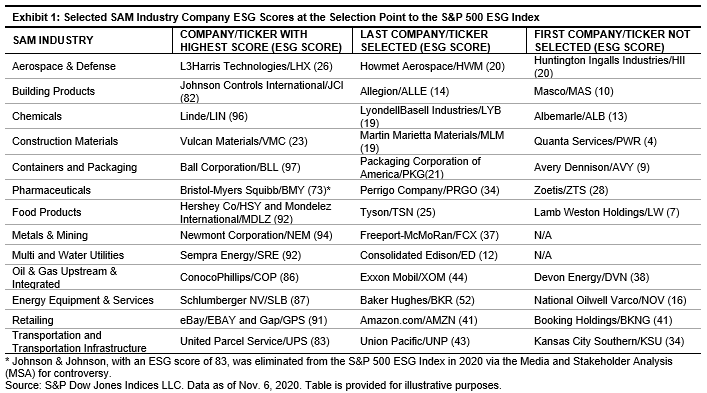

How precisely is core ESG indexing engaged to drive the varieties of change that ESG traders need to see? At first look, most core ESG indices should not excluding as many industries or corporations as ESG “chief” indices. The aware design distinction in core ESG has helped to traditionally make sure that core ESG indices monitor their benchmark carefully. But the core ESG number of eligible corporations primarily based on ESG rating results in trade and sector variations we will see. Exhibit 1 exhibits the final firm chosen and the subsequent firm not chosen primarily based on ESG scores for among the industries throughout the S&P 500. Sector weight info is accessible free on spglobal.com/spdji, displaying sector weight variations between benchmark and ESG indices.

On the firm stage, our expectation is that CFOs are engaged in addressing ESG inquiries from companies like SAM. SAM accesses each public and private info to render scores. This inquiry and reporting drives individuals and course of modifications at these corporations as they try to enhance yr over yr. And those self same CFOs strive to make sure their firm is chosen in core ESG indices. As investor demand for ESG continues to extend, my expectation is that choice within the S&P 500 ESG Index will matter to CFOs in an identical strategy to how choice issues in one in every of our Dividend Aristocrats® indices.

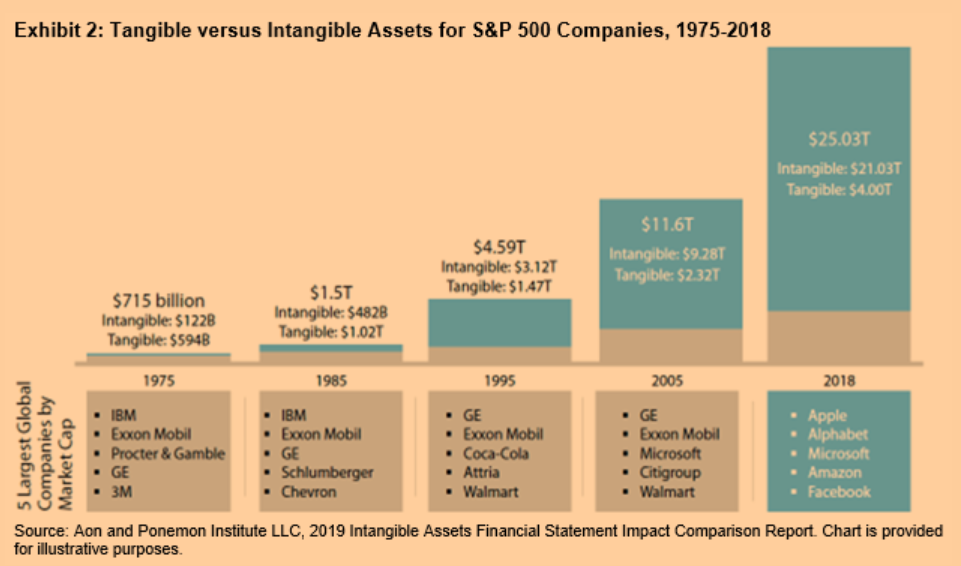

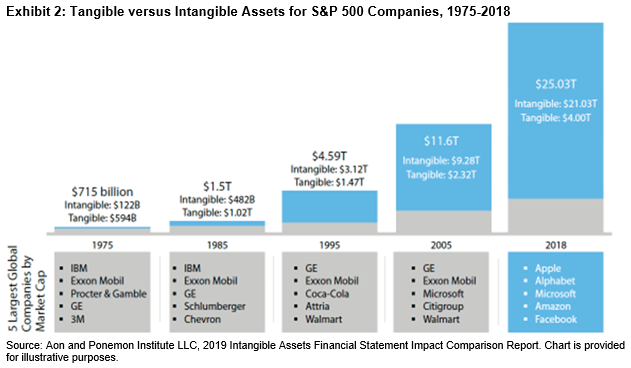

One other facet of engagement that core ESG indices drive is bringing extra transparency to how corporations are managing materials nonfinancial dangers and alternatives. Is that info related to firm valuation? A rising discipline of accountancy in addition to training and coaching follow led by universities and the Sustainability Accounting Requirements Board (SASB) are making that time, and I feel that time is commonly missed by advisors and traders of my era. We had been skilled to take a look at the three monetary statements of the agency. We might must have it identified to us how substantial the shift has been in valuation to intangible belongings. Exhibit 2 illuminates this level within the ubiquitous S&P 500 by displaying how intangible belongings have elevated considerably as a driver of market capitalization for the highest 5 corporations within the index over time.

Exhibit 2 exhibits that we should be extra interested by how ESG can present details about intangible belongings and nonfinancial dangers and alternatives. Extra info and knowledge from ESG knowledge suppliers like SAM will paint a extra full image of how one can measure the long-term sustainable efficiency of fairness and stuck earnings asset lessons.

Initially revealed by Indexology, 11/19/20

1 SAM, a part of S&P International, gives the info that powers the globally acknowledged Dow Jones Sustainability Indices, S&P 500 ESG Index, and others within the S&P ESG Index Collection. Every year, SAM conducts the Company Sustainability Evaluation, an ESG evaluation of over 7,300 corporations. The CSA has produced one of many world’s most complete databases of financially materials sustainability info, and serves as the premise for the scores that govern S&P DJI ESG indices.

The posts on this weblog are opinions, not recommendation. Please learn our Disclaimers.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.