By Kevin Flanagan, Head of Fastened Earnings Technique, WisdomTree

By Kevin Flanagan, Head of Fastened Earnings Technique, WisdomTree

The query of the week in bond-land is, “what’s going to the impression of the ‘blue wave’ be?” In our Market Insights: Planning for Potential 2020 Election Outcomes, WisdomTree provided quite a lot of situations for buyers to contemplate. One such end result was a Democrat sweep, or “blue wave,” whereby the presidency and each homes of Congress can be managed by the Democrat Get together. Final week within the U.S. Treasury (UST) market, this risk started to filter into the dialog—if not the outright pricing mechanism—to a sure diploma.

In our aforementioned election piece, we outlined two attainable outcomes from a “blue wave.” Curiously, they’re considerably polar opposites. In a single state of affairs, a possible increased tax, elevated regulatory surroundings and fewer “business-friendly” setting might lead to slower financial development. Nevertheless, in state of affairs #2, the elimination of gridlock, elevated authorities spending and different extra fiscal stimulus would serve to spice up financial development potential.

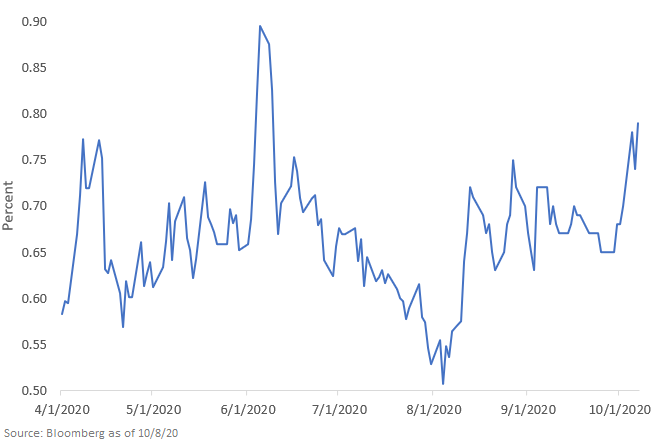

U.S. 10-Yr Treasury Yield

We’ll let the reader determine which of those two situations they agree with, however the one widespread thread amongst them is that “deficit self-discipline” will go utterly out the window. In different phrases, it appears seemingly trillion-dollar deficits for the U.S. will turn out to be the norm.

So how does the UST market view this? Primarily based upon value motion final week, mixed with attendant market commentary, it appeared as if buyers had been coming down on the facet of our state of affairs #2: Elevated authorities spending will result in increased development. Put merely: increased authorities outlays/GDP + rising finances deficits = increased UST 10-year yields. As of this writing, the yield was simply shy of 0.80%, and as you may see from the above graph, this stage has not been penetrated since June.

Oh, and are you aware what else can be a standard thread it doesn’t matter what the election outcomes are? Continued straightforward financial coverage from the Federal Reserve (Fed). However, the essential level is that even when the Fed doesn’t contemplate elevating charges till 2023, UST 10-year yields can nonetheless rise.

Fastened Earnings Answer

If the UST market does embrace our second state of affairs, buyers ought to contemplate a charge hedge inside their fastened earnings portfolio that would additionally probably benefit from a narrowing in credit score spreads, such because the WisdomTree Curiosity Charge Hedged Excessive Yield Bond Fund (HYZD). This technique gives buyers the next key attributes:

- A top quality display for excessive yield (consists of solely public issuers and people with optimistic money circulate)

- The chance for enhanced yield in a traditionally low charge setting

- A “zero-duration charge hedge” technique to probably mitigate the dangers of upper yields

Until in any other case acknowledged, all information sourced is Bloomberg, as of October 9, 2020.

Initially revealed by WisdomTree, 10/14/20

Essential Dangers Associated to this Article

There are dangers related to investing, together with attainable lack of principal. Excessive-yield or “junk” bonds have decrease credit score scores and contain a better threat to principal. Fastened earnings investments are topic to rate of interest threat; their worth will usually decline as rates of interest rise. The Fund seeks to mitigate rate of interest threat by taking brief positions in U.S. Treasuries (or futures offering publicity to U.S. Treasuries), however there isn’t any assure this will probably be achieved. By-product investments will be risky, and these investments could also be much less liquid than different securities, and extra delicate to the results of various financial situations.

Fastened earnings investments are additionally topic to credit score threat, the chance that the issuer of a bond will fail to pay curiosity and principal in a well timed method, or that detrimental perceptions of the issuer’s capacity to make such funds will trigger the value of that bond to say no. The Fund could interact in “brief sale” transactions the place losses could also be exaggerated, probably dropping more cash than the precise price of the funding, and the third celebration to the brief sale could fail to honor its contract phrases, inflicting a loss to the Fund. Whereas the Fund makes an attempt to restrict credit score and counterparty publicity, the worth of an funding within the Fund could change rapidly and with out warning in response to issuer or counterparty defaults and modifications within the credit score scores of the Fund’s portfolio investments. Because of the funding technique of sure Funds, they might make increased capital achieve distributions than different ETFs. Please learn the Fund’s prospectus for particular particulars relating to the Fund’s threat profile.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.