By Michael Venuto, Co‑founder & CIO, Toroso Investments

By Michael Venuto, Co‑founder & CIO, Toroso Investments

This weekend, many households obtained a listing from Amazon that includes vacation stickers, images of kids’s presents/toys, and a web page to draft a want listing. This daring advertising scheme intelligently omitted one key side that catalogues of the previous couldn’t: the costs for these items. The a number of ironies and brilliance of this catalogue are thoughts blowing. First, Amazon in some ways has changed the bodily e-book with digital textual content, however is now sending a bodily buying expertise to entice patrons who’re unaware of costs. Moreover, this catalogue is harking back to the 300-page mailman assassins that Sears and Toys “R” Us despatched in October of earlier a long time. These brick and mortar shops are actually nearly out of date, thanks partially to Amazon.

Developments in Affect

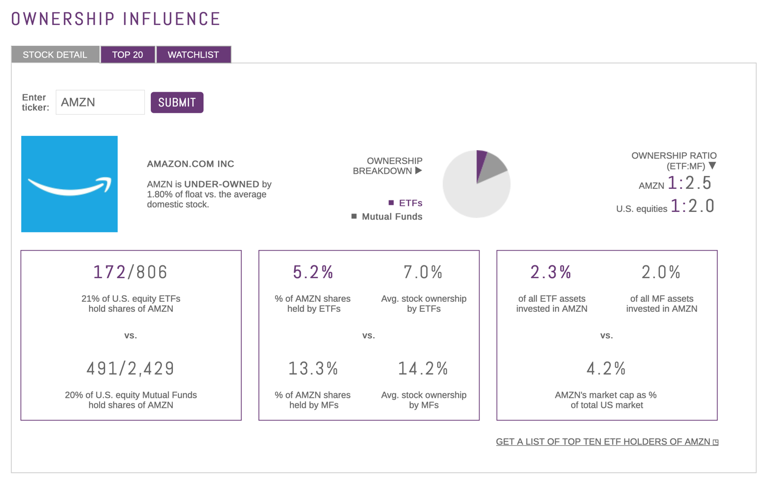

Placing these ironies apart, on the ETF Suppose Tank, now we have mentioned the influence of COVID-19 on the economic system and its acceleration of mega-trend adoption in themes like digital funds, on-line retail, blockchain and different Work From Anyplace themes. In at the moment’s analysis be aware, we discover the connection between Amazon inventory and the ETF ecosystem. We start with passive affect; ETFs personal 5.2% of the excellent share of AMZN, which is considerably beneath the 7.0% common for many US equities. The ETF influences on AMZN are additionally a lot lower than the 13.3% of the shares held by mutual funds. These statistics from the ETF Suppose Tank’s software program recommend that AMZN just isn’t materially impacted by ETF flows or buying and selling.

