By Rebecca Felton SUMMARY

By Rebecca Felton

SUMMARY

- Going into the election, we’ve got trimmed some danger.

- We’re sustaining our desire for US progress shares.

- With so many uncertainties, we acknowledge the significance of staying versatile.

Our Portfolio Positioning Going into the Election

Usually, after we take into consideration the phrase end result, it could actually evoke a way of an finish or finale of kinds. Whereas Election Day 2020 has lastly arrived, we imagine the story of the markets is ongoing. As we flip the calendar from November third to November 4th, we mark the top of a chapter in an excellent longer story, however it’s not the top of the story. Whatever the voting outcomes on Election Day 2020, we’re seeing basic financial drivers unfolding that may very well be constructive for fairness markets forward. Residents and companies are beginning to perceive learn how to ‘dwell with’ COVID-19 and financial exercise is slowly returning to regular.

- We imagine there may be an financial restoration underway as indices monitoring exercise in each manufacturing and companies are trending greater.

- Shopper exercise is rebounding as evidenced in confidence knowledge, shopper web value, and retail gross sales.

- Housing traits are again to pre-pandemic ranges and builder sentiment is at an all-time excessive.

- Company earnings are rebounding sooner than anticipated and ahead steerage is changing into extra encouraging than discouraging.

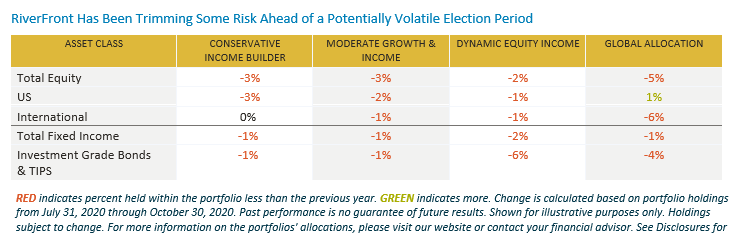

Moderately than ready to see who will reside at 1600 Pennsylvania Avenue on Inauguration Day, we’ve got continued to depend on our course of to find out portfolio positioning all through 2020. In our opinion, equities stay probably the most enticing asset class for progress over the long run and our portfolios are positioned accordingly. Nevertheless, over the previous three months Riverfront has been trimming some fairness danger within the face of latest all-time highs within the US market, and what we understand to be a risky post-election interval. The chart under summarizes the adjustments we’ve got made on the asset class ranges over the previous three months in our balanced methods. These actions have been a mixture of danger administration choices in addition to superb tuning choice with the addition of extra particular person equities.

We favor equities over fastened revenue: We acknowledge that US fairness valuations are elevated, however we imagine these valuations can keep elevated given the shortage of alternate options. Given the start line for yields and spreads, we imagine equities provide the very best prospects for progress over the long run.

We desire US over worldwide: Worldwide equities – each developed and rising – provide comparatively extra enticing valuations when in comparison with US equities, in our view. Nevertheless, we acknowledge that the US financial system was the strongest on the planet forward of the pandemic, and present financial knowledge traits counsel additionally it is the strongest developed area as we emerge from the downturn.

We’ve the next diploma of confidence in high quality and progress over cyclicality and worth: All through 2020, there have been transient durations of rotation away from progress and in direction of worth. Typically, these durations have been introduced on by hopes of a vaccine or therapeutic for COVID-19 and the prospect for added authorities stimulus. As COVID-19 instances have begun to extend and stimulus talks seem indefinitely stalled, an enduring rotation has did not materialize. Whereas we’ve got barely elevated our exposures to worth and cyclicality within the longer horizon methods over the previous few months, we’re unlikely to materially enhance these allocations till we get a greater sense the financial restoration is on stable footing.

US sector preferences:

- We stay obese expertise with an emphasis on software program and companies owing to our perception that the expansion cycle for these firms has accelerated as society gravitates to higher use of expertise to facilitate working from residence.

- We additionally favor areas inside shopper discretionary which might be COVID-19 restoration performs and beneficiaries of stimulus, corresponding to residence enchancment and multi-channel (bodily and digital) retail.

- Inside industrials, we’ve got bumped up publicity to sub-industries that play into infrastructure spending as both a Democratic or Republican Administration will possible embark on excessive ranges of infrastructure spending with a view to help our financial system.

