By Jianing Wu, Senior Analyst, Analysis

Vitalik Buterin got here up with the thought of Ethereum in 2013 on the age of 19. Later that 12 months, he printed a white paper describing Ethereum as “a next-generation good contract and decentralized software platform,”1 marking the start of Ethereum’s journey.

Ethereum is now the second-largest cryptocurrency by market capitalization, accounting for roughly 18% of the cryptocurrency market. Its success can’t be separated from a creatively elegant concept, a properly executed growth course of and the continued assist of the group.

On this article, we’ll look again on the historical past of Ethereum’s growth and supply an outlook for what’s upcoming.

Pre-launch

Ethereum’s invention was impressed by Bitcoin.

Bitcoin established the muse for decentralized blockchain know-how. However its performance is restricted to peer-to-peer digital money transfers. Seeing this limitation, Buterin needed to increase blockchain’s performance to programmable apps.

At first, he needed to attain this by including a extra superior scripting language on high of Bitcoin to permit good contracts processing, however this concept was rejected by the Bitcoin group. Then, Buterin determined to create a very new blockchain to allow this “world pc.”

In late 2013, Buterin printed his white paper outlining the thought of Ethereum. In January 2014, Ethereum was first introduced at The North American Bitcoin Convention in Miami. The concept attracted many builders, together with Gavin Wooden, who printed the well-known ”Yellow Paper” on the technical implementation for Ethereum2.

By the top of 2014, Ethereum had its first crowdfunding, elevating greater than $18 million by promoting the native token, ether. Early Ethereum founders and builders2 additionally hosted the primary Ethereum convention, known as DEVCON0, throughout which the builders met for the primary time.

Execution

Ethereum’s growth was deliberate with 4 fundamental levels. Every stage represents a vital system-wide improve of the community, at which level previous variations are now not supported. They’re additionally known as “exhausting forks.”

Inside the primary levels, there have been deliberate and unplanned sub-upgrades.

July 30, 2015–March 14, 2016: Implementing primary technical basis (“Frontier” part)

On July 30, 2015, the primary model of Ethereum (Ethereum 1.0) was launched, known as Frontier. It had the 2 most elementary features: to allow customers to mine ether and run good contracts. The aim of the preliminary stage was to get the community began, so miners may arrange their mining processes and builders may take a look at their decentralized purposes (DApps).

A minor fork known as Frontier Thawing adopted, throughout which gasoline was restricted to five,000 per transaction, to make sure transaction charges weren’t too excessive and hindering utilization.

March 14, 2016–October 16, 2017: Bettering infrastructure to deal with safety points (“Homestead” part)

If Frontier was the working model of Ethereum, Homestead was the “safer” model of Frontier.

Ethereum’s safety vulnerability was dropped at public consideration with the DAO hack. Launched in 2016, DAO was an revolutionary concept to permit customers to crowd supply funds. Nevertheless, it failed as a result of a bug in its good contract code that hackers exploited to steal a portion of the group’s funds. This occasion resulted in a controversial choice to implement a tough fork on the Ethereum community to return the stolen funds. A part of the group didn’t settle for the change, making a department known as Ethereum Basic, which nonetheless exists right this moment.

After struggling a number of DoS (denial-of-service) assaults, two sub-upgrades known as Tangerine Whistle and Spurious Dragon had been launched to deal with safety points, via adjusting gasoline charges and implementing state clearing.

October 16, 2017–January 2, 2020: Fixing challenges that include growth and development (“Metropolis” part)

Metropolis was a complete enchancment of Ethereum’s safety, privateness and scalability. It solved many challenges Ethereum confronted throughout its scaling course of and introduced a lighter, extra environment friendly expertise for builders and customers. As a result of the replace was so difficult, it was launched in two steps: Byzantium and Constantinople.

Byzantium was the primary stage, with fundamental upgrades launched in 9 patches, additionally known as Ethereum enchancment protocols (EIP). These included essential options akin to zk-SNARKs3, account abstraction4 and the problem bomb5.

Constantinople was alleged to launch in mid-2018 however was delayed for greater than half a 12 months as a result of a vital bug discovered hours earlier than its supposed launch. Constantinople was meant to repair any issues that may come up from Byzantium’s implementation. As well as, it laid the groundwork for the transition from proof-of-work to proof-of-stake, which is able to considerably cut back Ethereum’s validation power consumption.

