By Blake Heimann

One of many well-known variations between bitcoin and ether is the truth that ether doesn’t have an specific cap on provide, whereas the variety of bitcoins in circulation won’t ever exceed 21 million. This provide restrict attributes bitcoin its present major funding case as a result of its perceived retailer of worth. This is without doubt one of the few conclusions that has reached some degree of consensus within the funding group given the nascence of crypto property. So, what does this imply for those who wouldn’t have a provide cap? On this weblog put up, we’ll dive into the issuance of ether, the second-largest crypto asset by market cap, and why some upcoming modifications to its issuance mechanism might assist the case for it as not solely a retailer of worth, but additionally a deflationary asset.

Reminder: Bitcoin’s Issuance Mechanism

The issuance mechanism for bitcoin follows a technique of minting brand-new bitcoin as incentive for miners to confirm transactions and safe the blockchain. This freshly minted bitcoin is known as the block subsidy and declines over time, halving in worth roughly each 4 years1. The overall excellent provide will finally attain 21 million and cease rising.

As soon as the total provide is in circulation, the incentives for securing the blockchain are totally supported by transaction charges paid to the miners by these transacting on the community, reasonably than newly minted bitcoin. These transaction charges exist at present, serving as an incentive paid by the transactor to the miner for larger precedence in writing the transaction to the block.2 In conventional finance converse, these charges function a method for sooner execution. Because the community matures, these charges ought to attain an equilibrium between serving as the only real incentive for miners to safe the community and community individuals paying charges to transact on the community effectively.

Ether’s Issuance Mechanism: An Evolving System

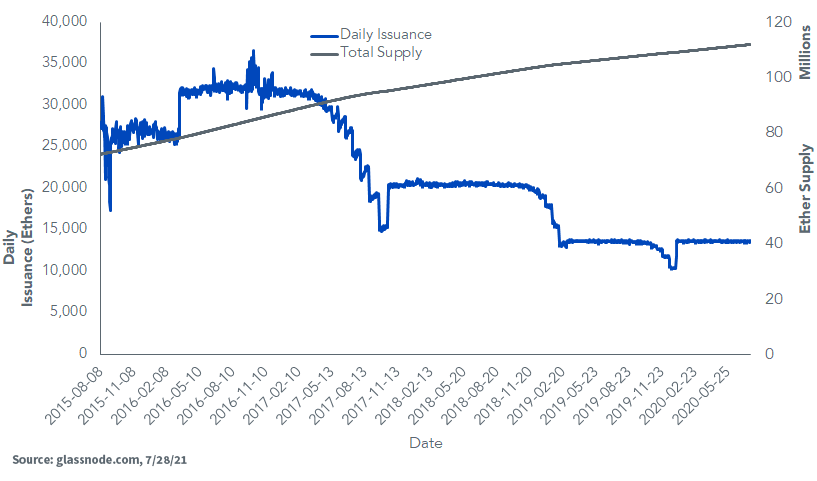

Presently, the issuance mechanism for ether loosely imitates that of bitcoin however doesn’t comply with the halving schedule. Proper now, each time a block on the Ethereum community is mined, two ethers are minted and gifted to the miner, creating new provide of ether. Like bitcoin, these subsidies have been decreased over time based mostly upon the entire variety of blocks mined on the blockchain, first beginning at 5 ethers for the primary 4.Four million blocks, then three for the next 2.9 million, and now two ethers3. These modifications in block subsidy, in addition to different enhancements to the community protocol, are carried out by way of Ethereum Enchancment Proposals, or EIPs.

EIPs are proposed modifications to the Ethereum code which might be reviewed by the group of customers, builders and validators by way of a lifecycle of technical opinions, analysis and dialogue.4 With a concentrate on sustaining the sanctity of the community, EIPs are authorized and carried out alongside present variations of the code in community upgrades. Community individuals might function on totally different variations of the community however could also be compelled to decide on between two variations when upgrades are incompatible throughout variations. These occasions are effectively broadcasted and documented previous to implementation, and community individuals might select to function on both model however are anticipated to gravitate towards the “higher” of the 2, which can presumably have extra customers and serve nearly all of community individuals. On this manner, the “finest” model of Ethereum prevails.

Along with the block subsidy, the miner receives a payment paid by the get together making the transaction, known as fuel5. This fuel serves the identical goal because the payment described for bitcoin, however it should come to play a higher function within the coming months. Roughly 6,500 blocks are mined per day on the Ethereum community6, which might subsequently lead to an extra provide of 13,000 ethers per day, or an annual issuance price of roughly 4%. With no specific provide cap and issuance charges as such, those that are skeptics of ether’s retailer of worth are rightly justified. However with newly proposed modifications to the issuance mechanism for the close to future, the narrative across the supply-side economics might change drastically.

Ether Issuance and Provide

Upcoming Adjustments: EIP 1559 and Proof of Stake

Now that we’ve touched on the present provide mechanism, we have to handle modifications to the provision mechanism which might be scheduled to happen in Ethereum upgrades within the close to future. The primary of those is an replace known as the Ethereum Enchancment Proposal 15597, or EIP 1559, and the second of those is the transition to proof of stake8 from proof of labor9. These modifications within the Ethereum protocol arguably have reductive results on the circulating provide of ether within the community2.

