Economies overseas and inside the U.S. are persevering with to overlook forecasts to more and more bigger levels in strikes which have buyers involved. The unfold of the delta variant and poorer-than-anticipated financial numbers, mixed with alerts that the Fed could also be withdrawing financial helps quickly, are all having a dampening impact on what has till just lately been a surging market.

Information reported within the U.S. has been persistently lacking economists’ objectives within the final month, and as of final week have been lacking predictions by their largest margin for the reason that pandemic began, studies the Monetary Occasions.

The data was collected by Citigroup, and recorded a pointy drop-off in shopper confidence. A retail gross sales report additionally posted weaker-than-expected numbers and new dwelling building is down, which may very well be signaling a slowing economic system within the U.S.

It’s a pattern that’s being repeated globally: Citi Financial institution’s evaluation of enterprise efficiency in G10 international locations replicate economies which might be lacking the mark, and regulatory crackdowns in China have solely exacerbated financial woes.

“The tone of investor focus has shifted from reopening momentum, robust fiscal and financial assist, and earnings energy to tapering discuss, political uncertainty… China slowdown and geopolitical tensions,” stated Mark Hackett, analyst at Nationwide Funding Administration.

Economists, taking a look at present tendencies, provide chain bottlenecks, and delta instances, have diminished progress forecasts to six.2%, down from the 6.6% forecast on the finish of July.

Energetic Administration with Avantis Traders by American Century Investments

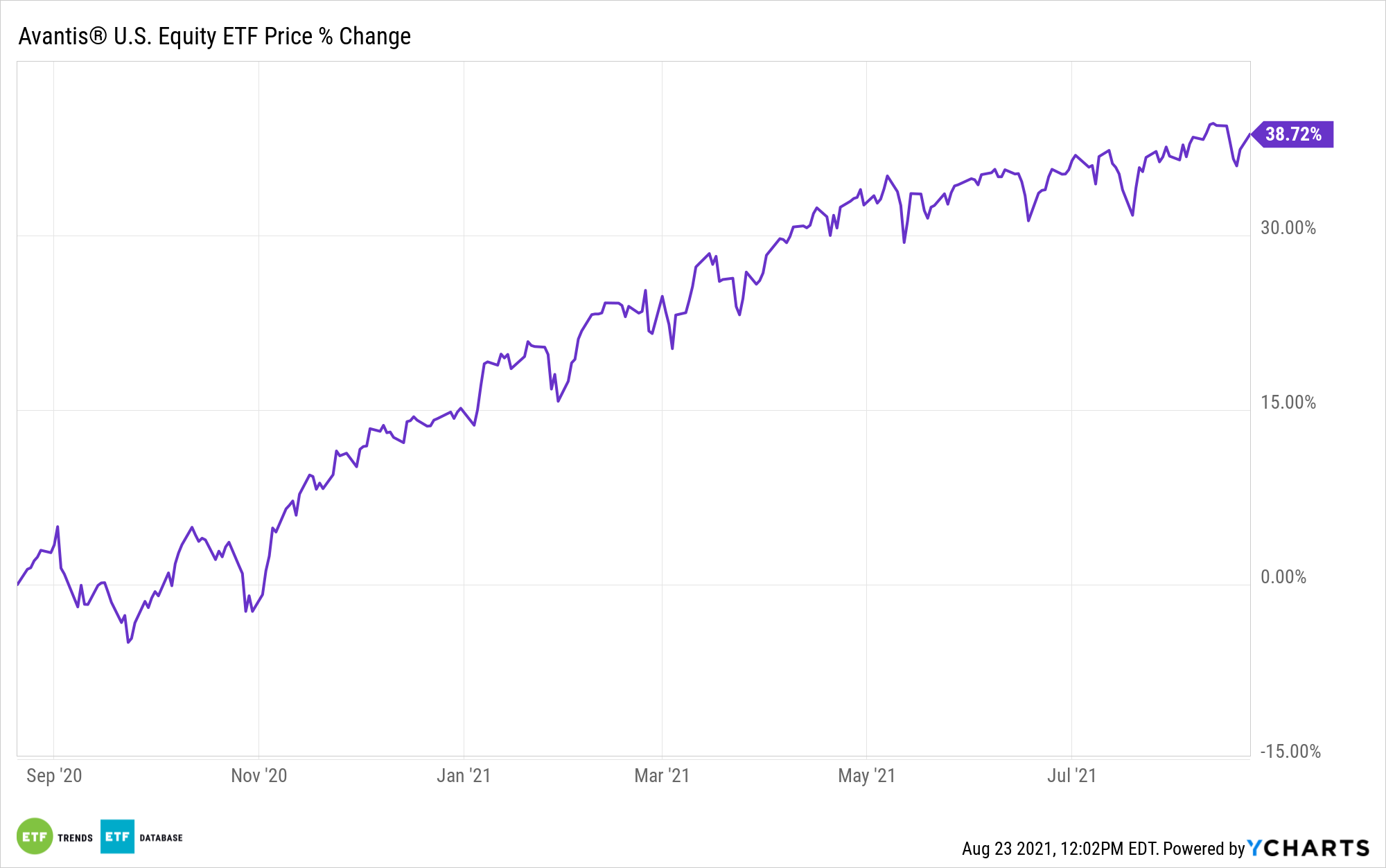

Diversifying exposures generally is a sensible play when markets are unsure, and the Avantis U.S. Fairness ETF (AVUS) gives diversification in spades. The fund is actively managed and invests in U.S. corporations throughout all market caps and sectors, providing publicity to quite a lot of industries.

AVUS is benchmarked to the Russell 3000 Index. It really works by overweighting smaller market cap corporations, excessive profitability corporations, and worth corporations and it underweights or excludes giant cap corporations that supply decrease returns.

The portfolio managers contemplate the financials and market knowledge of corporations when investing, in addition to business classification, the efficiency of a safety in comparison with its friends, in addition to the inventory’s liquidity, float, and tax issues.

As of the tip of July, sector allocations have been info know-how at 22%, financials at 16%, shopper discretionary at 15%, and healthcare and industrials each at 12%, with smaller allocations to different sectors.

AVUS has an expense ratio of 0.15%.

For extra information, info, and technique, go to the Core Methods Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.

www.nasdaq.com