By Frank Holmes How do you even start to visualise $277 tri

By Frank Holmes

How do you even start to visualise $277 trillion?

If we convert it into seconds, 277 trillion is the equal of 8.Eight million years. I’m unsure what was occurring that way back, however I assure you it didn’t contain individuals.

It’s been estimated that Jeff Bezos will increase his internet price by about $321 million a day. At that fee, you’d need to work for near 863,000 days, or 2,364 years, to achieve $277 trillion.

You get the purpose. It’s an unfathomable sum.

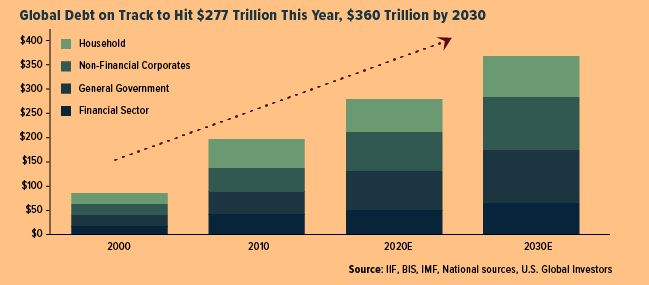

It’s additionally the whole quantity of debt the world is predicted to hit by year-end. That’s in response to the Institute of Worldwide Finance (IIF), whose members embody some 400 banks and monetary companies across the globe.

This yr alone, as of the top of September, the world added $15 trillion to the debt pile, with authorities borrowing accounting for half of the rise, the IIF says. Debt in developed markets is about to hit 432% of gross home product (GDP). For rising markets, it’s nearer to 250%.

By 2030, the IIF estimates, we may very well be $360 trillion in whole debt.

So how did we get right here, and what can traders do to guard their very own wealth?

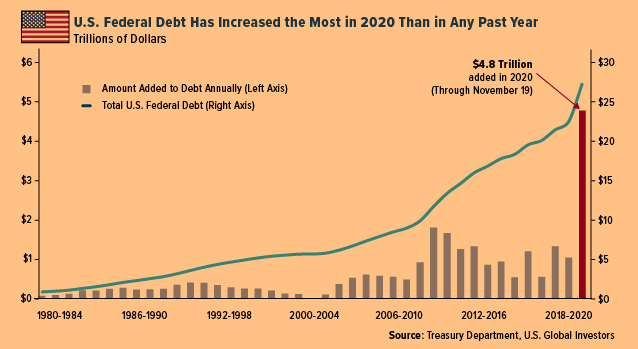

As you could anticipate, the financial fallout from the pandemic has dealt an enormous blow to authorities coffers. Up to now in 2020, the U.S. has added greater than $4.Eight trillion to the federal debt, probably the most ever for a single yr.

This has introduced whole federal debt as much as a report $27 trillion, or 143% of U.S. GDP. Debt per U.S. taxpayer now is available in at a staggering $218,450.

We will’t blame all the things on the pandemic. In accordance with the IIF, the previous 4 years have seen the most important debt buildup on report, with $52 trillion collected since 2016.

What this implies is that, even through the pre-pandemic financial increase years, governments weren’t training sound fiscal administration. Granted, governments weren’t the one contributors to the debt buildup, however they signify an enormous a part of it.

Realizing this, there’s no manner we will fairly anticipate them to get us out of this mess.

“There’s vital uncertainty about how the worldwide economic system can deleverage sooner or later with out vital antagonistic implications for financial exercise,” IIF economists say.

Jared Dillian: Gold Is A Hedge In opposition to Unhealthy Authorities Selections

Final week, Bloomberg printed an article by Jared Dillian, funding strategist at Mauldin Economics.

Within the article, titled “Gold Is a Hedge In opposition to Unhealthy Authorities Selections,” Dillian argues that traders mistakenly consider that gold is a hedge towards inflation and inventory market crashes.

As an alternative, he writes, gold “is a hedge on policymakers screwing up, and there was a number of screwing up within the final 20 years.”

Because the yr 2000, U.S.-denominated gold has surged roughly 555% versus 146% for the S&P 500 Index. The explanation for this, in response to Dillian, is that “considerably looser monetary circumstances” have meant that there are “no constraints on financial and financial coverage.”

