“One era passeth away, and one other era cometh: ho

“One era passeth away, and one other era cometh: however the earth abideth for ever.”

– Ecclesiastes 1:4

Word: We’ve been constantly involved about very excessive valuations within the world investing markets in addition to a rising set of contributors whose funding patterns are gambling-like. Whereas we stay involved about these issues, on this publication we’ll study an argument we’re listening to used to elucidate the elevated consideration (and worth) in crypto belongings. We gained’t be endorsing cryptocurrencies right here[i]. We’re simply seeking to spotlight an argument we’ve got heard favoring the world of crypto belongings with our purpose to make us all suppose. A big a part of our job is to have a look at a plethora of low chance occasions and determine when a type of occasion’s chance will increase sufficient to pose a danger to our purchasers’ financial savings. We see the notion that crypto will supplant the world’s fiat currencies as a low chance. Nonetheless, if it have been to mature, it might have a big impression that all of us want to grasp.

[wce_code id=192]

Let’s begin with a narrative…

A number of younger individuals discover themselves on an island, away from civilization. They cut up up features and chores to outlive on this new land. They resolve they want a forex—rabbit pelts—to characterize the worth of the products and companies they commerce amongst themselves. Finally, a number of of them decide it’s simpler to farm rabbits than to hunt them, making a extra plentiful provide of pelts (in addition to of rabbit stew, recipe right here).

Although farming made pelts simpler to return by, the islanders started capping manufacturing (or because the elder’s put it, “regulating”) rabbit farming to maintain equality and to carry up the worth of the pelts. Life settled down and have become nice for many. The island’s occupants started to give attention to household creation and fine-tuning their lives. Subsequent got here easy types of monetary engineering, similar to credit score (e.g., Islander A guarantees to ship 4 rabbit pelts to Islander B as soon as Islander A receives a future cost of pelts from Islander C). And on it went, with consumption progress fueled partially by a rising pelt credit score market.

A nasty winter or a sizzling summer time decreased the rabbits’ litters, straining the buying and selling of companies occasionally, and, if the climate stayed poor longer than anticipated, placing the pelt credit score system underneath important stress. Lots of the elders (our younger individuals are getting old now) had plentiful pelt financial savings, and lots of lent their pelts out. Throughout extended dangerous climate, these elders feared debtors would default; they felt they risked substantial losses. Attributable to this concern, the elders of the neighborhood permitted rabbit farming to be ramped up as a method of conserving individuals assured they might get by the seasonal excessive. After all, the elders wished to take care of a excessive diploma of management over the rabbit farms as a result of they thought of them instrumental to the well being and wellbeing of society.

The unique islanders have been pleased with the system as a result of most of their financial savings have been in investments backed or priced in rabbit pelts. Nonetheless, the rising variety of younger individuals have been changing into disenchanted with the monetary system their mother and father had created. And with the monetary system touching a lot of life’s actions, the frustration grew to incorporate the political construction of the island. Amongst this newer era, there was rising concern that the legal guidelines and the economic system have been skewed to favor a choose few and that rules weren’t being utilized pretty. The younger thought the system that labored so properly for his or her mother and father was leaving them out.

These whispers from the younger become screams. The social material appeared strained as demonstrations have been changing into commonplace. Lots of the demonstrations confirmed a deep frustration with the system moderately than any explicit end result of the system. The frustrations grew to a degree the place some younger ones devised an answer to, at the very least, handle the monetary features of their points.

Among the younger started considering up a brand new system, one which labored on their phrases moderately than their mother and father’. Though they nonetheless used rabbit pelts to commerce, additionally they started holding a few of their financial savings in a digital kind. (Sure, our society has developed computer systems! Please droop disbelief.) The younger wished an asset that was thought of valuable. They decided that shortage was inherently beneficial, as was the power to commerce with out permission from the elders. To that finish, a younger one (for enjoyable, let’s name him Satoshi Usagi[ii]) developed a mathematical algorithm with a finite output, forcing the quantity of the output to be fastened. As a aspect notice, the processing energy required to acquire output from the algorithm was substantial, making the duty of making the algorithm’s output more and more pricey because it approached its most. This was counter to what they skilled with the elders and rabbit pelts the place the incremental pelt grew to become simpler to justify.