The primary main change, EIP 1559, is scheduled to be efficient later this week; it has been within the works since April 2019, first proposed by the creator of Ethereum himself, Vitalik Buterin. It consists of a change to the protocol concerning the fuel that we talked about above. After the replace, this fuel will not be paid in full to the miners. Somewhat, a portion of this fuel can be “burned”—i.e., destroyed. This burned fuel can be predetermined because the “market price” of the transaction payment based mostly on present congestion within the community amongst these transacting, searching for to write down modifications in possession to the ledger. This base price can be burned, and any extra charges on high (the tip) can be handed on on to the miner10. From the transactor’s purview, this “tip” can be for the aim of receiving expedited transactions. The miner will nonetheless obtain their freshly minted two ethers along with this “tip.”

The second main change replaces the proof of labor consensus mechanism with proof of stake, which is at present reside in ETH 2.011 and is predicted to switch the legacy ETH blockchain in late 2021 or early 202212. The proof of labor mechanism is at present in place for ETH 1.Zero and lots of competing crypto property, together with bitcoin. This consensus mechanism is what maintains the integrity of the blockchain (and its transactions) by way of miners fixing cryptographic hash features to “seal” the block after validating the constituent transactions.9 Fixing these hash features requires important computing energy and electrical energy, which is the supply of debate across the general sustainability of the mining required to safe a crypto asset community.

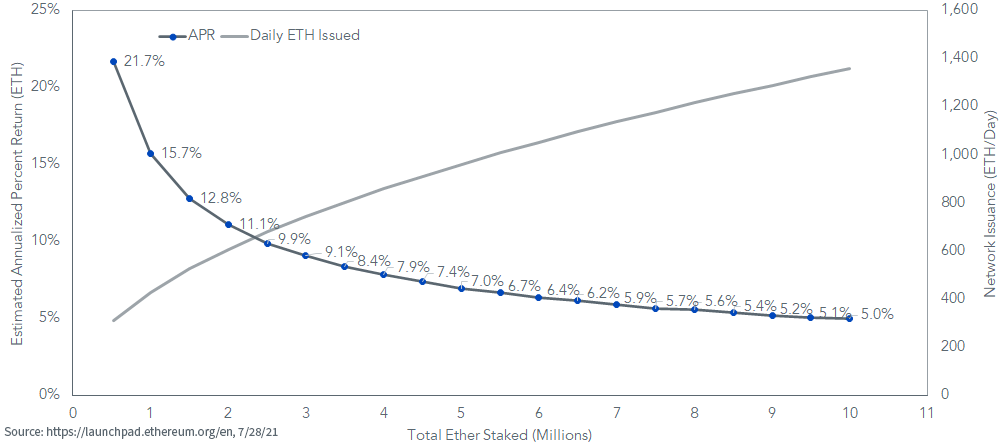

Proof of stake would take the place of this because the consensus mechanism, requiring miners (henceforth known as validators) to stake (or lock up) 32 ethers to start processing transactions on the community.8 Somewhat than requiring the fixing of a puzzle, the validators can safe the community free of those computation-intensive efforts. The 32 ethers staked function a type of collateral that the validator loses in the event that they validate a “unhealthy” or fraudulent block2. It’s burned, and this leads to a discount of provide similar to the bottom price for fuel referred to earlier. In return for performing validation to safe the community, the validator nonetheless receives their freshly minted ether and transaction charges (any fuel higher than the bottom price), however the quantity of ether issued to the validator modifications based mostly upon the combination quantity of ether staked13. This reward is set programmatically to entice extra validators when staking is low and to chorus from doing so when there may be loads of ether staked, and loads of validators. The implications of this are that the community’s issuance fluctuates to yield an optimum degree of safety whereas issuing the least quantity of latest ether, an equilibrium that’s forecasted to lead to a fraction of the present annual price of issuance.

Validator Economics and Issuance

Placing It All Collectively: A Potential Deflationary Asset

So, what does this imply for general ether provide? We all know that burning fuel will cut back provide by destroying ether, staking will cut back the quantity of circulating provide by locking up ether as a type of collateral, and the annual issuance of latest ether rewarded to validators is forecasted to lower considerably under present charges. Subsequently, combining these three elements, the logical expectation can be a decreased price of provide development in comparison with the present Ethereum protocol. This has been known as Ethereum’s triple halving. Barring any flip of occasions that will stop these updates from happening, some argue the mix of those modifications may have such a powerful impact that it’s going to internet out the minting of any new ether2—reaching a state at which provide is frequently reducing, attributing to ether deflationary asset standing.

