By Rebecca Felton, Senior Market Strategist, RiverFront Funding Group

Trying Forward to 2022 with ‘Real looking Optimism’

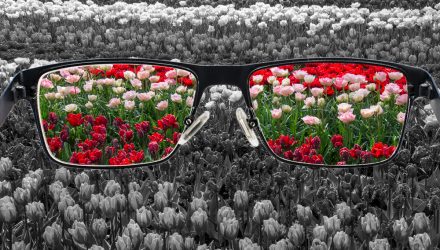

Inventory valuations are pushed by future expectations. That mindset proved helpful to fairness buyers who have been keen to look in the direction of the long run with optimistic expectations for a re-opened world and the resultant financial restoration. They’ve been rewarded with constructive returns over the previous twelve months, however now that we’re in restoration mode, what comes subsequent? Our Three Tactical Guidelines* form our view as we glance out over the following ninety days. Trying long run, nonetheless, we additionally contemplate many qualitative inputs to assist inform determination making. No one in every of these, individually, is sufficient to immediate a choice. Our views on these variables, mixed with our tactical alerts, inform portfolio positioning. Listed below are a few of the themes we’re watching now.

*Our Three Tactical Guidelines are: “Don’t Struggle the Fed,” “Don’t Struggle the Development,” and “Watch out for the Crowd at Extremes”.

[wce_code id=192]

We’re inspired by:

The robust restoration in S&P 500 company earnings

Each earnings reporting interval for the reason that onset of the pandemic has been marked by above consensus outcomes, however none higher than these of the primary quarter of 2021. Over 400 corporations within the index have reported, and 86% of these have had constructive earnings surprises. Revenues have additionally are available in above expectations. In keeping with FactSet, the blended development charge for the quarter might be virtually 50% 12 months over 12 months. The sector with the best development for the quarter is Shopper Discretionary with industries similar to vehicles, attire, and specialty retail main the way in which. For calendar 12 months 2021, earnings for the S&P 500 are actually projected to develop at a year-over-year charge of 32% and revenues are estimated to extend by roughly 11%. Whereas company earnings are solely one in every of a number of monetary elements used to gauge an organization’s efficiency, first quarter outcomes give a way of the magnitude of the progress for the reason that depths of the pandemic shutdown.

A wholesome client

We place quite a lot of emphasis on the buyer as a result of client spending is roughly 70% of US GDP (Gross home product) . Shopper sentiment indicators are actually trending increased. Stimulus checks have contributed to the well being of client steadiness sheets. Information from the Federal Reserve Financial institution of New York reveals that, on common, shoppers have saved about one-third of the monies obtained, used roughly one-third of it to pay down debt, and spent the rest. That spending has translated right into a rebound in retail gross sales with March retail gross sales rising virtually 10% (illustrated in chart beneath) owing to purchases on vehicles, attire, and sporting gear. Moreover, the advance within the classes of eating places and bars in addition to different meals and beverage providers is proof of the pent-up demand for a return to regular. We count on these developments to proceed as we transfer into the summer time months and extra restrictions are lifted.

Previous efficiency isn’t any assure of future outcomes. Proven for illustrative functions. Not indicative of RiverFront portfolio efficiency.

The strong housing market

Within the March eighth version of the Weekly View, entitled Housing is an Necessary Key to Financial Progress…Happily it’s Getting Again on Observe, we mentioned the significance of the housing market as a barometer for the US economic system. We consider the mixture of favorable demographics, low relative rates of interest for the foreseeable future, and the developments in the direction of elevated office flexibility bode properly for future gross sales developments. There’s additionally proof that power within the housing market can translate into increased ranges of client spending and investments. Financial research have proven shoppers who buy houses additionally spend cash on home-related sturdy items in addition to elevated expenditures on residence enhancements and upkeep. Add within the elevated employment alternatives afforded by new residence building, and we see it as pure to conclude {that a} strong housing market is sweet for the economic system.

Bettering employment developments

The employment restoration has been uneven and small companies have been disproportionately negatively impacted as a consequence of lockdown restrictions and an incapability to rent certified staff. This was evidenced by April’s non-farm payroll report, which was in need of expectations by over 700,000 jobs. Whereas the unemployment charge remains to be excessive when in comparison with the pre-pandemic low of three.5%, the drop from its excessive within the mid-teens in April 2020 to the latest report of 6.1% reveals vital progress in the fitting path. Throughout the previous week, there was extra encouraging information because it pertains to small companies. The Paychex/IHS Markit Small Enterprise Jobs Index elevated in April by over 4% and is now again to the pre-pandemic peak seen in February 2020. The information within the Paychex/IHS report mirrored that as extra companies have resumed common operations and vaccines have turn out to be extra extensively obtainable, development is bettering throughout a few of the all-important providers sectors similar to building and leisure and hospitality.