The younger ones have been enamored with the concept this algorithm might produce solely a lot, that its shortage couldn’t be modified by the elders, and that the elders weren’t influencing the actions of the algorithm. Although there was no onerous asset underlying the algorithm’s worth, the younger ones argued that the dearth of self-discipline in farming rabbit pelts had eroded their religion that the pelts would retain worth, particularly because the elders have been farming them at an ever-faster price.

Again to our actuality…

The Federal Reserve is as soon as once more believing its personal blather, considering it could possibly clear up all issues. Y2K? Straightforward. Mortgage bubble? You wager. European banking disaster? In our sleep. Pandemic? We’re simply warming up. Revenue inequality? Why not give us one thing onerous? Local weather Change? Allow us to sharpen our pencil.

Because the bankers’ financial institution and the lender of final resort, the Federal Reserve sees itself as infallible. But, historical past would recommend it isn’t. The present teachers on the Federal Reserve Board have achieved an incredible job finding out the Nice Melancholy to forestall right this moment the errors of that period. They’re open in discussing their fears that deflation might evolve right into a deep and extended financial hardship. Nonetheless, the present board ought to spend extra time reviewing the 1960’s and 70’s.

It’s changing into apparent that right this moment’s Fed members should not have learn Paul Volcker’s e book Preserving At It, nor absorbed his core perception in a steady worth for the U.S. greenback. For these that will not bear in mind, Volcker was the chairman of the Federal Reserve that broke the again of inflation within the late 1970’s and early 80’s. He displays in his e book on the excessive inflation then taking maintain within the U.S., and his perception that we wanted to interrupt it, regardless of how painful. “[The need to focus on price stability] enforced upon the Federal Reserve an inside self-discipline that had been missing: we couldn’t again away from our newfound emphasis on restraining the expansion within the cash provide with out risking a dangerous lack of credibility that, as soon as misplaced, could be onerous to revive.”

For you historical past buffs, the targets of the Federal Reserve modified fairly considerably in 1977. Previous to the Federal Reserve Reform Act of 1977, the Federal Reserve was centered on value stability and liquidity within the banking system to fend off the type of banking panics we skilled within the early twentieth century. The 1977 laws, nonetheless, added new targets—targets which have muddied the targets of the Federal Reserve’s actions ever since—that required them to additionally give attention to making an attempt to realize full employment. With this sometimes-contradictory new purpose, the Federal Reserve’s consideration to cost stability lessened.

[i] We would like it to be abundantly clear. Cryptocurrencies and crypto belongings are extremely dangerous issues (we’re not even positive if we actually need to name them belongings at this level). They’re risky, subjective in worth, and sometimes fleeting of their adoption. Be warned.

[ii] For these not hip to the crypto world (like us), the paper that first described Bitcoin entitled “Bitcoin: A Peer-to-Peer Digital Money System” was authored by the mysterious Satoshi Nakamoto. For our analogy, we selected the younger one to be named Satoshi Usagi the place Usagi is Japanese for rabbit.

