After the steep sell-off in Alibaba (NYSE: BABA) on antitrust points from Beijing, China expertise

After the steep sell-off in Alibaba (NYSE: BABA) on antitrust points from Beijing, China expertise sector-related trade traded funds are gaining momentum.

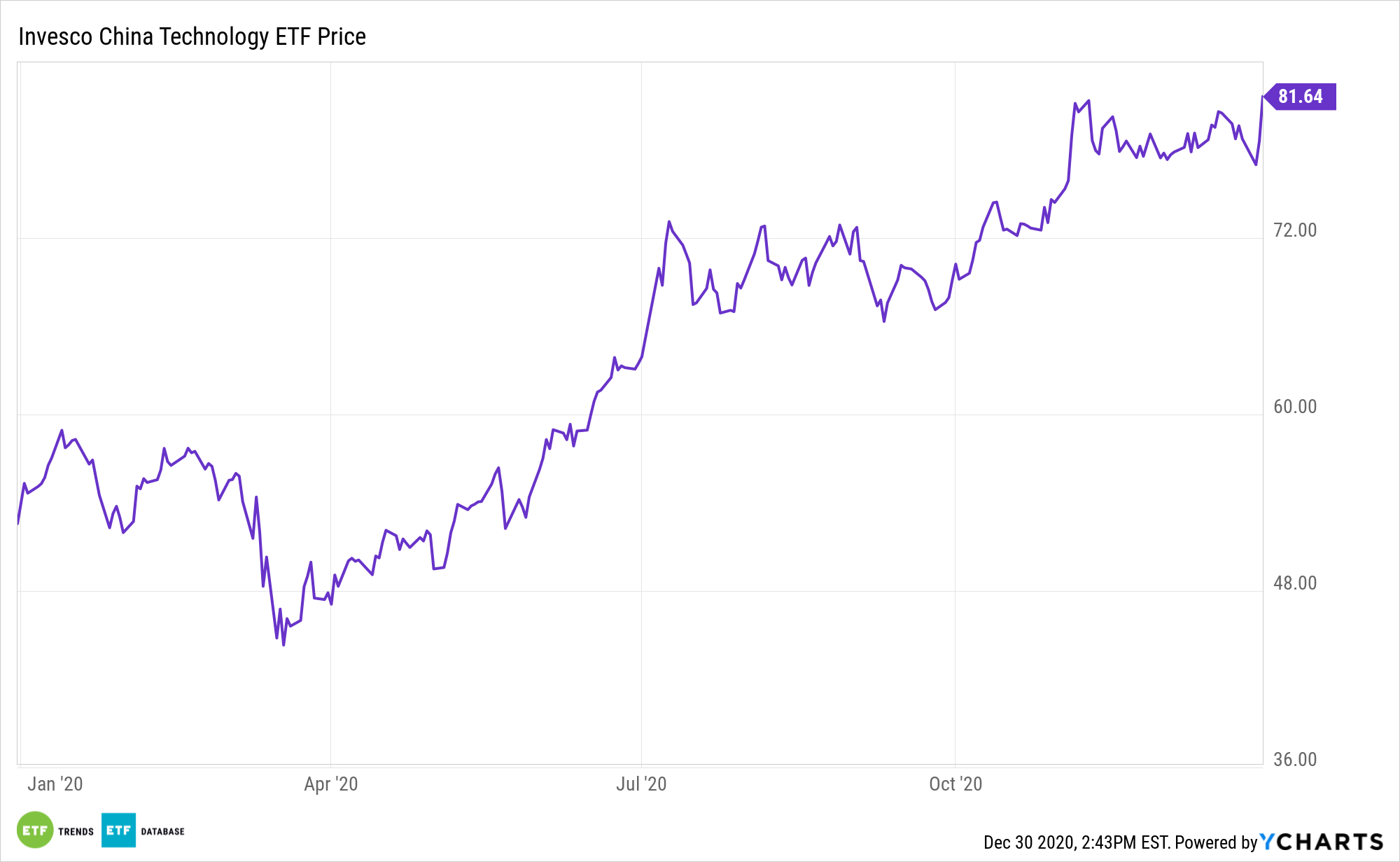

Among the many greatest performing non-leveraged ETFs of Wednesday, the Invesco China Know-how ETF (NYSEArca: CQQQ) elevated 3.9% and the KraneShares CSI China Web Fund (NasdaqGM: KWEB) superior 3.8%. Broader rising market internet-related ETFs that embody hefty tilts towards Chinese language firms have been additionally taking cost on Wednesday, with the World X Rising Markets Web & E-Commerce ETF (NASDAQ: EWEB) up 4.2% and Rising Markets Web & Ecommerce ETF (NYSEArca: EMQQ) 3.6% greater.

China’s greatest expertise firms have been initially pummeled at the beginning of the week as Chinese language regulators tightened their grip on the web trade to rein in monopolistic practices, South China Morning Publish reviews.

“The dangerous information [on antitrust against tech giants] has been digested by buyers,” Kingston Lin, managing director of asset administration division at Canfield Securities in Hong Kong, instructed the South China Morning Publish.

“The tech index rebound is short-term as buyers are nonetheless involved concerning the outlook, the shortage of stories and even dangerous information will weaken its momentum to additional rise,” he added.

Alibaba Beneath Scrutiny

Alibaba and affiliate Ant Group Co., each firms which are overseen by billionaire Jack Ma, have been summoned to a high-level assembly over monetary laws. Beijing has been making an attempt to rein within the more and more influential web big. The just lately drafted anti-monopoly guidelines launched November supplied the federal government a large attain to restrain entrepreneurs whom had loved uncommon freedom to develop their affect.

Alibaba and rivals like Tencent Holdings Ltd. are dealing with elevated scrutiny from regulators after attracting a whole bunch of tens of millions of customers and gaining affect within the on a regular basis lives of Chinese language netizens.

In keeping with Nomura, the sell-off made Alibaba “one of many least expensive in the entire Chinese language web area,” Dow Jones Newswires reviews.

Whereas some imagine the probe’s potential injury has been priced in to future earnings, others have issued a phrase of warning.

“Contemplating that the occasion’s affect is just not sure but, and that the inventory value has dropped considerably, we advise cautious optimism within the close to time period,” First Shanghai, a Hong Kong-based brokerage, instructed Dow Jones.

For extra data on the Chinese language markets, go to our China class.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.