By Taymour Tamaddon, CFA, Portfolio Supervisor, T. Rowe Value

By Taymour Tamaddon, CFA, Portfolio Supervisor, T. Rowe Value

KEY INSIGHTS

- The U.S. fairness market has turn out to be more and more concentrated lately, due principally to the stellar development of a handful of huge‑cap development corporations.

- This has successfully modified the funding panorama, with success now largely depending on making the fitting selections on a small group of dominant corporations.

- By way of valuations, market actions in current months have been pushed by additional a number of enlargement to ranges that, within the staff’s view, seem unsustainable longer time period.

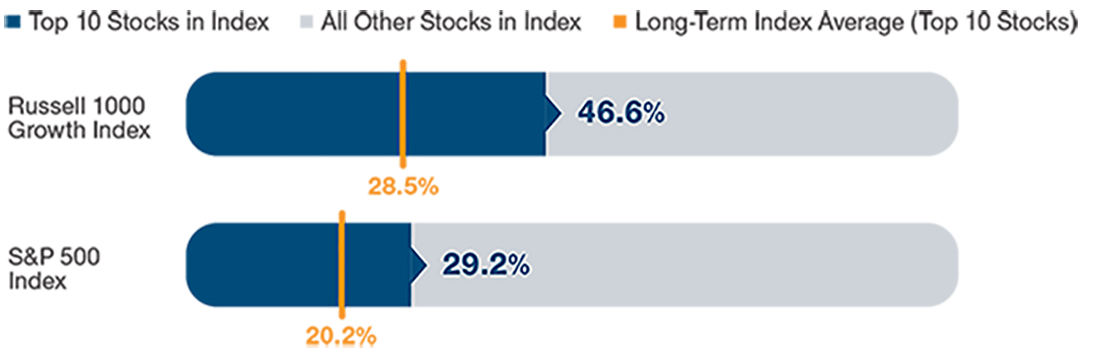

Amid the broader efficiency of the U.S. fairness market, one significantly astonishing statistic is that the highest 10 shares within the S&P 500 Index now account for nearly 30% of your entire index worth. The image is much more stark for the Russell 1000 Progress Index, with near half of your entire index worth concentrated within the 10 largest constituents.[1]

U.S. fairness market focus has been regularly growing because the international monetary disaster, however lately, it has turn out to be extra acute. A lot of the rise in focus might be attributed to only 5 shares—Fb, Amazon, Apple, Microsoft, Google/Alphabet—the so‑known as FAAMGs, which have skilled dramatic will increase of their market capitalization. The more and more concentrated market raises considerations in regards to the broader market being weak to the efficiency of the dominant few. It additionally creates distinct challenges for figuring out alpha[2] alternatives throughout the broader giant‑cap universe.

Understanding the Dangers by Isolating the Sources of Progress

In fascinated with the potential dangers posed by heightened market focus, there are two necessary inquiries to take into account.

The primary is: How a lot of the rise in index focus is as a result of pure topline development of corporations versus that which is because of corporations being reweighted larger within the index? Throughout the Russell 1000 Progress Index, for instance, sure corporations have been considerably reweighted larger lately, just by advantage of their larger inventory value. Apple is maybe the prime instance of this type of focus impact. In distinction, Amazon is a inventory that has seen solely comparatively modest will increase because of index reweighting and has as a substitute been pushed by underlying development in income and earnings.

JUST 10 STOCKS DOMINATE THE COMPOSITION OF KEY INDEXES

(Fig. 1) Proportion of high 10 shares* in Russell 1000 Progress Index and S&P 500 Index

Supply: T. Rowe Value evaluation utilizing information from FactSet Analysis Techniques Inc. All rights reserved.

(See Further Disclosures.)

The second query is whether or not the focus is being pushed by a divergence within the multiples of the businesses concerned. The purpose right here is that market focus itself is just not essentially a difficulty—it turns into problematic when it’s pushed by a small variety of corporations growing their weight throughout the index solely as a consequence of a number of enlargement,[3] reasonably than because of an precise enchancment in underlying money flows or earnings. That is the situation we’re beginning to see presently, and it’s trigger for concern, within the staff’s view.

Getting the Huge Selections Right Has Grow to be Paramount

As an lively supervisor, T. Rowe Value’s purpose stays unchanged—singularly centered on pursuing alpha for shoppers versus the index and, hopefully, with a decrease stage of volatility. That mentioned, by way of choice‑making, a extremely concentrated market presents a really completely different funding panorama in contrast with a extra normalized, diversified market.

