Our work means that U.S. financ

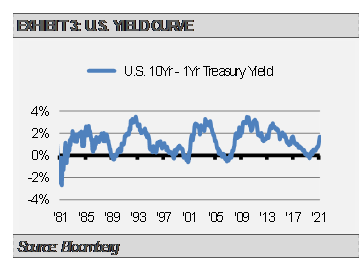

Our work means that U.S. financial prospects proceed to brighten. Greater long-term rates of interest at present replicate the market’s expectations for quicker financial progress and considerably larger inflation. We anticipate this development in the direction of larger rates of interest to proceed in matches and begins.

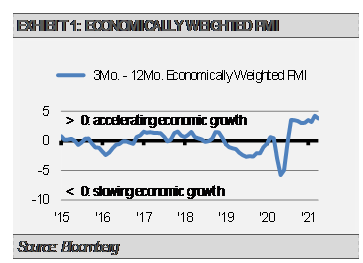

Total financial circumstances within the U.S. proceed to look sturdy as do many measures of elementary financial well being, resembling buying supervisor indices (PMIs). The next graph exhibits the 3-month transferring common PMI minus the 12-month transferring common PMI. When the 12-month is larger than the 3-month, the tempo of financial progress is anticipated to be slowing. Conversely, when the 3-month is larger than the 12-month, as is the case at this time, we anticipate the tempo of financial progress to be accelerating.

[wce_code id=192]

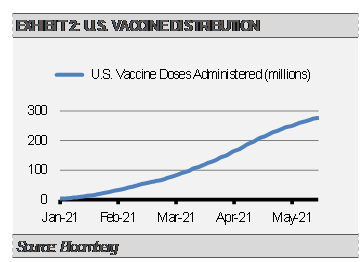

The economic system is constructing momentum because it reopens with broader vaccine distribution as a key driver. In line with latest Bloomberg estimates, with U.S. residents getting roughly 2,000,000 vaccine doses per day on common, we should always attain herd immunity in roughly three to 4 months.

We anticipate jobs creation to speed up within the coming months as companies enhance and the economic system reopens. Employment within the worst hit areas, resembling leisure and hospitality, ought to rebound strongly. Although the leisure and hospitality sector makes up solely 9% of U.S. employment, the business accounts for roughly 35% of the remaining job losses since final yr. We anticipate sturdy jobs numbers within the near-term to slender this hole. In line with the Bureau of Labor Statistics, the U.S. economic system created 1.617 million jobs within the first quarter of 2021, which was primarily led by 647,000 within the leisure and hospitality sector. As vaccine distribution broadens, financial restrictions will probably be lifted and most of the remaining unemployed will quickly discover work.

This all provides as much as a speedy financial restoration in our view, which has implications for inflation, bond costs, and inventory costs. After a near-term spike in inflationary measures on account of base results (i.e., going from deflation a yr in the past to reopening financial inflation), longer-term inflationary circumstances ought to construct over the approaching months. We anticipate improved actual financial progress mixed with larger inflation expectations to push long-term rates of interest larger in matches and begins.

The distinction between long-term and short-term rates of interest will increase to about 3% throughout an financial restoration. Given at this time’s rate of interest surroundings, that equates to the 10-year Treasury yield transferring nearer to three% over the following 12 to 18 months.

On the fastened revenue aspect, our Methods are underweight rate of interest sensitivity and U.S. Treasuries in favor of shorter-duration asset-backed and mortgage-backed securities together with Treasury Inflation Protected Securities (TIPS) and financial institution loans. This positioning permits us to offset fairness market danger with low-volatility fastened revenue holdings, whereas nonetheless not taking extreme rate of interest danger.

DISCLOSURES

Any forecasts, figures, opinions or funding strategies and techniques defined are Stringer Asset Administration, LLC’s as of the date of publication. They’re thought of to be correct on the time of writing, however no guarantee of accuracy is given and no legal responsibility in respect to error or omission is accepted. They’re topic to alter with out reference or notification. The views contained herein are to not be taken as recommendation or a suggestion to purchase or promote any funding and the fabric shouldn’t be relied upon as containing ample info to assist an funding resolution. It must be famous that the worth of investments and the revenue from them could fluctuate in accordance with market circumstances and taxation agreements and buyers could not get again the total quantity invested.

Previous efficiency and yield is probably not a dependable information to future efficiency. Present efficiency could also be larger or decrease than the efficiency quoted.

The securities recognized and described could not signify the entire securities bought, bought or beneficial for shopper accounts. The reader mustn’t assume that an funding within the securities recognized was or will probably be worthwhile.

Information is supplied by numerous sources and ready by Stringer Asset Administration, LLC and has not been verified or audited by an unbiased accountant.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.