January 2, 2020–2022: Ethereum 2.Zero to be extra scalable, safe and sustainable (“Serenity” part)

At the moment, the Serenity stage continues to be in growth. Also called Ethereum 2.0, this model goals to advance Ethereum to a stage that may be broadly used with out encountering safety or high-volume points.

Particularly, it intends to unravel two fundamental challenges Ethereum is going through: a clogged community that may solely deal with a restricted variety of transactions per second (with elevated gasoline charges for sooner transactions), and the massive consumption of power that comes with the proof-of-work mechanism.6

Two of the most important upgrades are the shift from proof-of-work to proof-of-stake and the implementation of shard chains which is able to unfold the workload of the community.7 Ethereum 2.Zero is envisioned to be extra scalable, safe and sustainable, though when (or if) it should in the end be applied, and different fallout points, stay unclear.

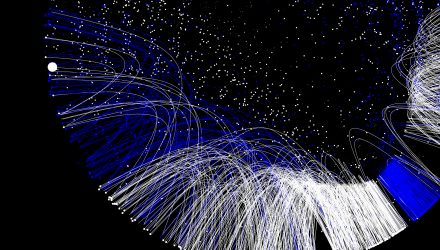

Ether Value And Growth Phases

Conclusion

After eight years of growth, Ethereum has gone from an concept to a vivid ecosystem, supported by one of many largest developer communities within the crypto area. As a software program platform, it must evolve to deal with its points. Its group is progressive and has applied a number of vital modifications over time. A number of the most essential modifications nonetheless lie forward, and we’ll tackle them in additional element in future posts.

Initially printed by WisdomTree, 7/15/21

1 https://ethereum.org/en/whitepaper/

2 Early founders included Vitalik Buterin, Anthony Di lorio, Charles Hoskinson, Mihai Alisie, Amir Chetrit, Joseph Lubin, Gavin Wooden and Jeffrey Wilcke.

3 “Zero-Information Succinct Non-Interactive Argument of Information,” and refers to a proof building the place one can show possession of sure data, e.g. a secret key, with out revealing that data, and with none interplay between the prover and verifier.

4 https://eips.ethereum.org/EIPS/eip-2938

5 Refers back to the improve of problem in Ethereum’s proof-of-work consensus mechanism.

6 Proof-of-work is a consensus mechanism used to confirm blockchain transactions’ validity, via fixing computationally intensive puzzles utilizing miners’ computer systems’ processing energy.

7 Proof-of-stake is one other consensus mechanism that’s used to confirm blockchain transactions. Nevertheless, it does so by utilizing miners’ current cash as a stake within the validation course of, which calls for much less pc processing energy.

Vital Dangers Associated to this Article

There are dangers related to investing, together with the potential lack of principal. Crypto belongings, akin to bitcoin and ether, are complicated, typically exhibit excessive worth volatility and unpredictability, and needs to be seen as extremely speculative belongings. Crypto belongings are steadily known as crypto “currencies,” however they usually function with out central authority or banks, aren’t backed by any authorities or issuing entity (i.e., no proper of recourse), haven’t any authorities or insurance coverage protections, aren’t authorized tender and have restricted or no usability as in comparison with fiat currencies. Federal, state or overseas governments might limit the use, switch, alternate and worth of crypto belongings, and regulation within the U.S. and worldwide continues to be growing. Crypto asset exchanges and/or settlement amenities might cease working, completely shut down or expertise points as a result of safety breaches, fraud, insolvency, market manipulation, market surveillance, KYC/AML (know your buyer/anti-money laundering) procedures, non-compliance with relevant guidelines and laws, technical glitches, hackers, malware or different causes, which may negatively impression the worth of any cryptocurrency traded on such exchanges or reliant on a settlement facility or in any other case might stop entry or use of the crypto asset. Crypto belongings can expertise distinctive occasions, akin to forks or airdrops, which may impression the worth and performance of the crypto asset. Crypto asset transactions are typically irreversible, which signifies that a crypto asset could also be unrecoverable in situations the place: (i) it’s despatched to an incorrect tackle, (ii) the inaccurate quantity is shipped, or (iii) transactions are made fraudulently from an account. A crypto asset might decline in recognition, acceptance or use, thereby impairing its worth, and the worth of a crypto asset can also be impacted by the transactions of a small variety of holders of such crypto asset. Crypto belongings could also be troublesome to worth and valuations, even for a similar crypto asset, might differ considerably by pricing supply or in any other case be suspect as a result of market fragmentation, illiquidity, volatility and the potential for manipulation. Crypto belongings typically depend on blockchain know-how and blockchain know-how is a comparatively new and untested know-how which operates as a distributed ledger. Blockchain techniques may be topic to Web connectivity disruptions, consensus failures or cybersecurity assaults, and the date or time that you just provoke a transaction could also be totally different than when it’s recorded on the blockchain. Entry to a given blockchain requires an individualized key, which, if compromised, may lead to loss as a result of theft, destruction or inaccessibility. As well as, totally different crypto belongings exhibit totally different traits, use instances and threat profiles. Data supplied by WisdomTree concerning digital belongings, crypto belongings or blockchain networks shouldn’t be thought-about or relied upon as funding or different recommendation, as a advice from WisdomTree, together with concerning the use or suitability of any specific digital asset, crypto asset, blockchain community or any specific technique. WisdomTree just isn’t performing and has not agreed to behave in an funding advisory, fiduciary or quasi-fiduciary capability to any advisor, finish shopper or investor, and has no duty in connection therewith, with respect to any digital belongings, crypto belongings or blockchain networks.

