By Ryan O’Malley, Fastened Reve

By Ryan O’Malley, Fastened Revenue Portfolio Strategist

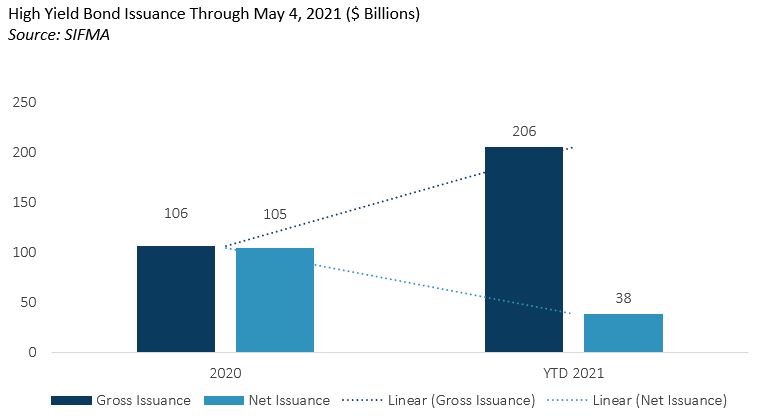

Excessive yield company bond issuance is up 93% in 2021 – from $106 billion in 2020 to $206 billion year-to-date. Company bond traders sometimes view such giant will increase in excessive yield issuance as a unfavourable for credit score fundamentals, because it often correlates with greater leverage. This cycle could show to be very totally different, nonetheless, as the basics of many excessive yield issuers are enhancing.

[wce_code id=192]

Regardless of the rise in gross issuance, internet issuance in excessive yield bonds has elevated solely by about $38 billion, implying that 81% of latest points this yr have been used to refinance older debt. Excessive yield issuers have used the robust demand for unfold product to restore their battered steadiness sheets moderately than partaking in M&A or shareholder-friendly actions on the expense of bond holders.

The common coupon of the Bloomberg Barclay’s U.S. Company Excessive Yield Index has decreased from 6.24% in February 2020 to five.86%, whereas concurrently rising the typical time to maturity of those bonds, from 6.06 years to six.53 years. Which means that the typical excessive yield issuer simply reorganized their debt to pay 0.40% much less curiosity whereas getting an additional six months to pay again the debt, reducing their curiosity expense and boosting their free money circulate. It is a significantly useful phenomenon for essentially the most susceptible debtors, and so we’ve seen CCC and “distressed” issuers put up the perfect efficiency within the index YTD by a large margin.

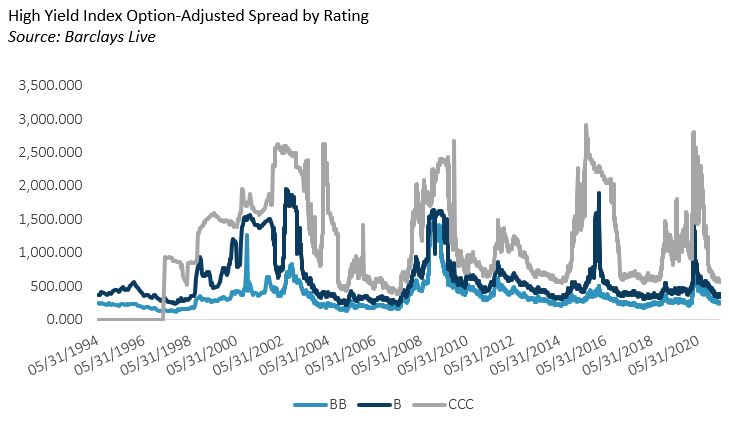

Whereas valuations stay tight, they’re nonetheless not fairly to tightest ranges of the previous 20 years. The BB index nonetheless has about 100bps of room to tighten earlier than reaching 2005 ranges, and CCC spreads are over 200bps above their 2007 nadir.

One other level bolstering the case for prime yield bonds in 2021 is the perceived capability for prime yield bonds to outperform as in comparison with funding grade credit throughout instances of accelerating inflation expectations. Sage regarded on the relationship between month-to-month Excessive Yield Index efficiency and the breakeven price for 10-year TIPS (typically thought of a measure of inflation expectations over the next 10 years). We discovered that the month-over-month change in inflation has a constructive covariance with month-to-month efficiency within the Excessive Yield Index of 41% going again to 1999. In different phrases, excessive yield bonds are inclined to have constructive efficiency in months the place the breakeven price on 10-year TIPS will increase from the earlier month.

Along with holding excessive yield bonds, there are a pair different methods Sage employs to place portfolios for rising inflation; the primary is to keep up a decrease general portfolio period as in comparison with related benchmarks, and the second is so as to add to TIPS the place applicable. We want the 10-year a part of the TIPS curve in comparison with shorter maturities, as we consider the yield curve inversion (3-year and 5-year TIPS have greater breakeven charges than 10-year TIPS) is unjustified as a result of inflation is probably going a longer-term proposition. This three-pronged strategy ought to assist portfolios outperform if inflation does certainly proceed to rise.

Disclosures: That is for informational functions solely and isn’t supposed as funding recommendation or a suggestion or solicitation with respect to the acquisition or sale of any safety, technique or funding product. Though the statements of truth, info, charts, evaluation and information on this report have been obtained from, and are based mostly upon, sources Sage believes to be dependable, we don’t assure their accuracy, and the underlying info, information, figures and publicly accessible info has not been verified or audited for accuracy or completeness by Sage. Moreover, we don’t characterize that the knowledge, information, evaluation and charts are correct or full, and as such shouldn’t be relied upon as such. All outcomes included on this report represent Sage’s opinions as of the date of this report and are topic to alter with out discover because of numerous elements, comparable to market circumstances. Traders ought to make their very own choices on funding methods based mostly on their particular funding aims and monetary circumstances. All investments comprise danger and will lose worth. Previous efficiency will not be a assure of future outcomes.

Sage Advisory Companies, Ltd. Co. is a registered funding adviser that gives funding administration companies for quite a lot of establishments and excessive internet value people. For extra info on Sage and its funding administration companies, please view our website at www.sageadvisory.com, or discuss with our Type ADV, which is out there upon request by calling 512.327.5530.

Learn extra on ETFtrends.com.

The views and opinions expressed herein are the views and opinions of the creator and don’t essentially mirror these of Nasdaq, Inc.