On June 14, 2021, Dimensional F

On June 14, 2021, Dimensional Fund Advisors, a world chief in systematic investing, prolonged its change traded fund (ETF) choices by changing 4 U.S. tax-managed mutual funds into lively clear ETFs listed on the New York Inventory Change (NYSE). The brand new ETFs broaden Dimensional’s suite of broadly diversified funding options, providing better selection in how monetary advisors and institutional traders entry Dimensional’s funding options.

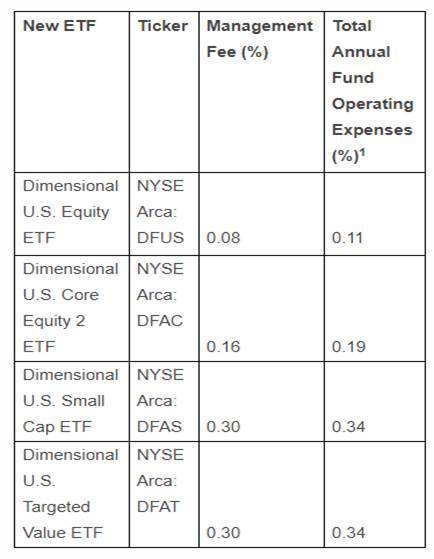

The 4 ETFs listed at present are a part of the agency’s plan to transform six tax-managed mutual funds into ETFs, which supply traders a further software to handle capital good points, supporting the funds’ purpose of delivering greater after-tax returns by minimizing tax affect. Dimensional plans to transform two extra non-U.S. market tax-managed mutual funds to ETFs in September 2021.

Dimensional is likely one of the first asset managers to transform mutual funds into ETFs. With the profitable launch of the agency’s first three ETFs and the conversion of those 4 mutual funds, Dimensional turns into one of many largest lively ETF issuers within the business, with greater than $30 billion in mixed ETF property beneath administration, putting the agency within the high 10% of all ETF issuers throughout each lively and passive choices.

“We anticipate to have a full lineup of ETFs to supply shoppers alongside our mutual fund choices and expanded individually managed accounts platform,” mentioned Dimensional Co-CEO and Chief Funding Officer Gerard O’Reilly.

“Our methods provide the advantages of indexing—corresponding to low prices, low turnover, and excessive diversification—paired with some great benefits of versatile implementation that present a steady give attention to greater anticipated returns and strong danger administration.”

See additionally: Yahoo Finance: Crypto Gudiance And Dimensional’s Conversion

“For 4 many years, we’ve targeted on empowering funding professionals, to allow them to ship their shoppers the most effective funding expertise,” added Dimensional Co-CEO Dave Butler. “The options we’re bringing to the ETF market will additional that mission, providing extra capability to customise and tailor investments to shoppers’ particular wants and preferences.”

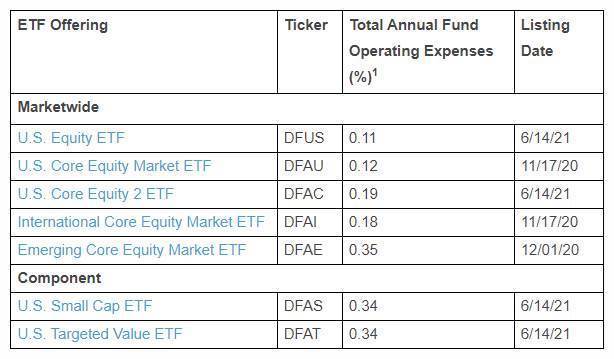

The brand new listings comply with Dimensional’s profitable launch of three core fairness market ETFs in 2020. Dimensional funding methods search to harness a constant, broadly-diversified, and systematic method that goals to outperform the market with out outguessing the market. Methods inside Dimensional’s suite of ETFs have various tilts from market weights to securities that supply greater anticipated returns, corresponding to small cap, worth, and excessive profitability securities.

Dimensional ETFs now present a spread of fairness options that embody marketwide, core fairness portfolios with various levels of emphasis on drivers of anticipated returns, and part options, corresponding to worth and small cap portfolios. This vary of methods offers extra customization in asset allocation, which can assist monetary professionals meet the particular funding objectives and wishes of their various investor bases.

Extra details about Dimensional ETFs could be discovered right here: us.dimensional.com/etfs

For extra market developments, go to ETF Developments.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.