U.S. buyers solely: Click on right here to acquire a WisdomTree ETF prospectus which comprises funding goals, dangers, expenses, bills, and different data; learn and take into account rigorously earlier than investing.

There are dangers concerned with investing, together with potential lack of principal. Overseas investing includes forex, political and financial threat. Funds specializing in a single nation, sector and/or funds that emphasize investments in smaller firms might expertise higher worth volatility. Investments in rising markets, forex, fastened earnings and various investments embrace extra dangers. Please see prospectus for dialogue of dangers.

Previous efficiency just isn’t indicative of future outcomes. This materials comprises the opinions of the writer, that are topic to alter, and will to not be thought-about or interpreted as a advice to take part in any specific buying and selling technique, or deemed to be a suggestion or sale of any funding product and it shouldn’t be relied on as such. There isn’t any assure that any methods mentioned will work beneath all market circumstances. This materials represents an evaluation of the market atmosphere at a particular time and isn’t supposed to be a forecast of future occasions or a assure of future outcomes. This materials shouldn’t be relied upon as analysis or funding recommendation concerning any safety particularly. The consumer of this data assumes all the threat of any use product of the data supplied herein. Neither WisdomTree nor its associates, nor Foreside Fund Providers, LLC, or its associates present tax or authorized recommendation. Traders in search of tax or authorized recommendation ought to seek the advice of their tax or authorized advisor. Until expressly said in any other case the opinions, interpretations or findings expressed herein don’t essentially signify the views of WisdomTree or any of its associates.

The MSCI data might solely be used to your inside use, is probably not reproduced or re-disseminated in any kind and is probably not used as a foundation for or part of any monetary devices or merchandise or indexes. Not one of the MSCI data is meant to represent funding recommendation or a advice to make (or chorus from making) any sort of funding choice and is probably not relied on as such. Historic information and evaluation shouldn’t be taken as a sign or assure of any future efficiency evaluation, forecast or prediction. The MSCI data is supplied on an “as is” foundation and the consumer of this data assumes all the threat of any use product of this data. MSCI, every of its associates and every entity concerned in compiling, computing or creating any MSCI data (collectively, the “MSCI Events”) expressly disclaims all warranties. With respect to this data, in no occasion shall any MSCI Celebration have any legal responsibility for any direct, oblique, particular, incidental, punitive, consequential (together with loss income) or some other damages (www.msci.com)

Jonathan Steinberg, Jeremy Schwartz, Rick Harper, Christopher Gannatti, Bradley Krom, Tripp Zimmerman, Michael Barrer, Anita Rausch, Kevin Flanagan, Brendan Loftus, Joseph Tenaglia, Jeff Weniger, Matt Wagner, Alejandro Saltiel, Ryan Krystopowicz, Kara Marciscano, Jianing Wu and Brian Manby are registered representatives of Foreside Fund Providers, LLC.

WisdomTree Funds are distributed by Foreside Fund Providers, LLC, within the U.S. solely.

You can not make investments instantly in an index.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.