In a standard surroundings, investing is all about sustaining a excessive common—that’s, getting extra funding concepts proper than unsuitable, throughout the market. Nonetheless, when sure shares turn out to be very giant weightings throughout the benchmark, we consider the foundations of the sport change. Slightly than a sport of averages, success turns into way more about making the fitting selections on smaller group of huge corporations. Within the present surroundings, this implies getting the large selections proper on the FAAMGs over the following three to 5 years is paramount.

Valuation Multiples Have Continued to Broaden—The Underlying Causes Matter

In attempting to evaluate the sustainability of present valuations, you will need to take into account the assorted elements that drive market multiples.

Rates of interest have performed a major half in present fairness market valuations. The U.S. Federal Reserve’s coverage of low (and persistently low) charges has positioned upward stress on market multiples, which has been extra acutely felt by higher-growth corporations. There are different elements that may impression the multiples, particularly volatility and the cyclicality of earnings, however these are much less influential presently. Take earnings, for instance: We’re some 10 years right into a restoration and much from the underside by way of the type of depressed earnings ranges that will serve to raise multiples.

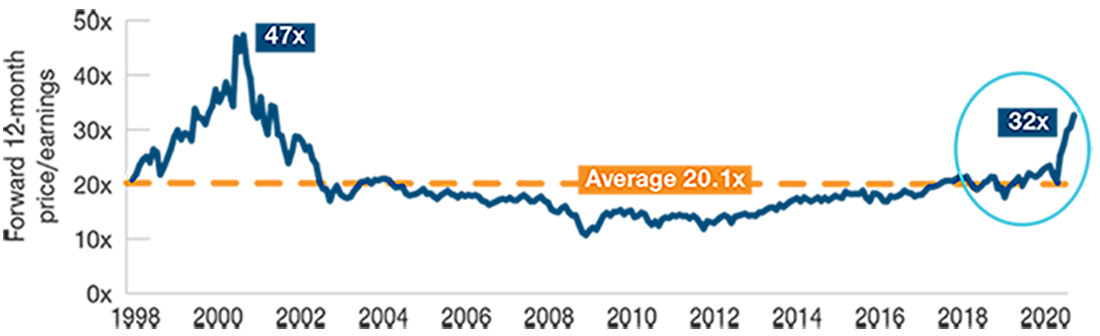

GROWTH VALUATIONS HAVE RISEN SHARPLY IN 2020

(Fig. 2) Russell 1000 Progress Index—P/E ratio spikes to 32x

Supply: T. Rowe Value evaluation utilizing information from FactSet Analysis Techniques Inc. All rights reserved.

(See Further Disclosures.)

Trying on the present stage of U.S. fairness market multiples as just lately as a few quarters in the past, these appeared typically affordable. Nonetheless, newer market actions have been pushed by additional a number of enlargement to ranges that now look extra regarding. That is much less perceptible for the S&P 500 Index however is especially evident within the Russell 1000 Progress Index, given its higher publicity to high-growth corporations. Whereas this doesn’t essentially recommend a reversion in multiples anytime quickly, we consider that the present ranges are unsustainable over the long run.

Which of As we speak’s Giant‑Cap Leaders Can Proceed to Excel?

Can the massive‑cap development corporations which have excelled over the previous 5 to 10 years proceed to guide the market over the following 5 to 10 years?

By advantage of the dominant positions of the 2 digital giants Google and Fb, we consider they’re prone to proceed to realize market share and add extra worth through focused promoting for the businesses that use their companies. Of course, this outlook doesn’t account for any potential exterior elements, similar to adjustments in regulation. Lately in Europe, for instance, there was dialogue about probably requiring sure corporations to share their information on customers with third events in an try to stage the enjoying area.

Elsewhere, Amazon has demonstrated a capability to reinvent itself and discover novel areas of development and momentum. We consider that Amazon’s huge logistics capabilities may very well be a significant driver of lengthy‑time period development. As well as, Amazon’s promoting enterprise, whereas nonetheless very small in contrast with Google and Fb, may additionally proceed to develop.

In distinction, we consider there’s a pure restrict to the quantity of market share that Apple can obtain as a {hardware} firm within the cell phone business. If Apple is to proceed to be as profitable because it has been, over the following decade, it might want to develop a brand new product in a novel market space—just like what it achieved with the iPad and the Apple watch. Apple both must develop some new services or products that we aren’t but speaking about or it must have nice success with its just lately launched Apple TV streaming platform.

Progress Multiples Are Trying Stretched

Whereas focus threat[4] is just not a brand new market phenomenon, it has turn out to be extra acute in right this moment’s U.S. fairness market, as a result of stellar efficiency of a handful of huge‑cap development corporations throughout the shopper, media, and know-how‑associated industries. The success of those companies is being pushed by forces which might be reshaping economies and markets. By innovation and disruption of conventional enterprise fashions, they’re quickly taking market share from lengthy‑standing business gamers, putting valuation and focus concerns in a complete new context.

