El Salvador is the smallest nation in Central America, smaller than the Commonwealth of Massachusetts, and but it simply did one thing very massive. This week it turned the world’s first nation to undertake Bitcoin as authorized tender, marking an enormous turning level for the cryptocurrency.

It may additionally probably be a turning level for El Salvador and its residents, 70% of that are unbanked. Anybody with a cellphone may be his or her personal financial institution whenever you add Bitcoin, and luckily for El Salvador, cellular penetration is unusually excessive for such a low-income nation.

Underneath the brand new regulation—which was proposed by President Nayib Bukele Saturday night, close to the top of the Bitcoin 2021 convention in Miami—the U.S. greenback will proceed to be El Salvador’s forex, however all companies will now have to just accept fee in Bitcoin until they lack the expertise to take action.

A standard chorus at Bitcoin 2021 was that Bitcoin “fixes every part.” Though nobody had El Salvador in thoughts, they might as nicely have.

Money Is Trash

Apart from appearing as a retailer of worth—a sort of digital gold, as some have known as it—Bitcoin exists fully outdoors the standard banking system. El Salvador’s central financial institution can not “print” extra Bitcoin; nor can its authorities cease a transaction from taking place.

It’s simple to see why, then, some authoritarian governments have moved to ban or severely limit Bitcoin, China chief amongst them.

It’s additionally simple to see why individuals in poorly managed international locations have had little selection however to make use of Bitcoin to get by. Venezuela, as an illustration, has one of many highest Bitcoin adoption charges on this planet as a result of hyperinflation has destroyed its forex, the bolivar.

The purpose was nicely made: Money is trash. If a considerable chunk of your family wealth is sitting within the financial institution, you’re taking up an enormous threat.At Bitcoin 2021, somebody hauled in a literal dumpster stuffed with 1000’s of 50-bolivar notes, lots of which ended up being scattered throughout the convention grounds like a lot litter. It was jarring to see attendees utterly ignore the paper cash proper underneath their toes as they walked from one panel to the following.

An Unprecedented International Experiment

It’s possible you’ll suppose that hyperinflation and forex debasement are issues that occur solely in third-world international locations, however there’s no motive why it couldn’t occur right here within the U.S., nevertheless unlikely.

Since 1971, when President Richard Nixon formally killed the gold normal, the U.S. greenback has been a wholly free-floating fiat forex, backed by nothing. There’s no restrict to how a lot cash may be created. The identical goes for almost each different forex on this planet.

I don’t suppose sufficient individuals respect the truth that this can be a world financial experiment by no means earlier than seen in historical past. Each different try at utilizing paper cash prior to now has led to catastrophe.

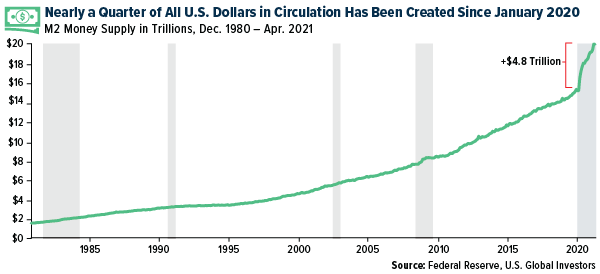

Check out the chart under. Near $5 trillion have been pumped into the U.S. economic system since January 2020 in response to the pandemic. This represents almost 25% of all U.S. {dollars} in circulation. In as little as a 12 months and a half, the dollar has basically misplaced 1 / 4 of its worth.

click on to enlarge

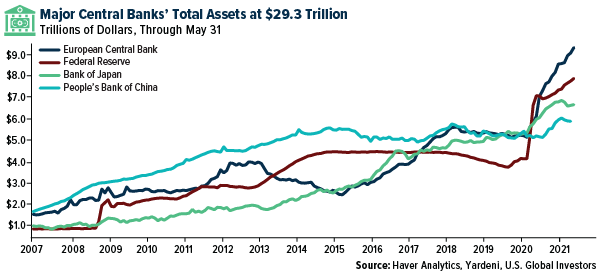

Cash has additionally been created—and diluted—via central banks’ runaway bond buy packages. As of the top of Might, the 4 largest central banks held a staggering $29.three trillion on their steadiness sheets.

click on to enlarge

To borrow the road from above, Bitcoin fixes this. Provide is capped at 21 million cash. As soon as the final Bitcoin is mined, in 2140, there can by no means be any extra. No central banker or finance minister can flip a change and dilute the availability by creating extra Bitcoins. Like several asset, Bitcoin has its personal dangers, however poor financial coverage will not be amongst them.

I hope monetary liberty for El Salvador’s 6.5 million residents was prime of thoughts when President Bukele selected to pursue Bitcoin adoption. His administration has a historical past of corruption, and a few Salvadorans allegedly surprise if the cryptocurrency might be used as simply one other instrument for political achieve and self-enrichment.

So What’s Subsequent?

El Salvador would be the first to undertake Bitcoin, however I don’t consider for a second that it will likely be the final. Politicians in different Latin American international locations, together with Paraguay, Panama and Brazil, have already expressed assist for making the crypto authorized tender.

As for now, El Salvador is on a path to start out mining its personal Bitcoin. On Wednesday, President Bukele mentioned he instructed the president of LaGeo, the nation’s geothermal electrical firm, to “put up a plan to provide amenities for Bitcoin mining with very low-cost, 100% clear, 100% renewable, zero emissions power from our volcanos.”

Inquisitive about studying the way to make investments with model? You could find every part you’re in search of, from the USLUX reality sheet to historic efficiency, by clicking right here.

How cool is that? Volcano-powered Bitcoin.

It goes with out saying that every one eyes might be on El Salvador going ahead. Many Bitcoiners little question hope to see some value appreciation because of President Bukele’s choice, however I’m extra curious to see what Bitcoin can do for El Salvador’s economic system.

Initially printed by US Funds, 6/10/21

All opinions expressed and information supplied are topic to vary with out discover. A few of these opinions is probably not applicable to each investor. By clicking the hyperlink(s) above, you can be directed to a third-party web site(s). U.S. International Buyers doesn’t endorse all data provided by this/these web site(s) and isn’t answerable for its/their content material. Beta is a measure of the volatility, or systematic threat, of a safety or portfolio compared to the market as a complete.

M2 is a measure of the cash provide that features money, checking deposits, and simply convertible close to cash.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.