The financial institution inventory story is well-documented this yr. Amid a rally in worth shares and a spike by 10-year Treasury yields, financial institution shares and trade traded funds, together with the Invesco KBW Financial institution ETF (NASDAQ: KBWB), are again with a vengeance.

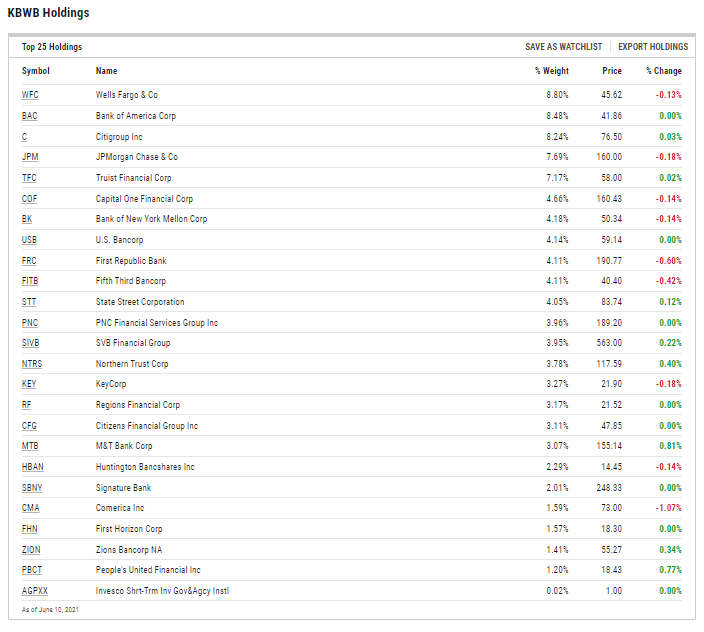

KBWB, which tracks the KBW Nasdaq Financial institution Index, is larger by 32.45% year-to-date. A giant transfer like that in lower than six months could suggest upside from right here is proscribed, however that is probably not the case.

Outcomes of the Federal Reserve’s annual stress checks on the biggest U.S. banks are due out on June 24 and expectations are that the Fed will log off on banks boosting dividends and restarting share repurchase packages.

“Analysts are optimistic concerning the trade’s efficiency on this yr’s stress checks and the prospects for banks to pay capital again to shareholders,” experiences Carleton English for Barron’s. “The full capital return for banks may hit $200 billion over the subsequent 4 quarters, in keeping with Barclay’s analyst Jason Goldberg. He expects that the whole yield for the sector shall be roughly 8.5% with 2.6% from dividends and 5.8% from buybacks.”

A Optimistic Turnabout for KBWB

As of June 11, KBWB sported a dividend yield of 1.96%. If the Barclays forecast is correct and financial institution dividend yields develop by means of elevated payouts, there’s some potential upside on that metric for KBWB.

That is a doubtlessly optimistic reversal from 2020 when the Fed prevented banks from elevating dividends whereas forcing them to halt buyback plans amid the coronavirus pandemic. The central financial institution additionally pressured monetary establishments to put aside huge quantities of money to cowl bitter loans on expectations that the pandemic would create a deeper recession, resulting in a wave of shopper defaults.

In the end, that state of affairs did not arrive, and with the good thing about hindsight, buyers now know that loads of KBWB holdings may have boosted dividends final yr if the Fed would have allowed it. It stays to be seen if banks will play dividend catch-up this yr, nevertheless it’s clear there’s room to spice up payouts.

“Based mostly solely on their comparatively low payout ratios in 2019 in addition to in a difficult 2020, the next banks could have essentially the most room to raise their dividends this yr: Financial institution of America (ticker: BAC), Citigroup (C), Fifth Third (FITB), JPMorgan Chase (JPM), M&T Financial institution (MTB), and Zions Bancorporation (ZIONS),” in keeping with Barron’s.

These shares mix for about 30% of KBWB’s weight. Buyers have added $748 million in new capital to the fund year-to-date.

For extra information, data, and technique, go to the Nasdaq Portfolio Options Channel.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.