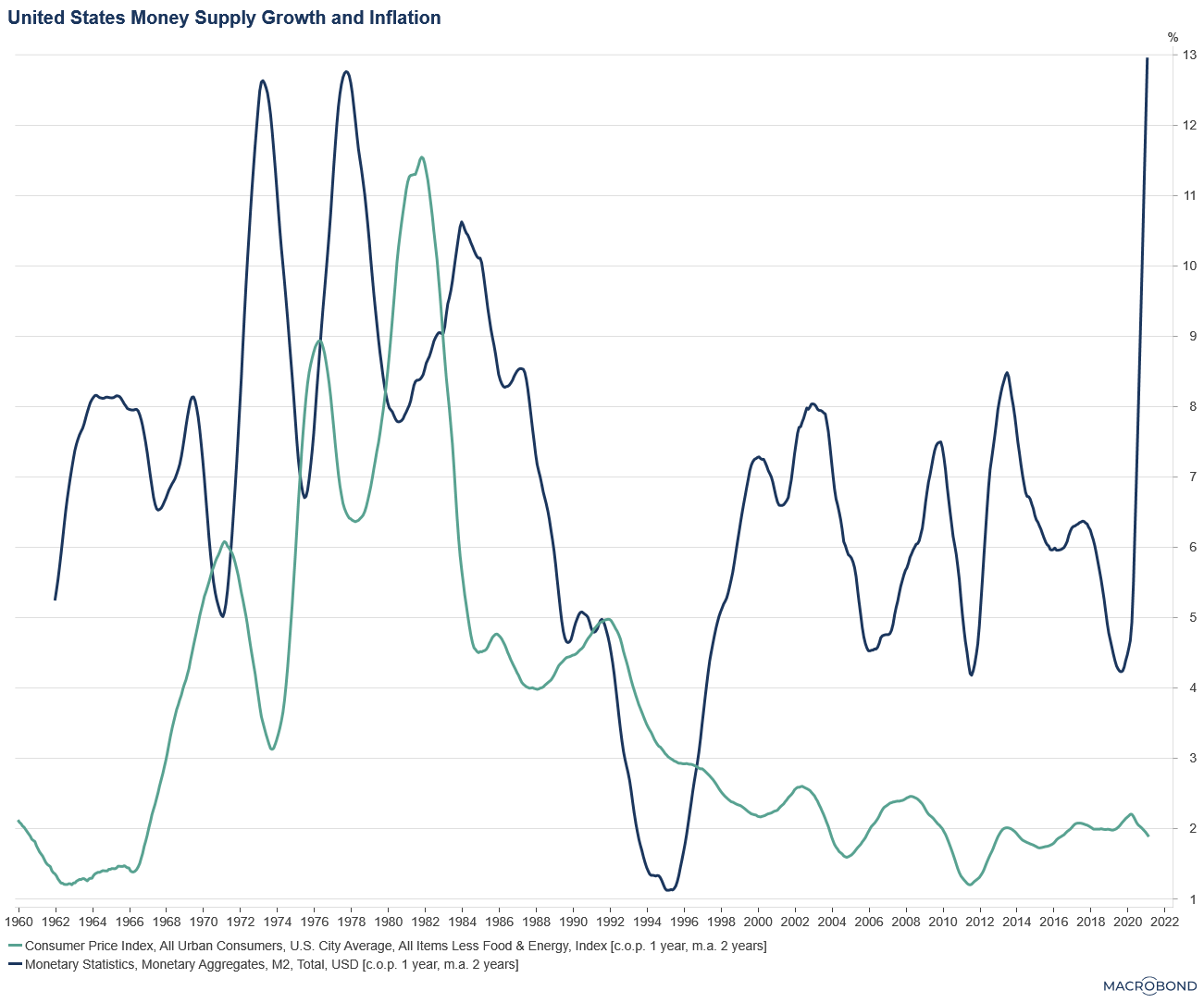

Given the muted inflation atmosphere by the 1990’s and 2000’s, the Federal Reserved gained confidence that it might sort out virtually all issues with added financial stimulus. It seems like a high quality concept, till you have a look at the chart above, which reveals that dramatically rising {dollars} previously has led to inflation. Within the late 1970’s, it led to stagflation (i.e., low financial progress and excessive inflation). Word that right this moment’s stimulus packages create a leap that surpasses even what was skilled within the stagflation days of the 70’s.

And what comes after a quick and enormous progress in {dollars} into the economic system? Utilizing the 1970’s could also be too simplistic (and we undoubtedly shouldn’t have plentiful information) however we do know that in that period, the outcome was very excessive ranges of inflation.

Mr. Volcker died in December 2019, and we worry that a lot of his concepts about our financial system could have died with him. Two of his statements resonated with us: First, “The purpose was that the Fed shouldn’t be appeared to as lender of final resort past the banking system.” And second, “My view, broadly shared, is that it’s inappropriate for an establishment that advantages from the federal ‘security internet’ (for instance, entry to Federal Reserve liquidity, FDIC insurance coverage, and fewer tangible comforts) to have interaction in danger taking unrelated to the important banking features of deposit taking, lending, and serving prospects whereas sharing in working a protected, environment friendly, and vital funds system.”