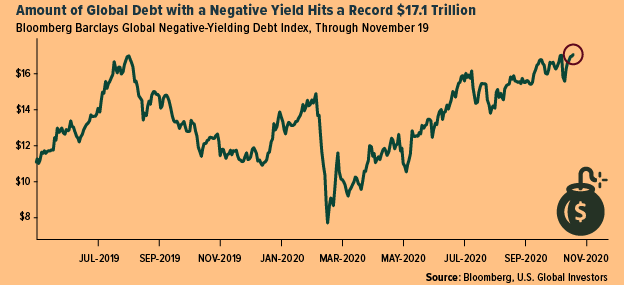

Certainly, the world is caught in a low-rate setting. As of proper now, no 10-year authorities bond in any main economic system in Europe or North America has a yield greater than 1%. A number of nations—together with France, Germany, Sweden, the Netherlands and Switzerland—situation debt with a destructive yield. And that’s the nominal yield, earlier than factoring in inflation.

On Friday, in reality, the quantity of presidency debt all over the world buying and selling with a destructive yield rose to $17.1 trillion, a troubling new report.

Foreign money devaluation is actual, and it’s solely more likely to speed up. In case you’re in search of to guard your loved ones’s wealth towards the failures of governments and central banks, I don’t consider there’s a extra prudent possibility than onerous belongings. That features not simply gold and treasured metals but in addition actual property, housing and, in case you can stand the volatility, cryptocurrencies akin to Bitcoin and Ethereum.

Cryptos at a Almost Three-12 months Excessive

Talking of which, Bitcoin has been on a tear this yr, having climbed nearly 160%. On Friday, the world’s largest digital foreign money by market cap traded above $18,000, hitting its highest for the primary time since December 2017. Ethereum, in the meantime, broke above $500, its highest degree since June 2018.

The distinction between then and now’s that, whereas the 2017 Bitcoin rally was extremely speculative and retail-driven, at present’s surge seems to be propelled by good cash in search of to hedge towards the issues we simply talked about.

That’s the evaluation of ex-hedge fund supervisor Mike Novogratz. Talking to CNBC final week, Novogratz mentioned he believes Bitcoin has “hit escape velocity” because the cryptocurrency enjoys more and more larger demand from institutional traders. He has an end-of-year value goal of $20,000 and sees $60,000 by the top of 2021.

Rising Markets to Outperform in 2021?

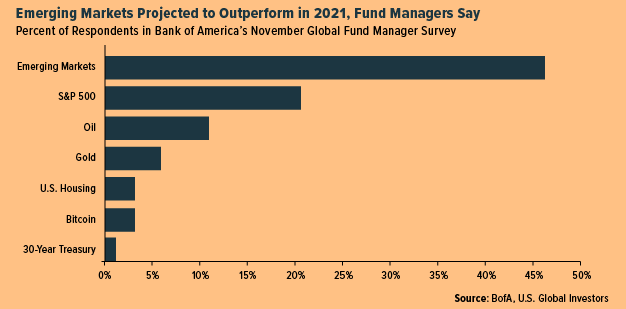

For what it’s price, different fund managers aren’t in settlement with Novogratz. Lower than 5% of these surveyed by Financial institution of America consider Bitcoin will outperform subsequent yr. In the meantime, near half of managers say they consider rising markets are the place to be heading into 2021, forward of the S&P 500, oil and gold.

Buyers are betting {that a} vaccine towards COVID-19 may benefit rising economies probably the most. A weaker U.S. greenback may make rising markets extra aggressive. The U.S. Greenback Index is down greater than 3% year-to-date.

Did You Miss the Mining Expo?

In case you had been one of many many individuals who attended our latest Digital Junior Mining Expo, thanks! The digital occasion, co-hosted by StreetSmart Dwell!, was an enormous success, bringing 10 of probably the most thrilling junior metallic producers to curious traders akin to your self.

For these of you who missed it or wish to watch it once more, a recording is now accessible. Simply click on right here!

Initially printed by U.S. Funds, 11/23/20

The S&P 500 Inventory Index is a well known capitalization-weighted index of 500 frequent inventory costs in U.S. corporations. The U.S. greenback index (USDX) is a measure of the worth of the U.S. greenback relative to the worth of a basket of currencies of the vast majority of the U.S.’s most vital buying and selling companions. Bloomberg Barclays World Mixture Destructive Yielding Debt Index represents the destructive yielding phase of the worldwide funding grade debt from twenty-four native foreign money markets. This multi-currency benchmark consists of treasury, government-related, company and securitized fixed-rate bonds from each developed and rising markets issuers.

All opinions expressed and information supplied are topic to alter with out discover. A few of these opinions might not be acceptable to each investor. By clicking the hyperlink(s) above, you may be directed to a third-party web site(s). U.S. World Buyers doesn’t endorse all info equipped by this/these web site(s) and isn’t accountable for its/their content material.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.