By Stephen McBride Would you like in on the following nice

By Stephen McBride

Would you like in on the following nice tech revolution? Effectively, it’s occurring earlier than our eyes. However it’s a shift so refined, hardly anybody acknowledges the earnings at stake.

As I’ll present you as we speak, these refined shifts in computing occur as soon as each 20 years or so. Final time, it handed buyers 833% and a couple of,247% good points in just some years. And I’m predicting even larger earnings this time round.

You see, each 20 years or so, computer systems undergo a whole transformation. I’m not speaking about getting just a little quicker or just a little smaller. That occurs nearly daily. I’m speaking a whole change in how computer systems “work.”

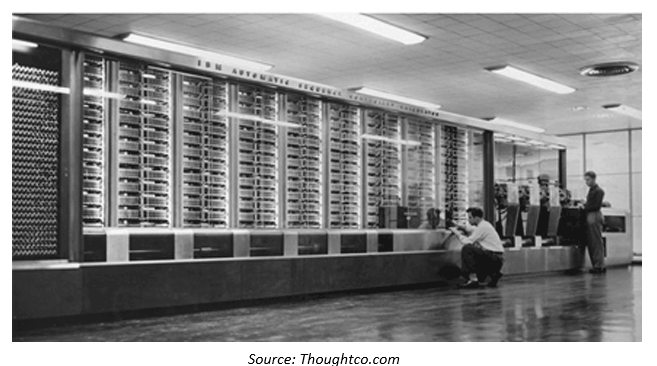

Let me present you. In 1944, IBM engineers constructed the primary “all-purpose” laptop. Weighing in at 10,000 kilos, the Harvard Mark 1 stretched 51 ft. lengthy.

These large “mainframes” are what began all of it. However they have been so large and clunky, they have been confined to science labs. IBM (IBM) pioneered this primary computing wave. And buyers who purchased its inventory in 1960 quadrupled their cash over the following decade.

Then, in 1973, a Harvard drop-out hatched an enormous concept

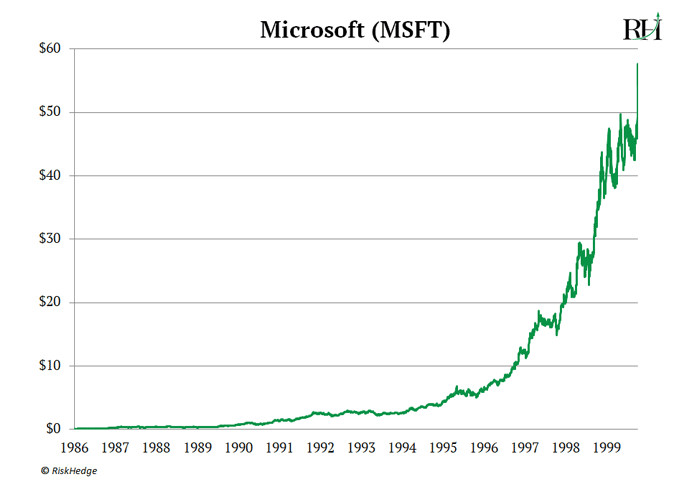

By the early ‘70s, computer systems had superior lots, however they nonetheless had one large drawback. You needed to be a whiz child to make use of one. And this stored them off-limits for atypical Individuals. Invoice Gates based Microsoft (MSFT) in 1975 with the objective of creating computer systems accessible to everybody.

This was the primary main shift in how computer systems “labored.” The private laptop (PC) revolution pulled know-how out of science labs. Computer systems have been now not reserved for geniuses at Harvard and MIT.

For the primary time ever, tech was distributed amongst tens of millions of households and companies. Microsoft led this transformation and handed early buyers 58,000% good points within the course of.

Dozens of others disruptors who led this transformation like Intel, Apple, and Oracle handed buyers many occasions their cash, too.

Then computing shifted once more

Do you know 3.5 billion individuals personal a smartphone as we speak? There are extra computer systems on the earth than ever earlier than. And you are able to do virtually something with these pocket-sized machines. BUT—behind the scenes, how computing “works” has flipped again to the times of 50 foot-long mainframes.

Whenever you hit search on Google, that question isn’t processed by your telephone. As a substitute, it travels by miles of fiber optic wires and right into a warehouse packed stuffed with servers… referred to as an information middle. These servers deal with your request, and ship a trickle of data again to you.

Whether or not you’re listening to music on Spotify, or streaming Netflix, that is how fashionable computing works. Computing has shifted again to a “centralized” mannequin. Smartphones are merely our gateway into the community of big information facilities which might be the “brains” of contemporary computing.

Now you could be pondering, “Stephen, that is such a refined change. Why ought to I even care?” This shift may appear insignificant, but it surely kicked off the “cloud computing” period, one of many biggest moneymaking tendencies in inventory market historical past.

