Partwork of my job as a CIO for Astoria Portfolio A

Partwork of my job as a CIO for Astoria Portfolio Advisors is to

- Determine market traits

- Alert shoppers of those traits

- Counsel methods to profit, shield, or diversify one’s portfolio

If I recognized a pattern and urged to shoppers to behave on my premise solely as soon as, I don’t assume I’d get a lot traction. Therefore, I need to continuously repeat myself. Nicely, ever since I used to be a younger child, I was instructed that I are likely to repeat myself. I should have been destined to be a CIO since I used to be a child!

Anyhow, again to the markets. The US 10-year touched the 1.75% stage this week. That’s an unimaginable transfer since March 2020. As I’ve repeated continuously, this has enormous portfolio implications.

Astoria has been on the forefront of this transfer. Again in June 2020, I appeared on CNBC, arguing for the very rotation that we’re seeing right now. I can’t embrace the June 2020 CNBC hyperlink anymore as a result of even I get bored with listening to myself particularly point out this interview. Individually, I might be on CNBC this coming Monday – pleased to ship particulars!

[wce_code id=192]

The underside line is the next:

- I’m fairly involved for portfolios as most are OW lengthy period belongings, expertise shares, and US large-capgrowth.

- Most portfolios personal low-costmarket cap weighted ETFs, which have an enormous expertise bias.

- Most portfolios are underweight cyclicals – the very space that’s benefiting probably the most with this transfer greater in charges.

Danger cuts each methods. These portfolios did effectively when expertise shares have been going to the moon. After all, nothing goes up perpetually. Now these portfolios are struggling.

At this level, proudly owning a 10% sleeve in reflationary belongings is just not even a tactical place anymore. For my part, it’s merely a prudent hedge in opposition to expertise which, as talked about, makes up 25% of that US large-cap market cap weighted ETF.

Astoria’s prime concepts for that 10% sleeve:

- Cyclicals

- Inflation delicate belongings (we embrace bodily commodities, commodity equities, cyclicals, and TIPS in our answer)

- Small/mid-cap shares

- Rising Markets (China, actually although)

(Nick Cerbone has run numerous simulations exhibiting that the chance of a reasonable risk-type portfolio doesn’t change a lot with a 10% sleeve; contact us should you want to see his analysis).

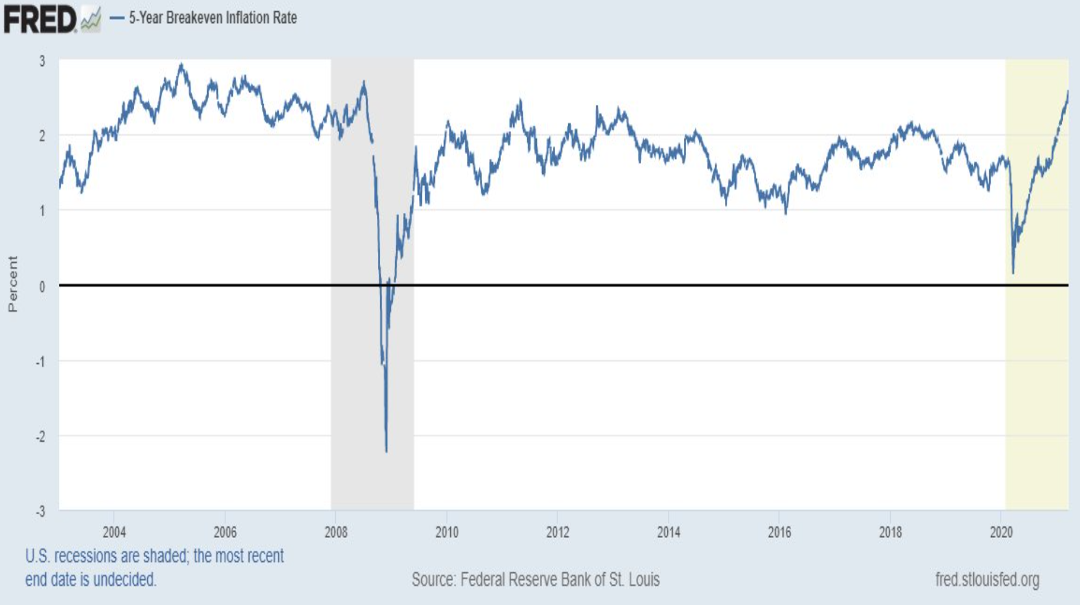

Take a look at the 5-year breakeven inflation chart under. Clearly, the inventory and bond market are giving us a sign. The sign is:

- Charges are trending greater

- Inflation is (on the margin) growing

Supply: Federal Reserve Financial institution of St. Louis

Additionally, should you consider there may be potential for greater taxes within the subsequent few years to assist fund the ballooning federal deficit, then maybe what is sensible is:

- Taking beneficial properties right now from a better principal notional however decrease capital beneficial properties stage

- Re-establishing the proper asset allocation technique (tilt extra in the direction of worth, worldwide, small/mid-caps, commodities, and tilt away from large-cap expertise)

I worry buyers who’re sitting on large-cap expertise shares are hamstrung on trimming their place due to incurring taxes. Nicely, seeing the principal erode doesn’t make an excessive amount of sense to me. Full disclosure: We’re not accountants, so please communicate along with your tax skilled earlier than doing something.

See our earlier notice on what a rising 10-year surroundings means in your portfolio (click on right here). I’ll attempt to not repeat myself sooner or later!

Finest,

Astoria Portfolio Advisors

Any third-party web sites supplied on www.astoriaadvisors.com are strictly for informational functions and for comfort. These third-party web sites are publicly obtainable and don’t belong to Astoria Portfolio Advisors LLC. We don’t administer the content material or management it. We can’t be held chargeable for the accuracy, time delicate nature, or viability of any data proven on these websites. The fabric in these hyperlinks is just not meant to be relied upon as a forecast or funding recommendation by Astoria Portfolio Advisors LLC, and doesn’t represent a suggestion, supply, or solicitation for any safety or any funding technique. The looks of such third-party materials on our web site doesn’t suggest our endorsement of the third-party web site. We’re not accountable for your use of the linked web site or its content material. As soon as you permit Astoria Portfolio Advisors LLC’s web site, you can be topic to the phrases of use and privateness insurance policies of the third-party web site. Refer right here for extra particulars.

For full disclosure, please consult with our web site: https://www.astoriaadvisors.com/disclaimer

Click on right here for Picture Supply

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.