By Solomon G. Teller, CFA, Chief Funding Strategist, Inexperienced Harvest Asset Administration

With the S&P500 index already up 20% this 12 months after gaining 18% in 2020, U.S. fairness traders have been nicely rewarded. By specializing in tax alpha in addition to funding alpha, traders may have elevated their alternatives to carry out even higher than the market.

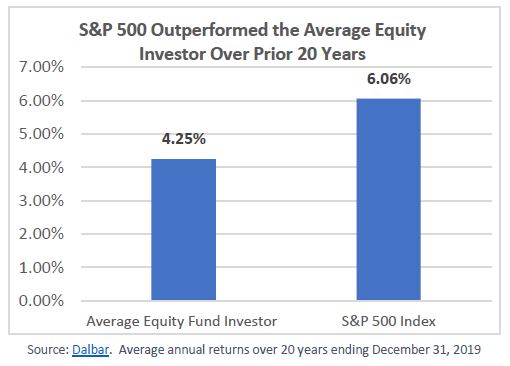

However a current research by Dalbar revealed that the common fairness mutual fund investor has been lagging the U.S. fairness market by over 2% within the first half of 2021. In line with Dalbar, many traders have misplaced out from their tendency to promote funds throughout market declines, solely to then miss out on market rebounds. Their longer-term research states this was a serious purpose that the common fairness fund investor underperformed the S&P500 by 1.81% yearly over the primary 20 years of the millennium – see chart.1

The excellent news is traders could possibly rise above the averages just by adhering to a long run, after-tax funding plan. Make a plan or ask a monetary advisor to assist make you one.

[wce_code id=192]

Disclaimers:

Efficiency quoted represents previous efficiency, which is not any assure of future outcomes. Funding return and principal worth will fluctuate, so you’ll have a achieve or loss when the portfolio is liquidated. Present efficiency could also be greater or decrease than that quoted. Efficiency of an index isn’t illustrative of any specific funding. It isn’t potential to speculate instantly in an index.

GHAM doesn’t present tax recommendation and doesn’t make use of a Licensed Public Accountant on its workers. We work with exterior accounting companies and tax counsel that present steerage and updates on related tax regulation, and we’ve got reviewed the tax remedy of our transaction constructions with these skilled advisors. Based mostly on these evaluations, GHAM is glad that our constructions assist the specified tax outcomes, however we urge shoppers to seek the advice of their very own authorized and tax advisors concerning the tax remedy of the transactions effected of their GHAM account. Such transactions embrace ETFs. Federal, state and native tax legal guidelines are topic to alter. GHAM isn’t liable for offering shoppers updates on any modifications in tax legal guidelines, guidelines or statutes. Purchasers stay absolutely liable for their very own tax positions. Though GHAM doesn’t present tax, authorized or accounting recommendation, we stand prepared to help shoppers and their advisors in reviewing the related tax guidelines.

Causes to reap capital losses, sources of capital beneficial properties and the suggestion that mutual funds distribute capital beneficial properties are for illustrative functions solely. The provision of tax alpha is extremely dependent upon the preliminary date and time of funding in addition to market route and safety volatility through the funding interval. Tax loss harvesting outcomes might range tremendously for shoppers who make investments on completely different days, weeks, months and all different time intervals. A shopper’s tax alpha will rely on the shopper’s particular person circumstances, that are exterior of GHAM’s data and management. All efficiency and tax profit seize figures are derived from knowledge offered from a number of third-party sources. All estimates had been created with the advantage of hindsight and might not be achieved in a stay account. The information obtained by GHAM is unaudited and its reliability and accuracy isn’t assured.

This materials isn’t supposed to be relied upon as authorized, funding or tax recommendation in any type or for any particular shopper. The knowledge offered doesn’t bear in mind the precise aims, monetary scenario or specific wants of any particular individual. All investments carry a sure diploma of danger, and there’s no assurance that an funding will carry out as anticipated over any time frame.

As a comfort to our readers, this doc might comprise hyperlinks to info created and maintained by third celebration websites. Please word that we don’t endorse any linked websites or their content material, and we aren’t liable for the accuracy, timeliness and even the continued availability or existence of this exterior info. Whereas we endeavor to supply hyperlinks solely to these websites which might be respected and protected, we can’t be held liable for the data, services or products obtained from such different websites and won’t be answerable for any damages arising out of your entry to such websites.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com