- Inside well being care, we favor medical units over giant cap prescription drugs as a result of potential drug-price laws.

We’ve a barbell strategy to fastened revenue positioning: Our major exposures inside fastened revenue at this juncture embrace shorter-to-intermediate funding grade company bonds. Moreover, we maintain longer-term US Treasuries to behave as a buffer towards fairness volatility. In our longer horizon methods, we’ve got added publicity to ‘fallen angels’ (bonds which have not too long ago been downgraded under funding grade) as we imagine the mix of financial and monetary help may very well be considered as backstops for firms that fall below this class.

Tactical Danger Administration: Although the S&P 500 is roughly 8% under its September 2nd file excessive the first development as outlined by the 200-day transferring common continues to be rising. In our opinion, the pullback over the previous three weeks has taken the S&P right down to what we might think about a minimal retracement of its rally from March’s bear market low. Up to now, we imagine this can be a comparatively gentle pullback within the context of a bull market. As might be seen within the chart (under), S&P 500 ranges (blue line) we’re watching embrace help round 3240 (September’s low) after which 3050. We’d watch for a decisive break of those ranges earlier than changing into extra cautious.

![]()

Maybe the starkest lesson discovered in 2020 is extra a reminder – all the time be prepared for the sudden and regulate portfolio positioning when our course of suggests it’s crucial. We imagine the danger administration element of our funding course of allows us to navigate by way of unsure durations in search of to cut back and take away the burden of feelings. From a technical perspective our workforce has recognized value ranges that may set off danger administration. Moreover, there are a bunch of basic components corresponding to, extended election uncertainty, an sudden downturn in company earnings, or weakening in financial knowledge; that would additionally result in a course correction.

Backside Line: With so many uncertainties, we acknowledge the significance of staying versatile over the following few months.

Initially printed by RiverFront Funding Group

Essential Disclosure Info

Opinions expressed are present as of the date proven and are topic to vary. Previous efficiency will not be indicative of future outcomes and diversification doesn’t guarantee a revenue or shield towards loss. All investments carry some degree of danger, together with lack of principal. An funding can’t be made straight in an index.

Chartered Monetary Analyst is knowledgeable designation given by the CFA Institute (previously AIMR) that measures the competence and integrity of economic analysts. Candidates are required to cross three ranges of exams overlaying areas corresponding to accounting, economics, ethics, cash administration and safety evaluation. 4 years of funding/monetary profession expertise are required earlier than one can change into a CFA charterholder. Enrollees in this system should maintain a bachelor’s diploma.

Info or knowledge proven or used on this materials was acquired from sources believed to be dependable, however accuracy will not be assured.

This report doesn’t present recipients with data or recommendation that’s enough on which to base an funding resolution. This report doesn’t have in mind the precise funding aims, monetary scenario or want of any explicit consumer and is probably not appropriate for every type of traders. Recipients ought to think about the contents of this report as a single think about investing resolution. Extra basic and different analyses could be required to make an funding resolution about any particular person safety recognized on this report.

ASSET CLASS WEIGHTINGS AS OF 10/30/20

| ASSET CLASS | CONSERVATIVE INCOME BUILDER | MODERATE GROWTH & INCOME | DYNAMIC EQUITY INCOME | GLOBAL ALLOCATION | |

| Whole Fairness | 30.17 | 49.88 | 70.04 | 78.36 | |

| US | 30.17 | 42.05 | 45.64 | 52.26 | |

| Worldwide | 7.83 | 24.4 | 26.1 | ||

| Whole Mounted Revenue | 63.25 | 43.11 | 21.8 | 12.48 | |

| Funding Grade Bonds & TIPS | 63.25 | 43.11 | 17.06 | 9.39 | |

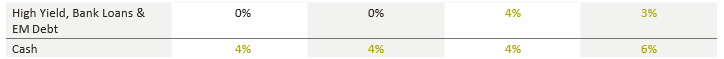

| Excessive Yield, Financial institution Loans & EM Debt | 0.00 | 0.00 | 3.83 | 3.07 | |

| Money | 6.58 | 7.01 | 8.16 | 9.18 |

Methods in search of greater returns and thereby higher allocations to equities can even carry greater dangers and be topic to a higher diploma of market volatility. Allocations topic to vary. Supply: RiverFront. Money is included within the weighting for fastened revenue. The portfolio weights and statistics proven above are primarily based on RiverFront’s Benefit individually managed accounts (SMA) solely. They don’t mirror different RiverFront portfolios or UMA/MDP fashions. Whereas our SMAs and fashions for UMAs and MDPs could have comparable funding weightings, there could also be variations between the fashions; as such, there will likely be variations within the present portfolio weights/statistics in precise consumer accounts.