And but, within the spring of 2020, the Federal Reserve did precisely what Volcker argued towards. The Federal Reserve established the Fundamental Avenue Lending Program, Paycheck Safety Program, Municipal Liquidity Facility, Secondary Market Company Credit score Facility, and different packages with the intent of immediately lending to companies. In Fed Chair Jerome Powell’s personal phrases, in entrance of the Senate Banking Committee in June 2020, “I don’t see us as eager to run by the bond market like an elephant, doing issues and snuffing out value alerts,” he stated. “We simply need to be there if issues flip dangerous within the economic system.” (After all, to some, driving yields decrease and defending risk-takers is the definition of snuffing out value alerts.)

Powell and the Federal Reserve’s focus then was most undoubtedly on aiding the economic system by the compelled shutdowns and to work in the direction of reaching full employment. And, latest feedback have them including local weather change to their listing of to-do’s. Within the phrases of Fed Governor Lael Brainard, “Local weather change and the transition to a sustainable economic system additionally poses dangers to the soundness of the broader monetary system. So a second core pillar of our framework seeks to deal with the macro monetary dangers of local weather change.” The actions of the Federal Reserve underneath Powell could lead on one to surprise if greenback stability is even of their high 5 worries.

Volcker’s efforts to squash the runaway inflation of the 1970’s—and the political and private challenges he confronted to do that onerous and unpopular work—spotlight for us that belief within the stability of the greenback was his and his board’s gravest concern. Now? Not a lot.