Nonetheless, in current months, we consider that development benchmark valuation multiples have elevated to ranges which might be unsustainable on an extended‑time period foundation. As such, we anticipate a reversion towards extra regular valuation ranges in some unspecified time in the future. Within the meantime, whereas there are nonetheless good development alternatives to be discovered, funding success will largely depend on getting the large selections proper on the index heavyweights.

Monitoring Progress Inventory A number of Enlargement

Some corporations are merely benefiting from the quick‐time period surroundings.

For the reason that onset of the pandemic, traders have successfully allotted corporations into two distinct buckets: the winners and the losers. These within the winners class have seen vital a number of appreciation as traders have assigned larger lengthy‐time period development valuations. Nonetheless, we aren’t satisfied that that is all the time justified, with some corporations merely benefiting within the quick time period. The chance introduced by the pandemic has allowed them to drag ahead free money flows, which in flip, will increase the corporate’s web current worth. On this foundation, traders are assigning larger lengthy‐time period valuations— valuations that, for a few of these companies, are unwarranted.

The precise corporations talked about above represented the highest 5 largest holdings within the US Giant‐Cap Progress Fairness

Consultant Portfolio, as of September 30, 2020.

The consultant portfolio is an account we consider most carefully displays present portfolio administration fashion for the technique. Efficiency is just not a consideration within the number of the consultant portfolio. The traits of the consultant portfolio proven could differ from these of different accounts within the technique. Info relating to the consultant portfolio and the opposite accounts within the technique is accessible upon request.

Further Disclosures

London Inventory Trade Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2020. All rights within the FTSE Russell indexes

or information vest within the related LSE Group firm which owns the index or the information. Neither LSE Group nor its licensors settle for any legal responsibility for any errors or omissions within the indexes or information and no social gathering could depend on any indexes or information contained on this communication. No additional distribution of knowledge from the LSE Group is permitted with out the related LSE Group firm’s categorical written consent. The LSE Group doesn’t promote, sponsor or endorse the content material of this communication.

Copyright © 2020, S&P World Market Intelligence (and its associates, as relevant). Replica of any data, information or materials, together with scores (“Content material”) in any type is prohibited besides with the prior written permission of the related social gathering. Such social gathering, its associates and suppliers (“Content material Suppliers”) don’t assure the accuracy, adequacy, completeness, timeliness or availability of any Content material and should not answerable for any errors or omissions (negligent or in any other case), whatever the trigger, or for the outcomes obtained from using such Content material. In no occasion shall Content material Suppliers be accountable for any damages, prices, bills, authorized charges, or losses (together with misplaced earnings or misplaced revenue and alternative prices) in reference to any use of the Content material. A reference toa specific funding or safety, a ranking or any statement regarding an funding that’s a part of the Content material is just not a advice to purchase, promote or maintain such funding or safety, doesn’t handle the suitability of an funding or safety and shouldn’t be relied on as funding recommendation. Credit score scores are statements of opinions and should not statements of truth.

Essential Info

This materials is being furnished for basic informational and/or advertising functions solely. The fabric doesn’t represent or undertake to present recommendation of any nature, together with fiduciary funding recommendation, neither is it supposed to function the first foundation for an funding choice. Potential traders are advisable to hunt unbiased authorized, monetary and tax recommendation earlier than making any funding choice. T. Rowe Value group of corporations together with T. Rowe Value Associates, Inc. and/or its associates obtain income from T. Rowe Value funding services and products. Previous efficiency is just not a dependable indicator of future efficiency. The worth of an funding and any earnings from it may well go down in addition to up. Traders could get again lower than the quantity invested.

The fabric doesn’t represent a distribution, a suggestion, an invite, a private or basic advice or solicitation to promote or purchase any securities in any jurisdiction or to conduct any specific funding exercise. The fabric has not been reviewed by any regulatory authority in any jurisdiction.

Info and opinions introduced have been obtained or derived from sources believed to be dependable and present; nonetheless, we can’t assure the sources’ accuracy or completeness. There is no such thing as a assure that any forecasts made will come to go. The views contained herein are as of the date written and are topic to vary with out discover; these views could differ from these of different T. Rowe Value group corporations and/or associates. Not at all ought to the fabric, in entire or partly, be copied or redistributed with out consent from T. Rowe Value.

The fabric is just not supposed to be used by individuals in jurisdictions which prohibit or limit the distribution of the fabric and in sure nations the fabric is offered upon particular request. It isn’t supposed for distribution to retail traders in any jurisdiction.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.