The Amazon Playlist

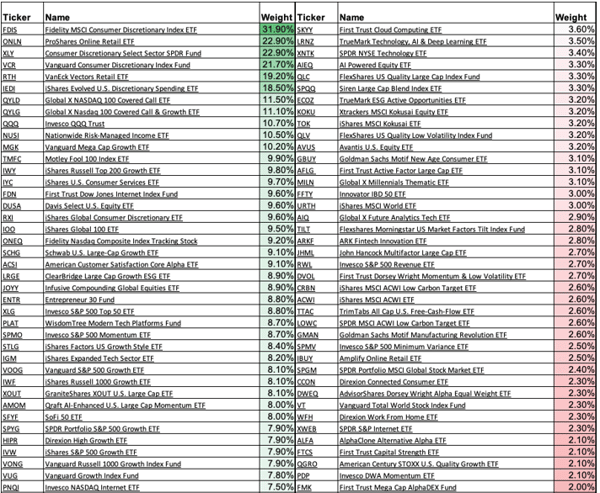

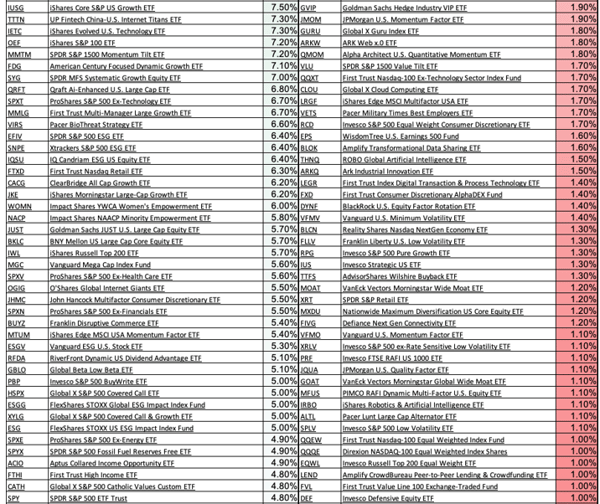

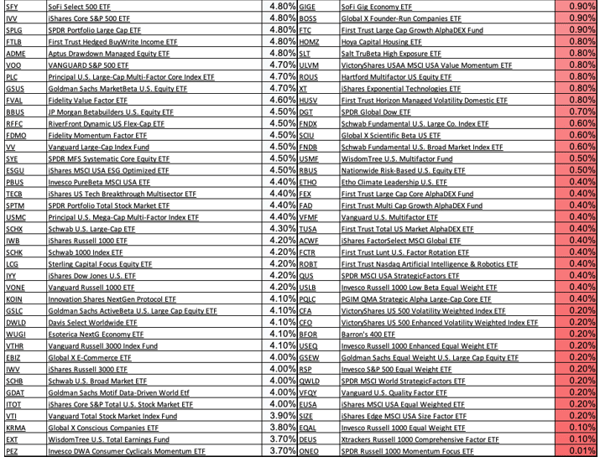

Regardless of being under-owned by ETFs as a proportion of market cap, AMZN is owned by 244 unlevered ETFs. The listing beneath, from ETF Analysis Middle, exhibits the weights and publicity. The listing is sort of lengthy, so we are going to present a abstract of the highlights of AMZN focus. The most important weights are in shopper discretionary ETFs, with allocations over 30%. The second largest allocation is in ProShares On-line Retail ETF (ONLN) with 22.9% which market cap weights the theme of Retail eCommerce. Lara Crigger from ETF.com not too long ago posted some nice evaluation on the ONLN and a aggressive fund Amplify On-line Retail ETF (IBUY). Regardless of vital variations in focus and index building, each of those funds are up over 89% in 2020.

[wce_code id=192]

Most traders in all probability assume Amazon is a know-how firm; not in response to sector ETFs, however it’s round 10% weight within the Invesco QQQ Belief (QQQ). From a method perspective, most development ETFs have AMZN as a sizeable weight. By way of elements, most multifactor funds are uncovered, but additionally many high quality and low volatility issue ETFs allocate to AMZN. Subsequent comes ESG, with nearly common attraction to exclusionary funds like Xtrackers S&P 500 ESG ETF (SNPE), Influence Shares NAACP Minority Empowerment ETF (NACP), and SPDR S&P 500 ESG ETF (EFIV), but additionally funds that search good company actors, like Goldman Sachs JUST U.S. Massive Cap Fairness ETF (JUST) and International X Acutely aware Corporations ETF (KRMA). Lastly, many thematic ETFs have publicity past the apparent web and on-line retail performs; $AMZN is current in 5G ETFs, Gig Financial system, Fintech, cloud computing and all 4 blockchain centered funds.

Talking of blockchain, be part of our Get Suppose Tanked digital comfortable hour this Thursday, October 22 at 5 pm EST to talk with Brian Estes, and get his distinctive views on all issues crypto, bitcoin and blockchain associated.

Initially revealed by ETF Suppose Tank, 10/21/20

Disclosure

The knowledge supplied right here is for monetary professionals solely and shouldn’t be thought-about an individualized suggestion or customized funding recommendation. The funding methods talked about right here is probably not appropriate for everybody. Every investor must evaluation an funding technique for his or her personal specific state of affairs earlier than making any funding determination.

All expressions of opinion are topic to vary with out discover in response to shifting market circumstances. Knowledge contained herein from third social gathering suppliers is obtained from what are thought-about dependable sources. Nonetheless, its accuracy, completeness or reliability can’t be assured.

Examples supplied are for illustrative functions solely and never meant to be reflective of outcomes you’ll be able to count on to realize.

All investments contain threat, together with attainable lack of principal.

The worth of investments and the revenue from them can go down in addition to up and traders could not get again the quantities initially invested, and will be affected by adjustments in rates of interest, in alternate charges, normal market circumstances, political, social and financial developments and different variable elements. Funding includes dangers together with however not restricted to, attainable delays in funds and lack of revenue or capital. Neither Toroso nor any of its associates ensures any price of return or the return of capital invested. This commentary materials is out there for informational functions solely and nothing herein constitutes a suggestion to promote or a solicitation of a suggestion to purchase any safety and nothing herein must be construed as such. All funding methods and investments contain threat of loss, together with the attainable lack of all quantities invested, and nothing herein must be construed as a assure of any particular consequence or revenue. Whereas now we have gathered the knowledge introduced herein from sources that we consider to be dependable, we can’t assure the accuracy or completeness of the knowledge introduced and the knowledge introduced shouldn’t be relied upon as such. Any opinions expressed herein are our opinions and are present solely as of the date of distribution, and are topic to vary with out discover. We disclaim any obligation to offer revised opinions within the occasion of modified circumstances.

The knowledge on this materials is confidential and proprietary and is probably not used aside from by the meant consumer. Neither Toroso or its associates or any of their officers or workers of Toroso accepts any legal responsibility in any way for any loss arising from any use of this materials or its contents. This materials is probably not reproduced, distributed or revealed with out prior written permission from Toroso. Distribution of this materials could also be restricted in sure jurisdictions. Any individuals coming into possession of this materials ought to search recommendation for particulars of and observe such restrictions (if any).

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially replicate these of Nasdaq, Inc.