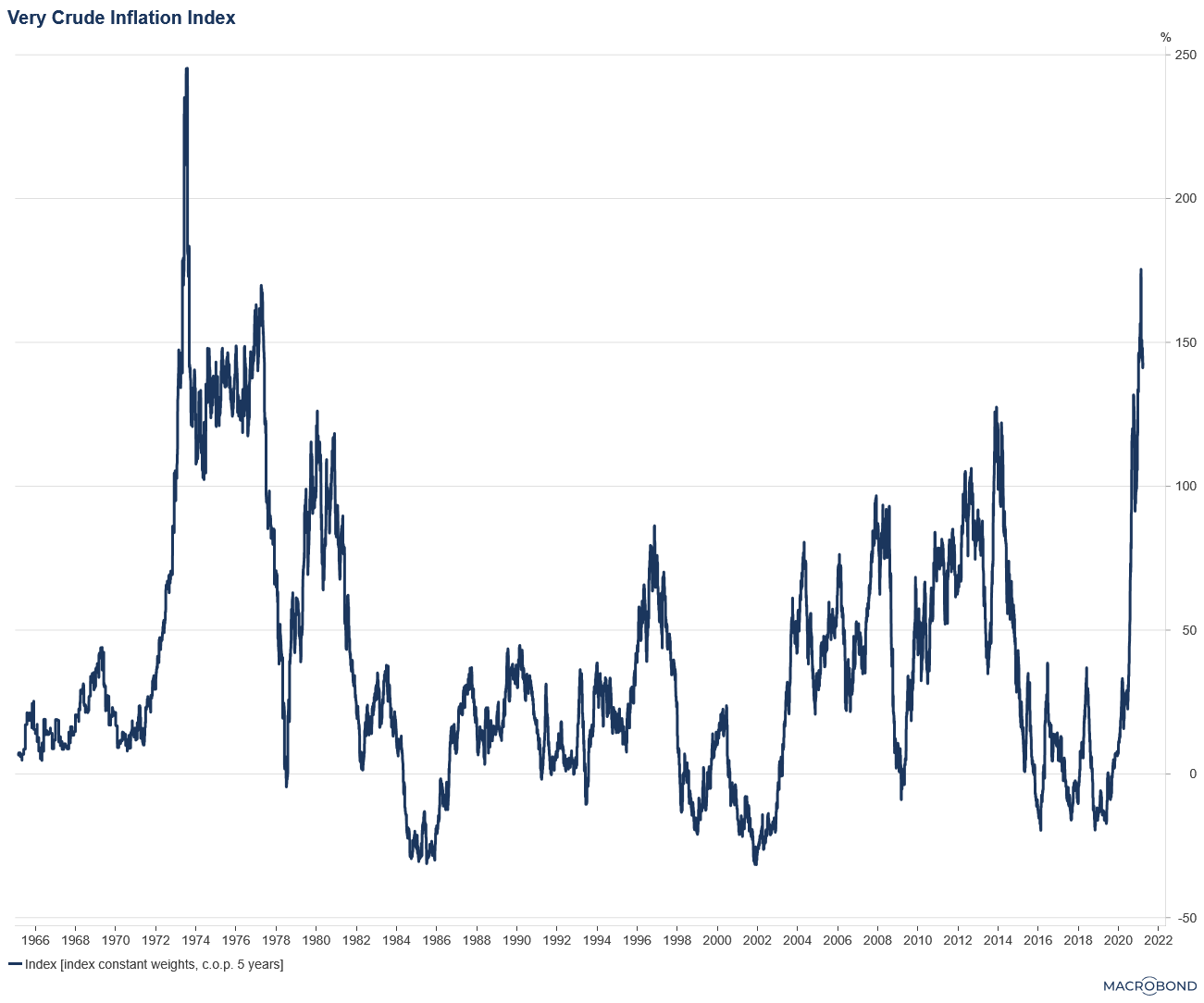

And this lack of give attention to the important stability of the greenback would possibly simply be why the younger ones are on the lookout for an alternative choice to rabbit pelts. They need an asset that goals for stability of the amount in circulation (though, crucially, possibly not in worth at this level). And it isn’t simply the younger ones. We have a look at a Very Crude Inflation Index (the VCII for us cool econ geeks) which tracks gold (for buying and selling), soybeans (for meals), and lumber (for shelter). The VCII weights meals and shelter extra closely than buying and selling. It’s a really crude index, as its title connotes, however generally a much less refined image reveals us extra of the view.

The VCII has hit a stage of progress not seen for the reason that early days of the 1970’s, when the U.S. went off the gold normal. It’s nonetheless early days, and a few might argue that is only a post-COVID spike, however we’re seeing an odd mixture of various generations agreeing to some extent. Each the younger and a few of the outdated are agreeing to some extent on the worth of belongings not depending on authorities printing presses, with the elders remembering the 1970s and looking for to guard themselves with a finite asset like gold and the younger ones appreciating the distinctive attributes obtainable to crypto belongings.

We finish this article with two quotations: one from a relative elder that has seen bubbles previously and invested properly round them, and one other from a younger one, on his preliminary reasoning for purchasing his first bitcoin in 2018.

Elder

“I do not hate $BTC. Nonetheless, for my part, the long-term future is tenuous for decentralized crypto in a world of legally violent, heartless centralized governments with #lifeblood pursuits in monopolies on currencies.” – Michael Burry by way of tweet, Scion Asset Administration

Younger One

“My thought was you shouldn’t belief authorities; most cash is intrinsically tied to a authorities; and I believe they are going to do one thing dumb like, oh, I don’t know, improve the amount of cash in circulation by 100% after which increase taxes and minimize its personal legs out.” – David

One sounding skeptical on the digital forex. One other sounding skeptical of fiat currencies. Each saying the identical factor.

*We can be digitizing this article and promoting it as a non-fungible token (NFT) to the very best bidder. 😊

[i] We would like it to be abundantly clear. Cryptocurrencies and crypto belongings are extremely dangerous issues (we’re not even positive if we actually need to name them belongings at this level). They’re risky, subjective in worth, and sometimes fleeting of their adoption. Be warned.

[ii] For these not hip to the crypto world (like us), the paper that first described Bitcoin entitled “Bitcoin: A Peer-to-Peer Digital Money System” was authored by the mysterious Satoshi Nakamoto. For our analogy, we selected the younger one to be named Satoshi Usagi the place Usagi is Japanese for rabbit.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the writer and don’t essentially replicate these of Nasdaq, Inc.