By Jeff Spiegel, Director, iShares Key takeaways:

By Jeff Spiegel, Director, iShares

Key takeaways:

- Traders are wanting on the 2020 U.S. elections as a catalyst for modifications to overseas coverage and commerce

- Two entrenched funding developments will stay in play whatever the final result: deglobalization and innovation

- These dynamic developments have elevated the significance of worldwide equities in investor portfolios

The end result of the 2020 U.S. elections has potential to usher in main modifications to overseas coverage and commerce.

International traders are watching to see how potential turnover within the White Home and Congress may have an effect on funding danger urge for food within the quick time period and, extra broadly, sway efficiency of worldwide monetary belongings over the long run.

The BlackRock Funding Institute believes {that a} victory by Democratic presidential nominee Joe Biden would probably signify a return to extra predictable overseas coverage and commerce relations, at the same time as it could additionally current some challenges for markets akin to elevated regulation and better U.S. company taxes. Extra predictable commerce coverage may gain advantage export-focused economies together with rising markets. A second time period for President Donald Trump, in contrast, would probably imply a continuation and maybe doubling down of an “America First” stance on commerce and immigration.

Whatever the election final result, the BII sees the U.S.-China rivalry staying structurally elevated, since there’s bipartisan help for a extra aggressive stance on China.

For traders, two notable long-term developments are more likely to be extremely related to worldwide equities nicely past the election: deglobalization and regional innovation.

Deglobalization: a structural pattern

The coronavirus pandemic has had profound results on international enterprise operations and provide chains, finally accelerating the continuing pattern of deglobalization, which refers to a retreat in multinational commerce and funding.

One outcome for traders has been the rising must look internationally for international asset progress that was beforehand accessible by investing in home corporations with strong multinational operations.

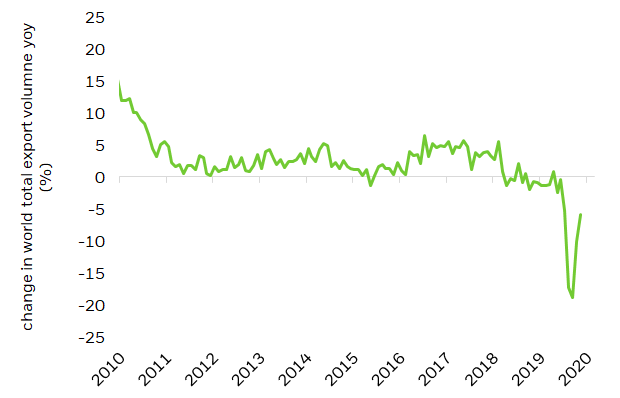

Determine 1: International complete commerce quantity declined since 2016

Supply: Thomson Reuters, as of September 2020

Deglobalization helps to upend assumptions concerning the position of worldwide equities in portfolios. For instance, the rising weight of corporations within the shopper, healthcare and data expertise sectors inside U.S. fairness benchmarks has come on the expense of sectors which can be traditionally correlated with international progress, akin to vitality and supplies. Traders ought to anticipate extra divergent outcomes between the U.S. and worldwide fairness indexes, they usually could more and more must look overseas as a way to really diversify fairness returns.

Innovation is more and more international

Quick-term modifications in home commerce insurance policies are unlikely to change the pattern for extra innovation and entrepreneurship to happen on the worldwide stage.

What are mature, established funding developments within the U.S. usually nonetheless have room to speed up from a decrease start line in less-developed markets, the place native gamers can develop shortly. For instance, progress in e-commerce has been considerably sooner for leaders in Southeast Asia, the place e-commerce penetration continues to be within the single digits versus teenagers in Europe, 27% in China and 18% within the U.S.[1] Because of this, each consumer progress and e-commerce penetration are gaining quickly within the area, a pattern accelerated additional by the COVID-19 lockdown.

A rising center class, coupled with creating infrastructure and elevated numbers of expert staff, may also help generate vital progress potential for enterprise improvements and new applied sciences. World-leading improvements are actually coming exterior of the U.S. in areas akin to industrial automation, funds and renewable vitality. For example, the variety of patents issued in China surpassed the united statesfor the primary time in 2019.[2] In Europe, robotics initiatives funded by Horizon 2020, a European Union research-funding program, have pushed innovation efforts for robotic functions in areas together with manufacturing, transportation and agriculture.[3]

Determine 2: Rising affect

Supply: IMF World Financial Outlook as of April 2020. Market cap relies on the MSCI ACWI Index as of September 2020.

Summing it up

Traders who’re singularly targeted on November to find out their worldwide fairness allocations could also be lacking structural shifts that ought to stay in play no matter which occasion controls the White Home.

The connectedness of world provide chains is in flux, and the epicenters for technological innovation are shifting. These developments will make sure that broad-based worldwide equities will play an more and more important position in portfolios sooner or later.

Associated ETFs:

© 2020 BlackRock, Inc. All rights reserved.

1. U.S. Division of commerce, Euromonitor, OC&C Technique Consultants (as of December 2019).

2. Clarivate Analytics (as of September 2020).

3. The European Union (as of September 2020).

Fastidiously contemplate the Funds’ funding goals, danger elements, and fees and bills earlier than investing. This and different data could be discovered within the Funds’ prospectuses or, if out there, the abstract prospectuses, which can be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Learn the prospectus rigorously earlier than investing.

Investing entails danger, together with potential lack of principal.

Worldwide investing entails dangers, together with dangers associated to overseas forex, restricted liquidity, much less authorities regulation and the potential for substantial volatility as a consequence of opposed political, financial or different developments. These dangers usually are heightened for investments in rising/ creating markets or in concentrations of single nations.

Funds that focus investments in particular industries, sectors, markets or asset courses could underperform or be extra risky than different industries, sectors, markets or asset courses and than the final securities market.

This materials represents an evaluation of the market setting as of the date indicated; is topic to vary; and isn’t supposed to be a forecast of future occasions or a assure of future outcomes. This data shouldn’t be relied upon by the reader as analysis or funding recommendation relating to the funds or any issuer or safety particularly.

The methods mentioned are strictly for illustrative and academic functions and will not be a suggestion, supply or solicitation to purchase or promote any securities or to undertake any funding technique. There is no such thing as a assure that any methods mentioned shall be efficient.

The knowledge offered doesn’t take into accounts commissions, tax implications, or different transactions prices, which can considerably have an effect on the financial penalties of a given technique or funding choice.

This materials comprises normal data solely and doesn’t take note of a person’s monetary circumstances. This data shouldn’t be relied upon as a main foundation for an funding choice. Reasonably, an evaluation needs to be made as as to whether the data is suitable in particular person circumstances and consideration needs to be given to speaking to a monetary skilled earlier than investing choice.

The knowledge offered is just not supposed to be tax recommendation. Traders needs to be urged to seek the advice of their tax professionals or monetary advisors for extra data relating to their particular tax conditions.

The Funds are distributed by BlackRock Investments, LLC (along with its associates, “BlackRock”).

The merchandise referred to herein will not be sponsored, endorsed, or promoted by MSCI Inc. and MSCI Inc. bears no legal responsibility with respect to any such merchandise or any index on which they’re based mostly. The prospectus comprises a extra detailed description of the restricted relationship MSCI Inc. has with BlackRock and any associated merchandise. BlackRock is just not affiliated with MSCI Inc.

©2020 BlackRock, Inc. All rights reserved. iSHARES and BLACKROCK are logos of BlackRock, Inc., or its subsidiaries in the USA and elsewhere. All different marks are the property of their respective homeowners.

ICRMH1120U-1377536

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.