Coffee futures and associated trade traded notes jumped on Monday as one other spherical of poor climate forecasts threatened to weigh on an already-stressed crop outlook in Brazil, the world’s greatest espresso producer.

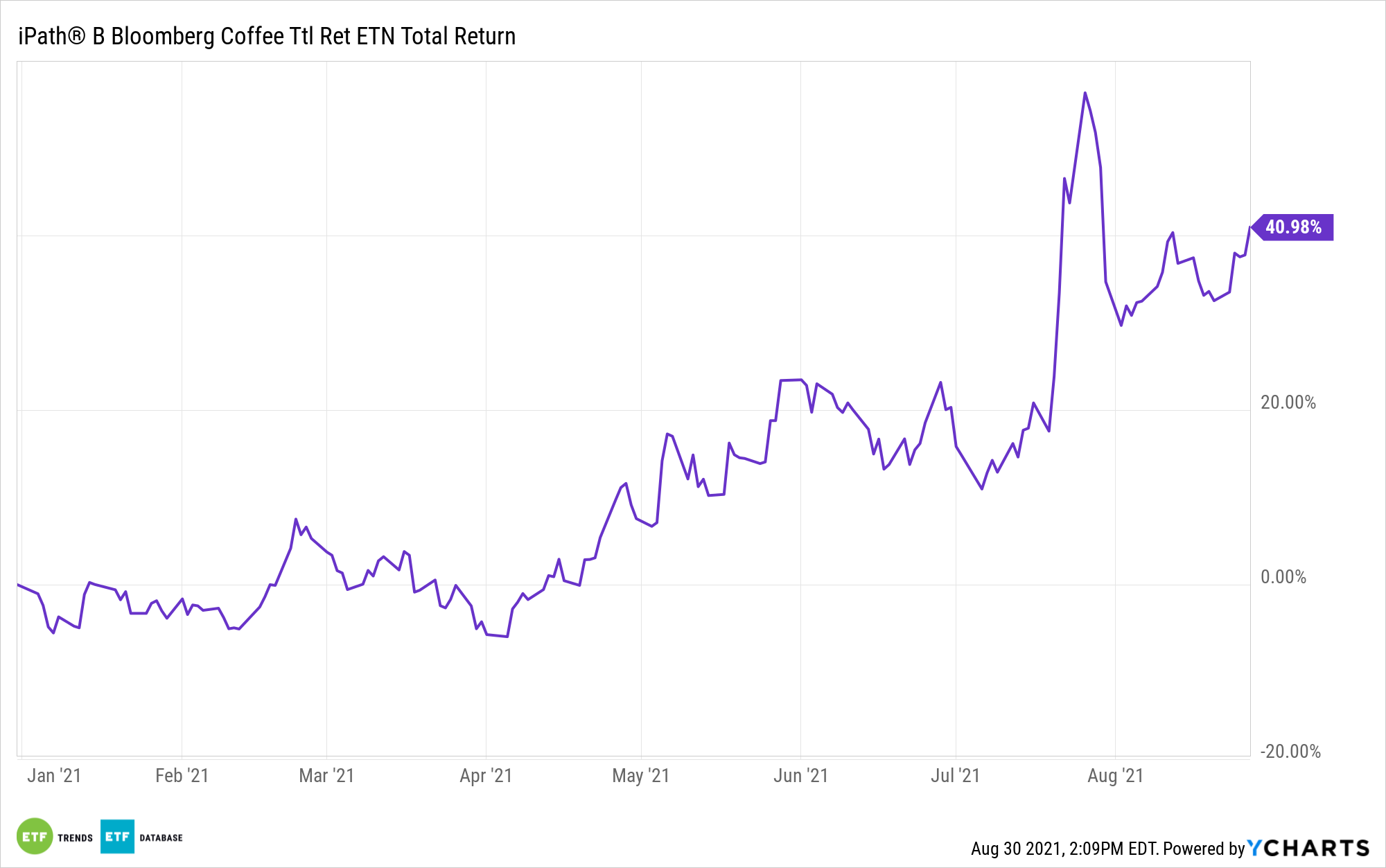

The iPath Sequence B Bloomberg Espresso Subindex Whole Return ETN (NYSEArca: JO) elevated 4.4% Monday and was up 41.0% year-to-date. In the meantime, ICE Espresso “C” futures gained 4.0% to $1.999 per pound.

Whereas weekend rains helped convey some moisture to the drought-stricken central areas of Brazil, together with Mato Grosso do Sul, elements of Parana, and Sao Paulo, Donald Keeney, senior meteorologist for Maxar Applied sciences Inc warned in Bloomberg that the the rainfall didn’t unfold out to Minas Gerais, the highest coffee-growing area.

Moreover, main arabica crop areas in Sao Paulo and Minas additionally face dry climate circumstances and above-average temperatures over the following two weeks, in response to Somar Meteorologia.

Costs on arabic espresso, which is the favored bean for a lot of corporations like Starbucks Corp, have surged this 12 months resulting from a devastating drought that has decimated the crop outlook in Brazil for 2021.

“The primary driver is Brazil’s forecast,” Hernando de la Roche, senior vice chairman for StoneX Monetary Inc., informed Bloomberg. “It will stay a climate marketplace for the following few weeks,” at the very least till the everyday arrival of the wet season by the second half of September.

Moreover, merchants are weighing the crop outlook towards the potential unfavorable impression of COVID-19 variants on the financial system and demand, de la Roche added.

This is not the one climate drawback that Brazil’s espresso producers have needed to deal with. Widespread frosts have beforehand hit Brazil’s espresso areas and appeared to have decimated the next 12 months’s Brazilian espresso manufacturing outlook. Farmers and merchants had been counting on the 2022 harvest to assist get better the low stockpiles after a drought prompted a considerably smaller crop.

As well as, too many cloudy days have stunted progress in espresso crops throughout Columbia, the second-biggest exporter of arabica. COVID-related lockdowns are additionally weighing on export flows out of Vietnam, the largest exporter of robusta beans traded on London exchanges.

For extra data on the commodities market, go to our commodity ETFs class.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially mirror these of Nasdaq, Inc.

www.nasdaq.com