Initially printed by WisdomTree, 8/2/21

1https://www.cmcmarkets.com/en/learn-cryptocurrencies/bitcoin-halving

2https://podcasts.apple.com/us/podcast/ethereum-into-the-ether/id1559120677?i=1000522314009

3https://docs.ethhub.io/ethereum-basics/monetary-policy/

4https://eips.ethereum.org/EIPS/eip-1

5https://ethereum.org/en/builders/docs/fuel/

6https://glassnode.com/

7https://eips.ethereum.org/EIPS/eip-1559

8https://ethereum.org/en/builders/docs/consensus-mechanisms/pos/#high

9https://ethereum.org/en/builders/docs/consensus-mechanisms/pow/#high

10https://www.gemini.com/cryptopedia/ethereum-improvement-proposal-ETH-gas-fee

11https://www.gemini.com/cryptopedia/ethereum-blockchain-pos-proof-of-stake

12https://www.thestreet.com/crypto/ethereum/ethereum-2-upgrade-what-you-need-to-know

13https://launchpad.ethereum.org/en/

Vital Dangers Associated to this Article

There are dangers related to investing, together with the potential lack of principal. Crypto property, comparable to bitcoin and ether, are advanced, typically exhibit excessive worth volatility and unpredictability, and ought to be seen as extremely speculative property. Crypto property are regularly known as crypto “currencies,” however they usually function with out central authority or banks, should not backed by any authorities or issuing entity (i.e., no proper of recourse), haven’t any authorities or insurance coverage protections, should not authorized tender and have restricted or no usability as in comparison with fiat currencies. Federal, state or overseas governments might prohibit the use, switch, trade and worth of crypto property, and regulation within the U.S. and worldwide continues to be creating.

Crypto asset exchanges and/or settlement amenities might cease working, completely shut down or expertise points as a result of safety breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your buyer/anti-money laundering) procedures, noncompliance with relevant guidelines and laws, technical glitches, hackers, malware or different causes, which may negatively impression the value of any cryptocurrency traded on such exchanges or reliant on a settlement facility or in any other case might stop entry or use of the crypto asset. Crypto property can expertise distinctive occasions, comparable to forks or airdrops, which may impression the worth and performance of the crypto asset.

Crypto asset transactions are typically irreversible, which implies that a crypto asset could also be unrecoverable in situations the place: (i) it’s despatched to an incorrect handle, (ii) the wrong quantity is distributed or (iii) transactions are made fraudulently from an account. A crypto asset might decline in reputation, acceptance or use, thereby impairing its worth, and the value of a crypto asset may additionally be impacted by the transactions of a small variety of holders of such crypto asset. Crypto property could also be tough to worth, and valuations, even for a similar crypto asset, might differ considerably by pricing supply or in any other case be suspect as a result of market fragmentation, illiquidity, volatility and the potential for manipulation. Crypto property typically depend on blockchain know-how, and blockchain know-how is a comparatively new and untested know-how which operates as a distributed ledger. Blockchain programs may very well be topic to Web connectivity disruptions, consensus failures or cybersecurity assaults, and the date or time that you just provoke a transaction could also be totally different than when it’s recorded on the blockchain. Entry to a given blockchain requires an individualized key, which, if compromised, may lead to loss as a result of theft, destruction or inaccessibility.

As well as, totally different crypto property exhibit totally different traits, use circumstances and threat profiles. Info offered by WisdomTree concerning digital property, crypto property or blockchain networks shouldn’t be thought-about or relied upon as funding or different recommendation or as a advice from WisdomTree, together with concerning the use or suitability of any specific digital asset, crypto asset, blockchain community or any specific technique. WisdomTree just isn’t appearing and has not agreed to behave in an funding advisory, fiduciary or quasi-fiduciary capability to any advisor, finish consumer or investor, and has no accountability in connection therewith, with respect to any digital property, crypto property or blockchain networks.

U.S. buyers solely: Click on right here to acquire a WisdomTree ETF prospectus which incorporates funding targets, dangers, prices, bills, and different data; learn and think about fastidiously earlier than investing.

There are dangers concerned with investing, together with potential lack of principal. International investing includes forex, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller corporations might expertise higher worth volatility. Investments in rising markets, forex, fastened earnings and various investments embrace extra dangers. Please see prospectus for dialogue of dangers.

Previous efficiency just isn’t indicative of future outcomes. This materials incorporates the opinions of the writer, that are topic to vary, and will to not be thought-about or interpreted as a advice to take part in any specific buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There isn’t a assure that any methods mentioned will work below all market circumstances. This materials represents an evaluation of the market setting at a selected time and isn’t supposed to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation concerning any safety specifically. The consumer of this data assumes all the threat of any use fabricated from the knowledge offered herein. Neither WisdomTree nor its associates, nor Foreside Fund Companies, LLC, or its associates present tax or authorized recommendation. Buyers searching for tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Except expressly acknowledged in any other case the opinions, interpretations or findings expressed herein don’t essentially symbolize the views of WisdomTree or any of its associates.

The MSCI data might solely be used on your inside use, is probably not reproduced or re-disseminated in any type and is probably not used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI data is meant to represent funding recommendation or a advice to make (or chorus from making) any form of funding determination and is probably not relied on as such. Historic knowledge and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI data is offered on an “as is” foundation and the consumer of this data assumes all the threat of any use fabricated from this data. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI data (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this data, in no occasion shall any MSCI Get together have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss income) or some other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Companies, LLC.

WisdomTree Funds are distributed by Foreside Fund Companies, LLC, within the U.S. solely.

You can not make investments straight in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.