By Jeremy Schwartz, CFA, International Head of Analysis; Kara Marciscano, CFA, Senior Analysis Anal

By Jeremy Schwartz, CFA, International Head of Analysis; Kara Marciscano, CFA, Senior Analysis Analyst

In 2006, WisdomTree launched its first household of basically weighted Indexes, difficult the market capitalization-weight established order.

Allocating weights based mostly on dividends or earnings challenged the environment friendly market speculation by suggesting that rebalancing to fundamentals may improve returns. Our basically weighted various helps handle valuation danger inherent to cap-weighted methods that give shares with increased multiples increased weights and permit these shares to run with out rebalancing on relative worth.

We weight our Home Core Fairness Indexes by earnings as a result of we imagine it will possibly decrease the price-to-earnings (P/E) ratios—a key metric for guiding danger and returns expectations.

Our crew is devoted to analysis and new components to enhance methods, and our Home Core Fairness household has included an additional layer of danger discount. The enhancements purpose to restrict publicity to outlying firms whose earnings could not mirror increased danger and decrease high quality.

The Core of Our Home Core Fairness Household Is Unchanged

Our Home Core Fairness household, which incorporates the WisdomTree U.S. LargeCap, MidCap and SmallCap Indexes, present broad earnings-weighted publicity to worthwhile U.S. firms.

The annual rebalancing mechanism nonetheless resets weights based mostly on the idea of relative worth, which helps keep a decrease P/E ratio, and to make sure traders don’t overpay—a subject of significance given the market’s current run.

Implementing New Threat Constraints

Our danger constraints marry basic and technical analyses—using earnings, high quality and value data—to offer a extra balanced view than a single metric alone.

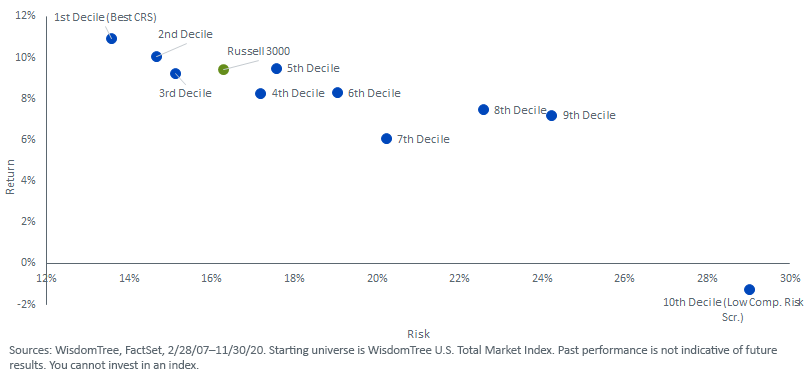

Shares (worthwhile or not) are ranked throughout two distinct U.S. universes, separated by measurement right into a large-/mid-cap group and a small-cap group. The shares rating within the backside 10%, or the worst decile, are excluded from our core fairness Indexes, eliminating publicity to firms indicated to be decrease high quality, decrease momentum and better danger.

WisdomTree U.S. Complete Market Index – CRS Deciles – Threat/Return Traits (2/28/2007 – 11/30/2020)

- Lively Sector Constraints – Along with our current 25% sector cap, we’re introducing +/- 5% energetic sector constraints. This implies sector weights will probably be restricted inside 5% of the sector publicity of a market capitalization-weighted model of our core fairness Indexes.

- Particular person Safety Constraints – We’re limiting the diploma to which our core fairness Indexes will be over-/under-weight in particular person securities. Relative to the market capitalization-weighted model of our core fairness Indexes, the burden of an eligible firm will probably be equal to or between 0.33x and 3x its market cap weight.

2020 Rebalance Outcomes

In mid-December, our Home Core Fairness Indexes accomplished their annual reconstitution.

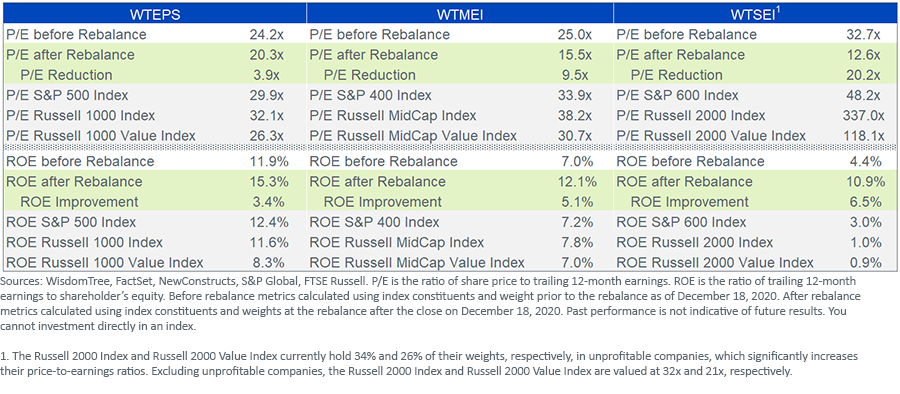

P/E ratios have been decreased throughout the core household for the 14th consecutive 12 months, and all Indexes are at present priced at important reductions to their benchmarks.

