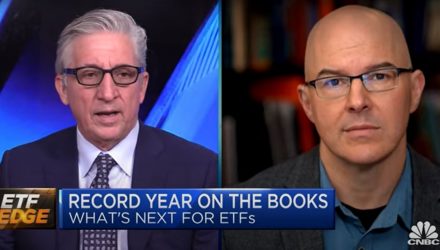

Starting this new yr on "ETF Edge," ETF Developments CIO and Director of Analysis, Dave Nadig, join

Starting this new yr on “ETF Edge,” ETF Developments CIO and Director of Analysis, Dave Nadig, joins host Bob Pisani, and Harry Whitton, Head of ETF Gross sales Buying and selling for Previous Mission, to go over ESG inflows in thematic ETFs in 2020, and the way that can have an effect on issues going ahead in 2021.

Nadig begins by explaining how 2020 was a file yr, with over $500 billion in new cash flowing into the ETF business and over 300 new funds for traders to commerce in — common thematic or actively managed funds, if not one thing ESG-related. That stated, there are steps to take subsequent.

He continues, “I do assume people are somewhat extra involved about threat administration. However, thematic ETFs are, for certain, right here to remain. We have all seen this Okay-shaped restoration, and the way it’s actually nominated winners and losers available in the market, and traders and advisories are on the market making an attempt to actually discover these winners.”

Accounting For Conversion

Turning to Whitton, who’s requested in regards to the traits for lively non-transparent ETFs and the conversion of mutual funds into ETFs, he states how issues went from zero to 20 non-transparent funds by the tip of 2020, and 2021 is just going to see a larger enhance.

So far as conversion, Whitton notes how a number of companies, together with Dimensional, are going by means of this course of on plenty of mutual funds. Dimensional, specifically, goes to vary 6 funds with over $20 billion in property.

“This has plenty of potential within the market to see many property being moved rapidly,” Whitton explains.

He continues, “They had been telling individuals actively, they need to transfer their mutual fund share class to the ETF share class. They’ve somewhat bit completely different construction than a conventional ETF, and that is what they’re doing.”

When contemplating how important this conversion course of could possibly be so far as the impact on ETF inflows, Whitton sees there’s a probability of this being large. Not in retirement plans, however different property can have plenty of wealth to share round.

Watch Dave Nadig And Harry Whitton Focus on ETF Themes For 2021:

For extra market traits, go to ETF Developments.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.