It opened the floodgates for dozens of corporations to faucet into these big information facilities and “stream” their companies over the web. Cybersecurity consultants Okta (OKTA) and Zscaler (ZS) used this trick to internet a fortune for buyers. The truth is, Okta has shot up 833% over the previous three years.

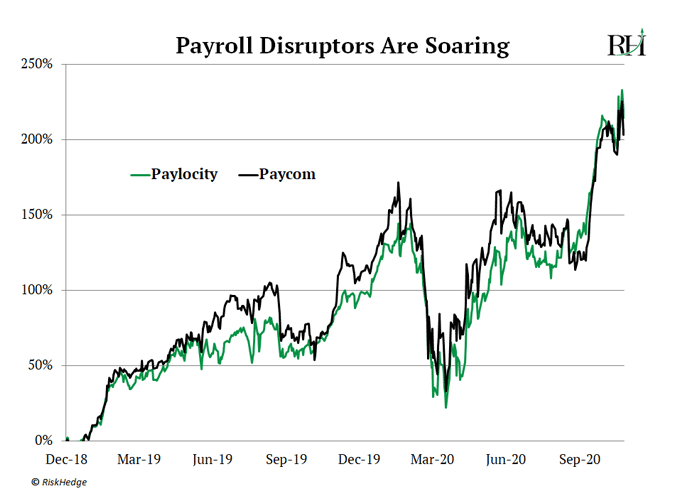

Ditto for corporations promoting boring outdated payroll software program. Paycom (PAYC) has shot up 2,247% since its IPO in 2014. Together with Paylocity (PCTY), they’ve been two of the top-performing shares over the previous couple of years.

We’re on the cusp of the fourth nice computing shift

A community of big information facilities primarily management fashionable computing. This centralized mannequin works high quality for yesterday’s applied sciences. However it’s too sluggish for as we speak and tomorrow’s tech breakthroughs.

Take self-driving automobiles. They have to make lightning-fast, 100% correct choices. If a baby runs throughout the road, the automotive can’t threat even the slightest delay earlier than it applies the brakes. As you may think about, this can be a large drawback if the automotive has to attend for cues from an information middle 500 miles away. Ditto for industries like distant surgical procedure and flying supply drones.

Computer systems are as soon as once more shifting from a centralized, to a distributed manner of working. And edge computing is the important thing.

In brief, edge computing is all about processing information on the spot on the “edge” of the community. It eliminates the necessity to connect with a faraway information middle. For that cause, it’s quicker than “cloud computing” can ever be. Research present it will possibly enhance processing speeds by 30X!

I do know that is all a bit technical. The important thing takeaway is that edge computing makes the “unattainable” potential. Applied sciences like self-driving automobiles, IoT, AR, and the commercialization of 5G won’t ever get off the bottom with out edge computing.

If this large shift is something just like the final one, fortunes are at stake

There aren’t many publicly traded edge computing shares, but. The “purest” one is Fastly (FSLY). Web titans like Google, Shopify, The New York Instances, and electronic mail disruptor Slack pay Fastly for entry to its “edge servers.”

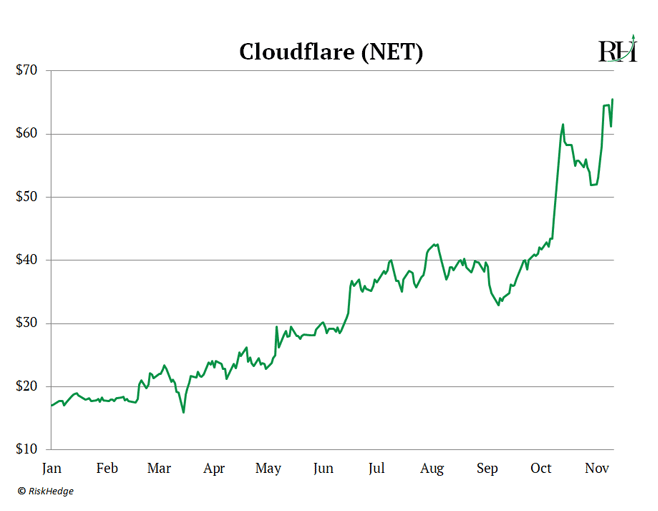

In brief, this permits customers to entry their web sites quicker. Fastly has surged 260% since January. Cloudflare (NET) is one other chief in edge computing. It’s constructed servers in over 200 cities around the globe. And it’s one of many best-performing US shares this 12 months:

Each are nice methods to revenue from edge computing.

The Nice Disruptors: Three Breakthrough Shares Set to Double Your Cash”

Get my newest report the place I reveal my three favourite shares that may hand you 100% good points as they disrupt entire industries. Get your free copy right here.

Initially printed by Mauldin Economics

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.