As supposed, the mix of earnings weighting and the exclusion of the worst-ranking CRS decile leads to our core Indexes exhibiting high-quality traits, with mixture return on fairness (ROE) above their benchmarks.

2021 Positioning

2020 was a banner 12 months for costly, unprofitable shares. Adverse earners and the best P/E shares inside the Data Expertise (e.g., cloud computing shares Twilio +244% and DocuSign +200%), Client Discretionary (e.g., Overstock +580%, Tesla +743%, Etsy +302%) and Communication Providers (e.g., Pinterest +253%) sectors have been the top-performing subsets of the Russell 3000 Index.[1]

In response to Bloomberg, the 502 unprofitable and cash-burning firms inside the Russell 3000 Index have returned 40.6% year-to-date, whereas the common return of the subset of firms with constructive earnings and money move was solely 15.6% on common.[2]

These teams benefited from the “stay-at-home commerce” on the expense of cyclical shares linked to the reopening of the U.S. financial system.

However that could be altering.

Since September 2020, worth outperformed development by 5.3%, as worthwhile and lower-valuation Financials, Utilities and Supplies shares rebounded.[3]

Trying forward into 2021, these valuation-sensitive, earnings-weighted methods are higher positioned for the reopening of the U.S. financial system than their market capitalization-weighted friends, they usually deliver good valuations to spice up.

Initially revealed by WisdomTree, 1/6/21

1 Sources: WisdomTree, FactSet, for the interval 12/31/19–12/31/20. As of December 31, 2020, WTEPS, WTMEI and WTSEI didn’t maintain Twilio, DocuSign, Overstock or Tesla. As of December 31, 2020, WTEPS held a 0.02% of its whole weight in Etsy.

2 Sophie Caronello, “It’s Worthwhile to Be Unprofitable in a Boon for DoorDash: Chart,” Bloomberg, 12/9/20. https://blinks.bloomberg.com/information/tales/QL3DSHT1UM1D. Accessed 12/18/2020.

3 As measured by the efficiency of the Russell 3000 Worth Index and the Russell 3000 Development Index for the interval August 30, 2020 to December 31, 2020.

U.S. traders solely: Click on right here to acquire a WisdomTree ETF prospectus which accommodates funding targets, dangers, prices, bills, and different data; learn and think about rigorously earlier than investing.

There are dangers concerned with investing, together with doable lack of principal. International investing entails forex, political and financial danger. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller firms could expertise better value volatility. Investments in rising markets, forex, fastened earnings and various investments embrace further dangers. Please see prospectus for dialogue of dangers.

Previous efficiency will not be indicative of future outcomes. This materials accommodates the opinions of the creator, that are topic to vary, and may to not be thought-about or interpreted as a suggestion to take part in any specific buying and selling technique, or deemed to be a proposal or sale of any funding product and it shouldn’t be relied on as such. There isn’t a assure that any methods mentioned will work beneath all market circumstances. This materials represents an evaluation of the market atmosphere at a particular time and isn’t supposed to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation concerning any safety particularly. The person of this data assumes the complete danger of any use product of the data supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Providers, LLC, or its associates present tax or authorized recommendation. Buyers searching for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly said in any other case the opinions, interpretations or findings expressed herein don’t essentially characterize the views of WisdomTree or any of its associates.

The MSCI data could solely be used in your inner use, might not be reproduced or re-disseminated in any kind and might not be used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI data is meant to represent funding recommendation or a suggestion to make (or chorus from making) any type of funding determination and might not be relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI data is supplied on an “as is” foundation and the person of this data assumes the complete danger of any use product of this data. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI data (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this data, in no occasion shall any MSCI Celebration have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss earnings) or every other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Providers, LLC.

WisdomTree Funds are distributed by Foreside Fund Providers, LLC, within the U.S. solely.

You can not make investments straight in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.