In a rising rate of interest atmosphere, the worth of fixed-income securities typically declines.

The 200-day transferring common is a well-liked technical indicator which traders use to research value traits. It’s merely a safety’s common closing value during the last 200 days.

Shares characterize partial possession of an organization. If the company does properly, its worth will increase, and traders share within the appreciation. Nevertheless, if it goes bankrupt, or performs poorly, traders can lose their total preliminary funding (i.e., the inventory value can go to zero). Bonds characterize a mortgage made by an investor to an organization or authorities. As such, the investor will get a assured rate of interest for a particular time frame and expects to get their unique funding again on the finish of that point interval, together with the curiosity earned. Funding danger is compensation of the principal (quantity invested). Within the occasion of a chapter or different company disruption, bonds are senior to shares. Traders ought to pay attention to these variations previous to investing.

Know-how and internet-related shares, particularly of smaller, less-seasoned firms, are usually extra risky than the general market.

Investments in worldwide and rising markets securities embrace publicity to dangers corresponding to foreign money fluctuations, international taxes and laws, and the potential for illiquid markets and political instability.

Investing in international firms poses further dangers since political and financial occasions distinctive to a rustic or area could have an effect on these markets and their issuers. Along with such basic worldwide dangers, the portfolio can also be uncovered to foreign money fluctuation dangers and rising markets dangers as described additional under.

Adjustments within the worth of foreign currency echange in comparison with the U.S. greenback could have an effect on (positively or negatively) the worth of the portfolio’s investments. Such foreign money actions could happen individually from, and/or in response to, occasions that don’t in any other case have an effect on the worth of the safety within the issuer’s residence nation. Additionally, the worth of the portfolio could also be influenced by foreign money alternate management laws. The currencies of rising market international locations could expertise vital declines towards the U.S. greenback, and devaluation could happen subsequent to investments in these currencies by the portfolio.

International investments, particularly investments in rising markets, might be riskier and extra risky than investments within the U.S. and are thought of speculative and topic to heightened dangers along with the overall dangers of investing in non-U.S. securities. Additionally, inflation and fast fluctuations in inflation charges have had, and should proceed to have, adverse results on the economies and securities markets of sure rising market international locations.

When referring to being “obese” or “underweight” relative to a market or asset class, RiverFront is referring to our present portfolios’ weightings in comparison with the composite benchmarks for every portfolio. Asset class weighting dialogue refers to our Benefit portfolios. For extra data on our different portfolios, please go to www.riverfrontig.com or contact your Monetary Advisor.

Index Definition:

Commonplace & Poor’s (S&P) 500 Index measures the efficiency of 500 giant cap shares, which collectively characterize about 80% of the whole US equities market.

RiverFront Funding Group, LLC (“RiverFront”), is a registered funding adviser with the Securities and Change Fee. Registration as an funding adviser doesn’t suggest any degree of ability or experience. Any dialogue of particular securities is supplied for informational functions solely and shouldn’t be deemed as funding recommendation or a suggestion to purchase or promote any particular person safety talked about. RiverFront is affiliated with Robert W. Baird & Co. Included (“Baird”), member FINRA/SIPC, from its minority possession curiosity in RiverFront. RiverFront is owned primarily by its workers by way of RiverFront Funding Holding Group, LLC, the holding firm for RiverFront. Baird Monetary Company (BFC) is a minority proprietor of RiverFront Funding Holding Group, LLC and subsequently an oblique proprietor of RiverFront. BFC is the dad or mum firm of Robert W. Baird & Co. Included, a registered dealer/supplier and funding adviser.

To overview different dangers and extra details about RiverFront, please go to the web site at www.riverfrontig.com and the Type ADV, Half 2A. Copyright ©2020 RiverFront Funding Group. All Rights Reserved. ID 1393372

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.