An unwavering Federal Reserve

Because the US economic system recovers, Wall Road watches intently for indicators that the Federal Reserve goes to blink because it pertains to a change the present accommodative stance. At a press convention following the discharge of the latest FOMC assertion, Chairman Jerome Powell said, “It’s not time but” when requested a couple of potential change in coverage. With over eight million fewer US jobs now, versus previous to the pandemic, he famous that it’ll take time to achieve their objective.

We’re Involved by:

Indicators of inflation

Usually, administration feedback round present circumstances and future expectations play a extra outstanding position throughout earnings reporting season than the precise outcomes. Now we have been watching intently for warnings relating to the damaging impression of upper company taxes, however that has not materialized to this point. As a substitute, the phrase used with growing frequency is inflation as enter prices have been steadily rising. Individually, Treasury Secretary Janet Yellen lately fueled considerations over inflation by saying, “It could be that rates of interest should rise considerably to guarantee that our economic system does not overheat, despite the fact that the extra spending is comparatively small relative to the dimensions of the economic system.” Fairness markets reacted negatively to Secretary Yellen’s feedback prompting her to reiterate her assist of the Fed’s independence in setting rate of interest coverage.

COVID-19 developments

Within the US, COVID-19 case numbers, hospitalizations, and fatalities have trended decrease. Nonetheless, in international locations similar to Japan and India, the present developments are damaging as instances and fatalities climb. There are fears that new variants are overwhelming vaccination efforts. Some international locations have needed to impose lockdowns once more. Feedback by Japanese authorities officers have even forged doubt over the upcoming Olympic video games in Tokyo. Regardless of the encouraging statistics within the US, the director of the C.D.C stated in mid-April that she was “actually anxious concerning the rollbacks of restrictions in some states” citing the brand new variants and the ‘stall’ within the decline of latest instances. The priority is that we might lose floor within the combat in opposition to the virus.

International tensions

Right now, geopolitical tensions are simmering on a number of fronts. Worries about China deploying warplanes in Taiwanese airspace, Russia’s latest army buildup on the Ukrainian border, and North Korea’s umbrage over President Joe Biden’s remarks relating to that nation’s nuclear arsenal have created conditions on a number of fronts that require monitoring. Making an attempt to quantify these kinds of tensions will be troublesome, however what we all know is that uncertainty can create nervousness for buyers. At present, markets are signaling an absence of concern round these points, and we consider that complacency alone requires us to look at every of those conditions for doubtlessly damaging developments.

Above common valuation

In keeping with Factset, US Giant Cap equities are buying and selling at valuation ranges which can be above their 5 and ten-year averages however then rates of interest are properly beneath these averages, making shares extra engaging on a relative foundation. We mentioned valuations within the February 16 Weekly View, Valuations Are Elevated…. And That Is Okay in Our View. At the moment, the worth/earnings a number of for the S&P 500 was 22x ahead earnings. Since that publication, the index has appreciated by about 7% and the ahead value/earnings a number of nonetheless stands at 22x. Now we have grown into the a number of, so to talk, as earnings have exceeded expectations. To reiterate, markets are ahead trying. Above common valuations are a situation, not essentially a catalyst for inventory costs to show decrease. Nonetheless, the earnings development in 2022 is unlikely to fulfill or exceed that of 2021. As beforehand famous, FactSet forecasts 2021 earnings development for the S&P 500 to be 32%. Consensus for 2022 is for development to be within the low double-digits. We query whether or not above-average valuations are warranted if the speed of earnings development decelerates subsequent 12 months – even whether it is being measured in opposition to the extraordinary tempo for this 12 months. The time period ‘headwind’ is showing extra often in ahead trying Wall Road technique items as 2022 comes extra clearly into view. We consider it’s cheap to consider this 12 months’s charge of restoration is not going to be matched going ahead. The slowdown within the charge of development could also be exacerbated by the anticipated modifications to the company tax construction.

Conclusion:

As a result of shares have risen so quick in such a brief time period, one in every of our three guidelines (Watch out for the Crowd at Extremes) is suggesting warning. For that cause, we predict that shares might make little progress over the following few months because the political rhetoric over President Biden’s spending and tax plans heats up. Nonetheless, as we glance to the second half of 2021 and into 2022, we predict the robust financial and earnings restoration will outweigh present considerations, and shares will probably be increased a 12 months from now.

Necessary Disclosure Info

The feedback above refer typically to monetary markets and never RiverFront portfolios or any associated efficiency. Opinions expressed are present as of the date proven and are topic to vary. Previous efficiency is just not indicative of future outcomes and diversification doesn’t guarantee a revenue or defend in opposition to loss. All investments carry some stage of danger, together with lack of principal. An funding can’t be made immediately in an index.

Chartered Monetary Analyst is an expert designation given by the CFA Institute (previously AIMR) that measures the competence and integrity of economic analysts. Candidates are required to cross three ranges of exams masking areas similar to accounting, economics, ethics, cash administration and safety evaluation. 4 years of funding/monetary profession expertise are required earlier than one can turn out to be a CFA charterholder. Enrollees in this system should maintain a bachelor’s diploma.

