By Matt Wagner, CFA, Affiliate, Analysis

By Matt Wagner, CFA, Affiliate, Analysis

A hen within the hand is value two within the bush.[1]

In investing, this describes traders’ choice for dividends (the hen within the hand) relative to future value appreciation (two within the bush).

Whereas this choice is plain, the affect of dividends on firm valuation represents a fault line between a conventional finance view and a behavioral finance view of markets:

- From a conventional finance standpoint—the place all traders are rational and markets environment friendly—the relevance of dividends on agency valuation may be tenuous as a result of traders ought to be detached between dividends and capital features.

- A behavioral finance perspective offers license to the affect of dividends on agency worth as a result of traders might favor corporations that pay dividends, assigning worth to a gentle payout and thus rising the worth of those firms.

To get a way of how a lot traders care about dividends, take into account this: in keeping with Financial institution of America Analysis, 46% of actively managed fairness fund property is in yield-focused funds, up from lower than 20% in 2010.[2]

In brief, traders—each skilled and retail—care about dividends. Quite a bit.

Modigliani-Miller and Dividend Irrelevance

Franco Modigliani and Merton Miller each gained Nobel prizes partially for his or her “dividend irrelevance” concept.[3] The speculation states that corporations that pay extra in dividends may have much less value appreciation, leading to the identical whole return to shareholders no matter dividend payout.

Whereas the Modigliani-Miller Mannequin has a number of assumptions that don’t essentially maintain up in a real-world setting (no taxes or buying and selling prices, to call two), the creakiest assumption is that traders are detached between dividends and value appreciation.

Since their concept was revealed within the early 1960s, there have been profound adjustments in rates of interest and demographics which have accelerated investor demand for money dividends.

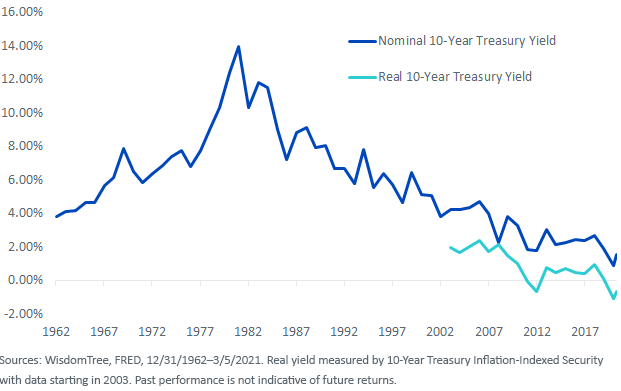

In 1962, the nominal 10-12 months Treasury yield was round 4%. The nominal 10-12 months authorities yield at present is round 1.60% and the true yield is damaging 60 foundation factors.

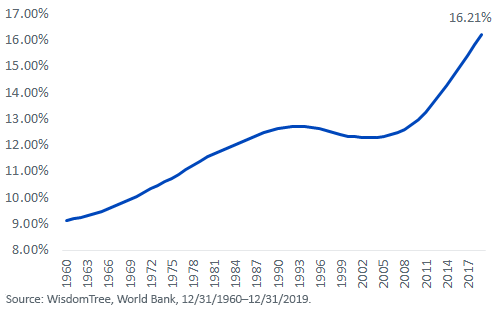

In 1960, 9% of the inhabitants was above 65. In 2019, that portion of the US inhabitants was 16% and steadily climbing every year with the getting older of Child Boomers.

% of US inhabitants above 65

The inhabitants at present has a higher share of retirement-aged people, and inflation-adjusted charges on authorities Treasuries are damaging. This paradox means there are extra retired traders with passive revenue wants at a time when fastened revenue returns after inflation could also be damaging.

However what concerning the notion that traders can promote an equal of shares to fabricate their very own dividend?

Richard Thaler and Psychological Accounting

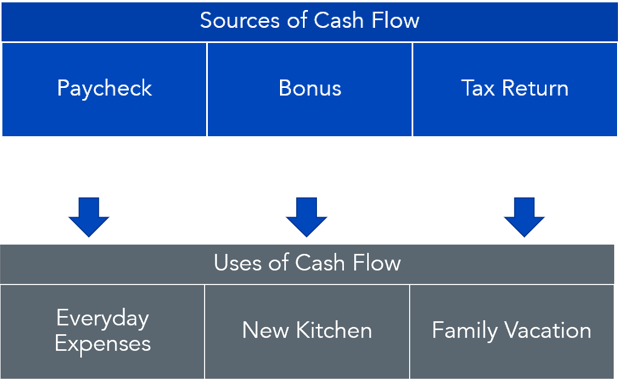

Whereas conventional finance tells us that cash is fungible and all money flows ought to be considered as one account, nearly everybody makes use of some psychological bucketing with their money inflows and outflows.

Richard Thaler gained the 2017 Nobel Prize for his analysis into behavioral economics, which included the examine of what’s known as psychological accounting.[4]

Most individuals use psychological accounts (or buckets) to information their monetary selections. Whereas this isn’t completely rational, these heuristics are how people make sense of complicated life selections.