Info or knowledge proven or used on this materials was obtained from sources believed to be dependable, however accuracy is just not assured.

This report doesn’t present recipients with info or recommendation that’s adequate on which to base an funding determination. This report doesn’t bear in mind the precise funding aims, monetary state of affairs or want of any explicit consumer and will not be appropriate for every type of buyers. Recipients ought to contemplate the contents of this report as a single think about investing determination. Extra basic and different analyses can be required to make an funding determination about any particular person safety recognized on this report.

In a rising rate of interest surroundings, the worth of fixed-income securities typically declines.

Investing in international corporations poses extra dangers since political and financial occasions distinctive to a rustic or area might have an effect on these markets and their issuers. Along with such basic worldwide dangers, the portfolio can also be uncovered to forex fluctuation dangers and rising markets dangers as described additional beneath.

Adjustments within the worth of foreign currency in comparison with the U.S. greenback might have an effect on (positively or negatively) the worth of the portfolio’s investments. Such forex actions might happen individually from, and/or in response to, occasions that don’t in any other case have an effect on the worth of the safety within the issuer’s residence nation. Additionally, the worth of the portfolio could also be influenced by forex trade management laws. The currencies of rising market international locations might expertise vital declines in opposition to the U.S. greenback, and devaluation might happen subsequent to investments in these currencies by the portfolio.

International investments, particularly investments in rising markets, will be riskier and extra unstable than investments within the U.S. and are thought-about speculative and topic to heightened dangers along with the final dangers of investing in non-U.S. securities. Additionally, inflation and speedy fluctuations in inflation charges have had, and will proceed to have, damaging results on the economies and securities markets of sure rising market international locations.

Shares symbolize partial possession of a company. If the company does properly, its worth will increase, and buyers share within the appreciation. Nonetheless, if it goes bankrupt, or performs poorly, buyers can lose their complete preliminary funding (i.e., the inventory value can go to zero). Bonds symbolize a mortgage made by an investor to a company or authorities. As such, the investor will get a assured rate of interest for a particular time period and expects to get their authentic funding again on the finish of that point interval, together with the curiosity earned. Funding danger is compensation of the principal (quantity invested). Within the occasion of a chapter or different company disruption, bonds are senior to shares. Traders ought to pay attention to these variations previous to investing.

Definitions: Don’t Struggle the Fed – ‘Supportive’ means the Fed’s financial coverage relating to inflation and employment is in what we consider based mostly on our evaluation to be the buyers’ greatest curiosity; ‘In opposition to’ means the Fed’s financial coverage, in our view, goes in opposition to the buyers’ greatest curiosity; ‘Impartial’ means the Fed’s financial coverage is neither supportive or in opposition to the buyers’ greatest curiosity in our view. Don’t Struggle the Development – Phrases correlate to the 200-day shifting common because it pertains to the fairness indexes: ‘Constructive’ implies that the pattern is rising, ‘Flat’ means the pattern is flat, ‘Unfavourable’ means the pattern is falling. Beware the Crowd at Extremes – Phrases correlate to the NDR Crowd Sentiment Ballot and its measurement of Excessive Optimism (Bearish), Impartial, or Excessive Pessimism (Bullish).

Index Definitions:

Customary & Poor’s (S&P) 500 Index TR USD (Giant Cap) measures the efficiency of 500 massive cap shares, which collectively symbolize about 80% of the whole US equities market.

The Paychex | IHS Markit Small Enterprise Employment Watch attracts from the payroll knowledge of roughly 350,000 Paychex shoppers to gauge small enterprise wage and employment developments on a nationwide, regional, state, metro, and business foundation.

RiverFront Funding Group, LLC (“RiverFront”), is a registered funding adviser with the Securities and Alternate Fee. Registration as an funding adviser doesn’t indicate any stage of ability or experience. Any dialogue of particular securities is offered for informational functions solely and shouldn’t be deemed as funding recommendation or a advice to purchase or promote any particular person safety talked about. RiverFront is affiliated with Robert W. Baird & Co. Included (“Baird”), member FINRA/SIPC, from its minority possession curiosity in RiverFront. RiverFront is owned primarily by its staff by RiverFront Funding Holding Group, LLC, the holding firm for RiverFront. Baird Monetary Company (BFC) is a minority proprietor of RiverFront Funding Holding Group, LLC and due to this fact an oblique proprietor of RiverFront. BFC is the dad or mum firm of Robert W. Baird & Co. Included, a registered dealer/vendor and funding adviser.

To overview different dangers and extra details about RiverFront, please go to the web site at www.riverfrontig.com and the Type ADV, Half 2A. Copyright ©2021 RiverFront Funding Group. All Rights Reserved. ID 1641890

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.