For a lot of retirees, when their major supply of money movement —a paycheck—goes away, it’s changed by the regular, recurring revenue acquired from dividends and curiosity in a retirement account.

Psychological Accounting Instance

The Dividend Anomaly

So, dividends matter to traders—maybe now greater than ever—even when purely academically talking a dividend may be manufactured by promoting shares.

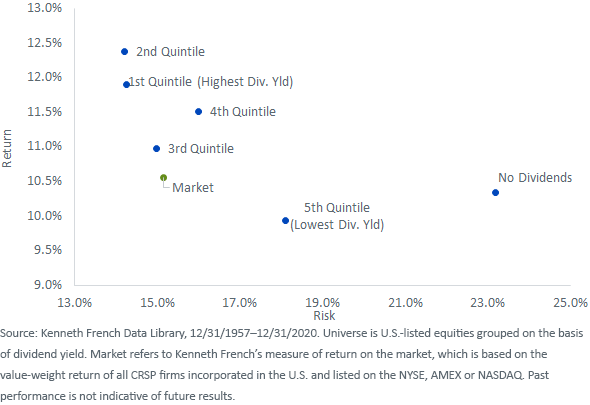

When wanting on the long-term returns and volatility of dividend payers, it is usually clear that an anomaly exists within the outperformance and decrease volatility of upper dividend payers relative to firms that pay low or no dividends in any respect.

Conventional finance concept would say there is no such thing as a justification for this anomaly to persist:

- Keep in mind, dividends ought to be irrelevant to traders versus capital appreciation

- Firms with much less danger ought to have decrease anticipated returns

Behavioral finance offers us an alternate concept to assist the persistence of this outperformance:

- Empirically, traders do care about dividends

- Loss aversion tells us that traders really feel the ache of loss greater than the satisfaction of features. Subsequently, when equities are in a drawdown, traders usually tend to maintain onto excessive dividend shares as a result of they’re nonetheless receiving the dividend and don’t wish to notice a loss.

To be clear—we aren’t implying that dividends are a free lunch. A dividend paid reduces an organization’s money stability and retained earnings from which future investments are funded.

However what is obvious is that over the long term, firms with excessive dividend yields have provided engaging risk-adjusted returns relative to the broader market, and at present’s low-yield surroundings is creating even higher demand for dividend-focused investing.

Dividend Yield Quintiles (1957-2020)

Initially revealed by WisdomTree, 3/9/21

1 The “hen in hand” concept of dividends is attributed to Myron Gordon and John Lintner from the early 1960s. Its detractors confer with it because the “hen within the hand fallacy” as a reminder to traders {that a} dividend paid ought to be related to a value drop.

2 Financial institution of America Analysis, “How Safe Are Your Dividends?” 4/7/20.

3 Merton H. Miller and Franco Modigliani, “Dividend Coverage, Progress and the Valuation of Shares,” The Journal of Enterprise, October 1961, Vol. 34, No. 4, pp. 411-433.

4 Thaler, Richard. “Psychological Accounting Issues,” 1999, Journal of Behavioral Choice Making, 12, 183-206.

U.S. traders solely: Click on right here to acquire a WisdomTree ETF prospectus which comprises funding goals, dangers, costs, bills, and different data; learn and take into account fastidiously earlier than investing.

There are dangers concerned with investing, together with doable lack of principal. Overseas investing entails forex, political and financial danger. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller firms might expertise higher value volatility. Investments in rising markets, forex, fastened revenue and different investments embody extra dangers. Please see prospectus for dialogue of dangers.

Previous efficiency isn’t indicative of future outcomes. This materials comprises the opinions of the writer, that are topic to vary, and may to not be thought-about or interpreted as a advice to take part in any specific buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There is no such thing as a assure that any methods mentioned will work underneath all market situations. This materials represents an evaluation of the market surroundings at a selected time and isn’t meant to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation relating to any safety particularly. The person of this data assumes the whole danger of any use manufactured from the knowledge offered herein. Neither WisdomTree nor its associates, nor Foreside Fund Companies, LLC, or its associates present tax or authorized recommendation. Traders in search of tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly acknowledged in any other case the opinions, interpretations or findings expressed herein don’t essentially signify the views of WisdomTree or any of its associates.

The MSCI data might solely be used to your inside use, might not be reproduced or re-disseminated in any type and might not be used as a foundation for or element of any monetary devices or merchandise or indexes. Not one of the MSCI data is meant to represent funding recommendation or a advice to make (or chorus from making) any sort of funding resolution and might not be relied on as such. Historic knowledge and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI data is offered on an “as is” foundation and the person of this data assumes the whole danger of any use manufactured from this data. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI data (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this data, in no occasion shall any MSCI Get together have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss earnings) or every other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Companies, LLC.

WisdomTree Funds are distributed by Foreside Fund Companies, LLC, within the U.S. solely.

You can not make investments straight in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.